|

|

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of the |

Securities Exchange Act of 1934 |

(Amendment No. ) |

|

| | | | | |

| Filed by the Registrant ý | Filed by a Party other than the Registrant ¨ | |

|

Check the appropriate box: |

|

¨ | Preliminary Proxy Statement |

|

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý | Definitive Proxy Statement |

|

¨ | Definitive Additional Materials |

|

¨ | Soliciting Material Pursuant to §240.14a-12 |

|

|

Meritage Homes Corporation |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| | | | | |

| Payment of Filing Fee (Check the appropriate box): | |

|

ý | No fee required. |

|

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

| | | | | |

| (1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) | Proposed maximum aggregate value of transaction: |

(5) | Total fee paid: |

|

| | | | | |

| ¨ | Fee paid previously with preliminary materials: | |

|

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| | | | | |

| (1) | Amount Previously Paid: | |

| |

(2) | Form, Schedule or Registration Statement No.: |

| |

(3) | Filing Party: |

| |

(4) | Date Filed: |

| |

Dear Fellow Stockholders:

You are cordially invited to join us for our 2015 annual meeting of stockholders, which will be held on May 13, 2015, at 10:00 a.m. local time at our corporate office location at 8800 E. Raintree Drive, Suite 300, Scottsdale, Arizona, 85260. Holders of record of our common stock as of March 19, 2015 are entitled to notice of, and to vote at, the 2015 annual meeting.

The Notice of Annual Meeting of Stockholders and the proxy statement that follow describe the business to be conducted at the meeting. We may also report on matters of current interest to our stockholders at that meeting.

We are pleased to be furnishing these materials to our stockholders via the Internet. We believe this approach provides you with the information that you need while expediting your receipt of these materials, lowering our costs of delivery, and reducing the environmental impact of our annual meeting. If you would like us to send you printed copies of our proxy statement and accompanying materials, we will be happy to do so at no charge upon your request. For more information, please refer to the Notice of Internet Availability of Proxy Materials that we previously mailed to you on or about April 1, 2015.

You are welcome to attend the meeting. However, even if you plan to attend, please vote your shares promptly and prior to the meeting to ensure they are represented at the meeting. You may submit your proxy by Internet or telephone, as described in the following materials, or, if you request printed copies of these materials, by completing and signing the proxy card enclosed therein and returning it in the envelope provided. If you decide to attend the meeting and wish to change your proxy, you may do so automatically by voting in person at the meeting.

If your shares are held in the name of a broker, bank, trust or other nominee, you may be asked for proof of ownership of these shares to be admitted to the meeting.

We thank you for your support.

Sincerely,

Steven J. Hilton

Chairman and Chief Executive Officer

8800 East Raintree Drive • Suite 300 • Scottsdale, Arizona • 85260 • Phone 480-515-8100

Listed on the New York Stock Exchange — MTH

Notice of Annual Meeting of Stockholders

Date: May 13, 2015

Time: 10:00 a.m. local time

Meritage Homes Corporation

8800 East Raintree Drive, Suite 300

Scottsdale, Arizona 85260

To Our Stockholders:

You are invited to attend the Meritage Homes Corporation 2015 annual meeting of stockholders at which we will conduct the following business:

| |

1 | Election of four Class II Directors, each to hold office until our 2017 annual meeting, |

| |

2 | Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2015 fiscal year, |

| |

3 | Advisory vote to approve compensation of our Named Executive Officers, |

| |

4 | The conduct of any other business that may properly come before the meeting or any adjournment or postponement thereof. |

These items are more fully described in the accompanying proxy. Only stockholders of record at the close of business on March 19, 2015 are entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement thereof.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, PLEASE SUBMIT YOUR PROXY BY FOLLOWING THE INSTRUCTIONS SET FORTH IN THE FOLLOWING MATERIALS. YOU MAY VOTE YOUR SHARES AND SUBMIT A PROXY BY USING THE INTERNET, REGULAR MAIL OR TELEPHONE AS DESCRIBED HEREIN OR ON YOUR PROXY CARD.

|

| |

| By Order of the Board of Directors |

| |

| C. Timothy White, Secretary |

Scottsdale, Arizona

March 24, 2015

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 13, 2015:

THIS PROXY STATEMENT AND MERITAGE’S 2014 ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE AT INVESTORS.MERITAGEHOMES.COM. ADDITIONALLY, AND IN ACCORDANCE WITH SEC RULES, YOU MAY ACCESS THESE MATERIALS ON THE COOKIES-FREE WEBSITES INDICATED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS THAT YOU HAVE RECEIVED.

Table of Contents

|

| |

| |

| |

| |

| |

| |

| |

Security Ownership by Management and Principal Stockholders | |

| |

Compensation Discussion and Analysis | |

| |

| |

| |

| |

Independent Compensation Consultant | |

| |

| |

Equity Based Awards | |

| |

Discussion of NEO Compensation | |

2015 Developments | |

| |

| |

| |

| |

| |

| |

Certain Relationships and Related Transactions | |

| |

| |

| |

| |

| |

1 MERITAGE HOMES | 2015 Proxy Statement

MERITAGE HOMES CORPORATION

8800 EAST RAINTREE DRIVE

SUITE 300

SCOTTSDALE, ARIZONA 85260

(480) 515-8100

www.meritagehomes.com

Proxy Summary

This summary highlights selected information contained elsewhere in this proxy statement and is not intended to contain all of the information that you should consider. Please read the entire proxy statement carefully before voting.

Proxy Statement Purpose

The Board of Directors of Meritage Homes Corporation (“Meritage” or the “Company”) is furnishing this Proxy Statement to solicit your proxy for our 2015 Annual Meeting of Stockholders. This Proxy Statement contains information to help you decide how you want your shares to be voted. To understand the proposals fully, you should carefully read this entire proxy statement and the other proxy materials identified in the Notice of Internet Availability of Proxy Materials ("the Notice"). This proxy statement will be available on the internet, and the notice of proxy materials is first to be mailed to stockholders beginning on or about April 1, 2015.

Date, Time and Place of Meeting

The annual meeting will be held on Wednesday, May 13, 2015, at 10:00 a.m. local time at our corporate office at 8800 East Raintree Drive, Suite 300, Scottsdale, Arizona, 85260. If you require directions to the annual meeting, please call (480) 515-8100.

Who Can Vote

Stockholders who hold shares of our common stock at the close of business on March 19, 2015, the record date, will be entitled to one vote for each share held regarding the matters proposed in this proxy statement. Only holders of record of common stock at the close of business on the record date will be permitted to vote at the meeting, either in person or by valid proxy. On the record date, there were 39,616,663 shares of Meritage common stock outstanding. The common stock is our only outstanding class of voting securities.

Voting Information

You can vote in person at the annual meeting or submit a proxy to have your shares represented without attending the annual meeting. The shares represented by a properly executed proxy will be voted as you direct. To submit a proxy, you must follow the instructions provided in this proxy statement and in the Notice. You may submit your proxy via the Internet, regular mail, or by calling the telephone number provided in the Notice, and you will be asked to enter your 11- or 12-digit control number. If you request a printed copy of these materials, you may also fill out and sign the proxy card enclosed therein and return it by mail in the envelope provided.

If you submit a signed proxy but do not indicate any voting instructions, your shares will be voted FOR the election as directors of the nominees named in this proxy statement, FOR the ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal 2015, and FOR the advisory vote to approve the compensation of our named executive officers.

You can revoke your proxy any time before it is voted by written notice delivered to the Company’s Secretary, by timely delivery of a later signed proxy (including via the Internet, regular mail, or telephone), or by voting in person at the annual meeting. Attendance at the meeting alone is not sufficient to revoke your proxy. You must also vote your shares to revoke your proxy.

MERITAGE HOMES | 2015 Proxy Statement 2

Holders of Record

If your shares are registered directly in your name with our transfer agent, you are considered the “holder of record” of those shares. If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and the Notice is being forwarded to you by your broker or nominee (the “record holder”) along with a voting instruction card. As the beneficial owner, you have the right to direct your record holder regarding how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions.

Record Holders and Beneficial Owners

As the record or beneficial owner of shares, you are invited to attend the annual meeting. Please note, however, that if you are a beneficial owner, you may not vote your shares in person at the meeting unless you obtain a “legal proxy” from the record holder that holds your shares. Rules of the New York Stock Exchange (the “NYSE”) determine whether proposals presented at stockholder meetings are “routine” or “non-routine.” If a proposal is routine, a broker or other entity holding shares for a beneficial owner in street name may vote on the proposal if you do not provide voting instructions. If a proposal is non-routine, the broker or other entity may vote on the proposal only if the beneficial owner has provided voting instructions. A “broker non-vote” occurs when the broker or other entity is unable to vote on a proposal because the proposal is non-routine and the beneficial owner does not provide instructions. If you do not give instructions to your record holder prior to the meeting, the record holder will be entitled to vote your shares in its discretion only on Proposal 2 (Ratification of Independent Registered Public Accounting Firm) and will not be able to vote your shares on Proposal 1 (Election of Directors), or Proposal 3 (Advisory Vote to Approve Compensation of our Named Executive Officers), and your shares will be treated as a “broker non-vote” on those proposals.

Quorum

The presence in person or by proxy of stockholders representing a majority of the votes entitled to be cast at the meeting is necessary to constitute a quorum at the meeting. Abstentions and broker non-votes are counted as present for purposes of determining whether a quorum exists.

|

| | | |

The following three proposals will be considered at the Annual Meeting: |

Proposal | Board Vote Recommendation | Page Number |

1 | Election of Directors | FOR Each Director | |

2 | Ratification of Independent Registered Public Accounting Firm | FOR | |

3 | Advisory Vote to Approve Compensation of our Named Executive Officers | FOR | |

|

|

PROPOSAL 1 |

Election of Directors (page 6) |

Each director nominee is up for election for a two-year term. Each director nominee is a current director and attended at least 75% of all meetings of the Board and of all Board committees on which he sits.

|

| | | | | | | | | | | | | | |

Name | | Age | | Director Since | | Independent | | AC | | CC | | NGC | | LC |

Peter L. Ax | | 55 | | 2000 | | Yes | | | | û | | û | | û |

Robert G. Sarver | | 53 | | 1996 | | No | | | | | | | | |

Gerald Haddock | | 67 | | 2005 | | Yes | | û | | û | | | | û |

Michael R. Odell | | 51 | | 2011 | | Yes | | û | | û | | û | | |

|

| | | | | |

| = | Chair | | AC | Audit Committee |

û | = | Member | | CC | Executive Compensation Committee |

| | | | NGC | Nominating/Governance Committee |

| | | | LC | Land Committee |

3 MERITAGE HOMES | 2015 Proxy Statement

|

| |

PROPOSAL 2 | |

Ratification of Independent Registered Public Accounting Firm | (page 7) |

Ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2015 fiscal year. |

| | | | | | | | |

| | Summary of Fees |

| | 2014 | | 2013 |

Audit fees | | $ | 1,109,100 |

| | $ | 1,049,800 |

|

Audit-related fees | | — |

| | — |

|

Tax fees | | — |

| | — |

|

All other fees | | — |

| | — |

|

Total fees | | $ | 1,109,100 |

| | $ | 1,049,800 |

|

|

| |

PROPOSAL 3 | |

Advisory Vote to Approve Compensation of our Named Executive Officers | (page 8) |

Stockholders will be given the opportunity to vote on an advisory resolution to approve the compensation of our Named Executive Officers (“NEOs”) (commonly referred to as “Say on Pay”).

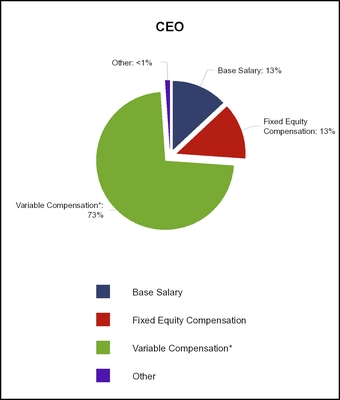

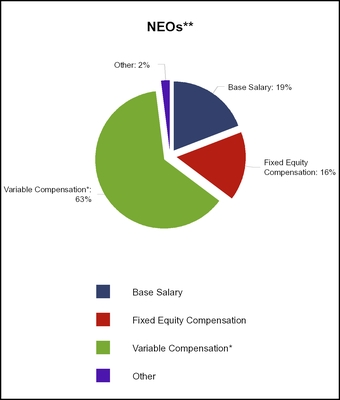

Our executive compensation program is designed to drive and reward superior corporate performance, both annually and over the long-term. The Board believes the Company’s compensation policies and practices are effective in achieving the Company’s goals of paying for performance and aligning the NEOs long-term interests with those of our stockholders. Compensation elements for our NEOs include: |

| | | |

Type | | Form | Terms |

Cash | | Base Salary | Competitively market-based |

Cash | | Annual Incentive Compensation | Based on performance measurements |

Cash | | Discretionary Bonuses | Based on specific achievements of each individual beyond those of the performance measurements included in the annual incentive compensation calculations, subject to approval by Executive Compensation Committee; no discretionary bonuses were awarded in 2013 or 2014 |

Equity | | Long-term Incentive Awards | Equity awards have a three-year service or performance period, with 50% of the total awards contingent upon the achievement of specified performance criteria |

Other | | Limited Perquisites | Primarily auto allowance and the reimbursement of certain life and disability (or equivalent) policies for the benefit of NEOs and their families |

The management and Board of Directors of the Company know of no other matters to be brought before the meeting. If other matters are properly presented to the stockholders for action at the meeting or any adjournments or postponements thereof, it is the intention of the proxy holders named in this proxy to vote in their discretion on all matters on which the shares of common stock represented by such proxy are entitled to vote. The entire cost of this solicitation of proxies will be borne by the Company, including expenses incurred in connection with preparing, assembling and mailing the Notice. The Company may reimburse brokers or persons holding stock in their names or in the names of their nominees for their expenses in sending the proxy materials to beneficial owners who request paper copies. Certain officers, directors and regular employees of the Company, who will receive no extra compensation for their services, may solicit proxies by mail, telephone, facsimile, email or personally.

MERITAGE HOMES | 2015 Proxy Statement 4

Meritage operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities and setting high standards for ethical conduct. Our Board of Directors has established the following governance committees:

|

| |

— | Audit Committee |

— | Executive Compensation Committee |

— | Nominating/Governance Committee |

— | Land Committee |

The charter of each of these committees is available on our website, along with our Code of Ethics, Corporate Governance Principles and Practices and Securities Trading Policy. Our committee charters, Code of Ethics, Corporate Governance Principles and Practices and Securities Trading Policy are also available in print, free of charge, to any stockholder who requests them by calling us or by writing to us at our principal executive offices at the address listed previously in this proxy statement, Attention: Secretary.

5 MERITAGE HOMES | 2015 Proxy Statement

Election of Directors

(Proposal No. 1)

Our Board of Directors currently has eight members. The directors are divided into two classes serving staggered two-year terms. This year, our Class II Directors are up for election. The Board, upon the recommendation of the Nominating/Governance Committee, has nominated for re-election Peter L. Ax, Robert G. Sarver, Gerald Haddock and Michael R. Odell, all of whom are presently serving as Class II Directors.

Biographical information for each of our director nominees is set forth beginning on page 14.

All nominees have consented to serve as directors. The Board of Directors has no reason to believe that any of the nominees will be unable to act as a director. However, should a nominee become unable to serve or should a vacancy on the Board occur before the annual meeting, the Board may either reduce its size or designate a substitute nominee. If a substitute nominee is named, your shares will be voted for the election of the substitute nominee designated by the Board. In the vote on the election of the director nominees, stockholders may vote FOR, AGAINST, or ABSTAIN for each Director.

Unless you elect to vote differently by so indicating on your signed proxy, your shares will be voted FOR the Board’s nominees. To be elected a director, a director nominee must receive the affirmative vote of the majority of the votes cast, meaning, that the number of votes cast "for" a director nominee must exceed the number of votes "against" that director nominee. Broker non-votes and abstentions will not count as either votes for or against the nominee.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE ABOVE-NAMED NOMINEES AS DIRECTORS.

MERITAGE HOMES | 2015 Proxy Statement 6

Ratification of Independent Registered Public Accounting Firm

(Proposal No. 2)

The Board of Directors seeks an indication from stockholders of their approval or disapproval of the Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2015.

Deloitte & Touche LLP was appointed our auditor in 2005 and no relationship exists other than the usual relationship between auditors and clients.

An affirmative vote of the majority of the votes cast at the annual meeting, at which a quorum is present, is required to ratify the selection of Deloitte & Touche LLP as the Company’s independent auditor. Abstentions will not be counted either for or against this proposal. If the appointment of Deloitte & Touche LLP as auditors for 2015 is not approved by stockholders, the adverse vote will be considered a direction to the Audit Committee to consider other auditors for next year. However, because of the difficulty in making any substitution of auditors after the beginning of the current year, the appointment in 2015 will stand, unless the Audit Committee determines there is a reason for making a change. In addition, even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of the Company and our stockholders.

THE BOARD OF DIRECTORS HAS APPROVED THIS PROPOSAL NO. 2 AND UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL NO. 2.

7 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

Advisory Vote to Approve Compensation of our Named Executive Officers

(Proposal No. 3)

Stockholders will be given the opportunity to vote on the following advisory resolution (commonly referred to as “Say on Pay”):

RESOLVED, that compensation paid to the Company’s named executive officers, as disclosed herein pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.

In accordance with the Dodd-Frank Act and related SEC rules, stockholders are being given the opportunity to vote at the annual meeting on this advisory resolution regarding the compensation of our NEOs.

At our 2014 Annual Meeting of Stockholders, the Company’s stockholders approved the compensation of our NEOs (on an advisory basis) by over 98% of total votes cast. We believe this high approval rating indicated that our stockholders were in agreement with the direction of our Executive Compensation Committee of setting competitive compensation arrangements based on criterion believed to be both in line with the goals of our stockholders and at levels that are realizable in relation to the Company’s performance and size. In addition, at our 2011 Annual Meeting of Stockholders, the stockholders indicated, on an advisory vote basis, that they preferred that we hold Say on Pay votes on an annual basis (a frequency vote is required to be held at least once every six years). In light of these results, the Company’s Board of Directors has decided to hold its future advisory votes on the compensation of named executive officers annually until the next frequency vote, which will be held on or before our 2017 Annual Meeting. This Proposal No. 3 represents this year’s Say on Pay vote.

For a comprehensive description of our executive compensation program, philosophy and objectives, including the specific elements of executive compensation that comprised the program in 2014, please refer to the Compensation Discussion and Analysis section of this proxy statement. The Summary Compensation Table and other executive compensation tables (and accompanying narrative disclosures) that follow it, beginning at page 35, provide additional information about the compensation that we paid to our NEOs in 2014. As described in the Compensation Discussion and Analysis, our executive compensation program is designed to drive and reward superior performance both annually and over the long term while simultaneously striving to be externally competitive. During 2014, through the combined efforts of our NEOs, Meritage was successful in achieving the following accomplishments:

| |

• | Generated year-over-year increases in most of our key operating metrics, including the following (dollars in thousands): |

|

| | | | | | | | | | |

| | 2014 | | 2013 | | % Increase |

Home Closing Units | | 5,862 |

| | 5,259 |

| | 11.5% |

Home Closing Revenue | | $ | 2,142,391 |

| | $ | 1,783,389 |

| | 20.1% |

Home Order Units | | 5,944 |

| | 5,615 |

| | 5.9% |

Home Order Value | | $ | 2,238,117 |

| | $ | 1,982,303 |

| | 12.9% |

Backlog Units | | 2,114 |

| | 1,853 |

| | 14.1% |

Backlog Value | | $ | 846,452 |

| | $ | 686,672 |

| | 23.3% |

Pre-Tax Income | | $ | 208,417 |

| | $ | 177,672 |

| | 17.3% |

Diluted Earnings Per Share | | $ | 3.46 |

| | $ | 3.25 |

| | 6.5% |

| |

• | Entry into new markets—In 2014, we reported our first full year of results in the Nashville, Tennessee market (operations there commenced in the third quarter of 2013), and in August 2014, we entered the Atlanta, Georgia and Greenville, South Carolina markets through the acquisition of the homebuilding assets and operations of BK Residential Construction, LLC ("Legendary Communities"). |

MERITAGE HOMES | 2015 Proxy Statement 8

|

| | | |

PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | | |

| |

• | Capital transactions—In the first quarter of 2014 we raised $110.5 million, net of offering costs, in a public equity offering. In addition, we increased the capacity of our unsecured revolving credit facility to $400 million during 2014 to provide additional liquidity, and in March of 2015 we further increased the capacity to $500 million. |

The Executive Compensation Committee continually evaluates the compensation packages for our NEOs and adjusts them as conditions warrant, including setting performance targets for both cash and equity awards, some of which have been forfeited in the past in cases where targets were not met. In 2013, the Executive Compensation Committee engaged a compensation consultant and revised some of the compensation arrangements effective in 2014. The Company over the last several years (inclusive of the most recent updates) has implemented prudent and responsible compensation policies in the stockholders’ interest, some of which include:

| |

• | Perquisites are limited to auto allowances and reimbursement of certain life and disability or long-term care insurance premiums, and limited other benefits as discussed on page 27. |

| |

• | NEOs must comply with security ownership requirements, as discussed on page 27. |

| |

• | Incentive compensation is balanced between cash and equity awards, as discussed beginning on page 26. |

| |

• | Each employment agreement of our NEOs includes a provision for the clawback (or offset) of incentive bonuses to the extent any financial results are misstated as the result of the NEO’s willful misconduct or gross negligence. |

Because the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to our NEOs and will not be binding on the Board of Directors or the Executive Compensation Committee. However, the Executive Compensation Committee will consider the outcome of the vote when making future executive compensation decisions.

An affirmative vote of a majority of the votes cast at the annual meeting, at which a quorum is present, is required to approve this advisory vote. Broker non-votes and abstentions have no effect on the result of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE RESOLUTION SET FORTH ABOVE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

9 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | |

| | | SECURITY OWNERSHIP BY MANAGEMENT AND PRINCIPAL STOCKHOLDERS |

Security Ownership by Management and Principal Stockholders

Management. The following table summarizes, as of March 15, 2015, the number and percentage of outstanding shares of our common stock beneficially owned by the following:

| |

• | each Meritage director and nominee for director; |

| |

• | each executive officer named in the summary compensation table; and |

| |

• | all Meritage directors and executive officers as a group. |

|

| | | | | | | | | | | | | | |

Name Of Beneficial Owner(1) | | Position With The Company | | Number Of Shares Owned | | Right To Acquire By May 14, 2015 | | Total Shares Beneficially Owned(2) | | Percent Of Outstanding Shares(3) |

Steven J. Hilton | | Director, Chairman and CEO | | 1,538,048 |

| (4) | — |

| | 1,538,048 |

| | 3.9 | % |

Robert G. Sarver | | Director | | 213,040 |

| (5) | — |

| | 213,040 |

| | * |

|

Raymond Oppel | | Director | | 49,000 |

| (6) | — |

| | 49,000 |

| | * |

|

Peter L. Ax | | Director | | 54,000 |

| | — |

| | 54,000 |

| | * |

|

Richard T. Burke, Sr. | | Director | | 51,500 |

| | — |

| | 51,500 |

| | * |

|

Gerald Haddock | | Director | | 61,000 |

| (7) | — |

| | 61,000 |

| | * |

|

Dana Bradford | | Director | | 37,000 |

| | — |

| | 37,000 |

| | * |

|

Michael R. Odell | | Director | | 18,000 |

| | — |

| | 18,000 |

| | * |

|

Larry W. Seay | | Executive Vice President and Chief Financial Officer | | 78,253 |

| | — |

| | 78,253 |

| | * |

|

C. Timothy White | | Executive Vice President, General Counsel and Secretary | | 29,149 |

| | — |

| | 29,149 |

| | * |

|

Steven M. Davis | | Executive Vice President and Chief Operating Officer | | 38,799 |

| | — |

| | 38,799 |

| | * |

|

All current directors and executive officers as a group (11 persons) | | | | 2,167,789 |

| | — |

| | 2,167,789 |

| | 5.5 | % |

* Less than 1%.

| |

(1) | The address for our directors and executive officers is c/o Meritage Homes Corporation, 8800 East Raintree Drive, Suite 300, Scottsdale, Arizona 85260. |

| |

(2) | The amounts shown include the shares of common stock actually owned as of March 15, 2015, and the shares that the person or group had the right to acquire within 60 days of that date. The number of shares includes shares of common stock owned by other related individuals and entities over whose shares of common stock such person has custody, voting control or the power of disposition. As of March 15, 2015, there were no outstanding options for any of our NEOs or Board members as we no longer award stock options as part of equity compensation. |

| |

(3) | Based on 39,616,613 shares outstanding as of March 15, 2015. |

| |

(4) | Shares are held by family trusts. As of March 15, 2015, Mr. Hilton had 900,000 shares pledged to a third-party lending institution, 350,000 of which are securing loans. Our pledging policy is discussed on page 21 of this proxy statement. |

| |

(5) | Shares are held by family trusts (6,000 shares Penny Sarver—wife; 2,000 shares Penny Sarver FBO Max Sarver—minor son; 8,170 shares Robert Sarver—trustee of Eva Lauren Hilton Trust; 8,170 shares Robert Sarver—trustee of Shari Rachel Hilton Trust; 188,700 shares Robert Sarver—trustee of Robert Sarver Trust). Mr. Sarver has expressly disclaimed any beneficial ownership of the shares held by the trusts for the benefit of Mr. Hilton’s children (Eva Lauren Hilton Trust and Shari Rachel Hilton trust). Mr. Sarver had 124,200 shares pledged to a third party lending institution as of March 15, 2015. None of these shares secured loans in 2015. Our pledging policy is discussed on page 21 of this proxy statement. |

| |

(6) | 6,000 shares are owned indirectly by family trusts. |

| |

(7) | Includes 15,000 shares held by charities on which Mr. Haddock serves as a board member and has authority to make investment decisions on behalf of. Holdings are with The Haddock Center (10,000 shares), and the Haddock Foundation (5,000 shares). Mr. Haddock has expressly disclaimed beneficial ownership of these shares. |

MERITAGE HOMES | 2015 Proxy Statement 10

|

| | | |

| | | |

SECURITY OWNERSHIP BY MANAGEMENT AND PRINCIPAL STOCKHOLDERS | | | |

Certain Other Beneficial Owners. Based on filings made under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as of March 15, 2015, the only other known beneficial owners of more than 5% of Meritage common stock are shown in the following table:

|

| | | | | | | | |

| | | | Shares Beneficially Owned |

Name of Other Beneficial Owners | | Address Of Beneficial Owner | | Number | | Percent |

BlackRock, Inc. (1) | | 55 East 52nd Street, New York, NY 10022 | | 4,228,397 |

| | 10.8 | % |

Sanders Capital, LLC (2) | | 390 Park Avenue, 17th Floor, New York, NY 10022 | | 3,928,036 |

| | 10.8 | % |

Citadel Advisors, LLC (3) | | 131 S. Dearborn Street, 32nd Floor, Chicago, IL 60603 | | 3,582,953 |

| | 9.2 | % |

T. Rowe Price Associates, Inc. (4) | | 100 E. Pratt Street, Baltimore, MD 21202 | | 2,985,680 |

| | 7.6 | % |

AllianceBernstein, LP (5) | | 1345 Avenue of the Americas, New York, NY 10105 | | 2,419,150 |

| | 6.2 | % |

Vanguard Group, Inc. (6) | | 100 Vanguard Blvd. Malvern, PA 19355 | | 2,311,231 |

| | 5.9 | % |

| |

(1) | Based solely on a Schedule 13G/A filed with the SEC on January 9, 2015, Blackrock, Inc. and certain affiliated entities have sole voting power with respect to 4,136,765 shares and sole dispositive power with respect to 4,228,397 shares. |

| |

(2) | Based solely on a Schedule 13G/A filed with the SEC on January 14, 2015, Sanders Capital, LLC has sole voting power with respect to 1,727,428 shares and sole dispositive power with respect to 3,928,036 shares. |

| |

(3) | Based solely on a Schedule 13G/A filed with the SEC on February 17, 2015, Citadel Advisors, LLC has shared voting power and shared dispositive power with respect to 3,582,953 shares. |

| |

(4) | Based solely on a Schedule 13G/A filed with the SEC on February 13, 2015, T. Rowe Price Associates, Inc. has sole voting power with respect to 765,190 shares and sole dispositive power with respect to 2,985,680 shares. |

| |

(5) | Based solely on a Schedule 13G/A filed with the SEC on February 12, 2015, AllianceBernstein, LP has sole voting power with respect to 2,117,480 shares and sole dispositive power with respect to 2,419,150 shares. |

| |

(6) | Based solely on a Schedule 13G/A filed with the SEC on February 11, 2015, Vanguard Group, Inc. has sole voting power with respect to 53,342 shares, sole dispositive power with respect to 2,260,489 shares and shared dispositive power with respect to 50,742 shares. |

For each of the reporting owners set forth above, the beneficially owned shares are held in various individual funds owned or managed by the reporting owners, but none of the individual funds managed by the reporting owners above hold more than 5% of the Company stock.

11 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | |

| | | CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

Corporate Governance and Board Matters

|

| | | | |

Role of the Board of Directors |

The Board of Directors (“the Board”) is elected by the stockholders to oversee the stockholders’ interests in the operation and overall success of our business. The Board serves as our ultimate decision-making body, except for those matters reserved to or that require a vote of our stockholders. The Board selects and oversees the members of senior management who are charged by the Board with conducting our business. We have established and operate in accordance with a comprehensive plan of corporate governance that defines and sets ethical standards for the conduct of our directors, officers and employees. This plan provides an important framework within which the Board can pursue our strategic objectives and ensure long-term stockholder value.

|

| | | | |

Corporate Governance Principles and Practices |

We have adopted Corporate Governance Principles and Practices that define the key elements of our corporate governance framework and philosophy, including:

| |

• | director qualifications, |

| |

• | director responsibilities, |

| |

• | committee responsibilities and structure, |

| |

• | officer and director stock ownership requirements, |

| |

• | director resignation policy, |

| |

• | director access to officers and employees, |

| |

• | our philosophy with respect to director compensation, |

| |

• | Board evaluation process, |

| |

• | confidentiality requirements, |

| |

• | director orientation and continuing education, and |

| |

• | our plans with respect to management succession. |

Our Corporate Governance Principles and Practices are available on our website at investors.meritagehomes.com and we will provide a printed copy to any stockholder upon request. These principles are reviewed regularly by the Nominating/Governance Committee and changes are made as the Committee deems appropriate.

|

| | | | |

Director Qualifications and Diversity |

Our Board of Directors is comprised of a group of individuals whose previous experience, financial and business acumen, personal ethics and dedication and commitment to our company allow the Board to complete its key task as the over-seer and governing body of Meritage Homes Corporation. The specific experience and qualifications of each of our Board members are set forth below. The Board is committed to a policy of inclusiveness and diversity. The Board believes members should be comprised of persons with diverse skills, expertise, backgrounds and experiences including, without limitation, the following areas:

| |

• | management or board experience in a wide variety of enterprises and organizations, banking and capital markets and finance, |

| |

• | real estate, including homebuilding, commercial and land development, |

| |

• | sales and marketing, and |

In 2014, the Board of Directors amended and restated our bylaws to adopt a customary majority voting standard for the election of directors. In addition, we updated our Corporate Governance Principles and Practices to require that any nominee for director who is an incumbent director but who is not elected by the vote required in the bylaws, and with respect to whom

MERITAGE HOMES | 2015 Proxy Statement 12

|

| | | |

| | | |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | | | |

no successor has been elected, promptly tender his or her offer to resign to the Board of Directors for its consideration. The Nominating/Governance Committee of the Board of Directors will recommend to the Board of Directors whether to accept or reject the resignation offer, or whether other action should be taken. In determining whether to recommend that the Board of Directors accept any resignation offer, the Nominating/Governance Committee will be entitled to consider all factors believed relevant by the Nominating/Governance Committee’s members. The Board of Directors will act on the Nominating/Governance Committee’s recommendation within 90 days following certification of the election results and will announce its determination and rationale in a Form 8-K. In deciding whether to accept the resignation offer, the Board of Directors will consider the factors considered by the Nominating/Governance Committee and any additional information and factors that the Board of Directors believes to be relevant. If the Board of Directors accepts a director’s resignation offer pursuant to its process, the Nominating/Governance Committee will recommend to the Board of Directors and the Board of Directors will thereafter determine what action, if any, will be taken with respect to any vacancy created by a resignation. Any director who tenders his or her resignation pursuant to this policy will not participate in the proceedings of either the Nominating/Governance Committee or the Board of Directors with respect to his or her own resignation.

In case of a Board vacancy or if the Board elects to increase its size, determinations regarding the eligibility of director candidates are made by the Nominating/Governance Committee, which considers the candidate’s qualifications as to skills and experience in the context of the needs of the Board of Directors and our stockholders. When seeking new Board candidates, the Nominating/Governance Committee is committed to a policy of inclusiveness and will take reasonable steps to ensure that women and minority candidates are considered for the pool of candidates from which the Board nominees are chosen and will endeavor to include candidates from non-traditional venues.

13 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | |

| | | CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

Our Board is comprised of the following members:

Class I Directors

|

| | |

Steven J. Hilton, 53 | | Mr. Hilton was co-chairman and co-chief executive officer of Meritage Homes Corporation from 1996 to May 2006. In May 2006, Mr. Hilton was named the Company’s chairman and chief executive officer. In 1985, Mr. Hilton co-founded Arizona-based Monterey Homes, the predecessor company to Meritage Homes Corporation. Under Mr. Hilton’s leadership, Monterey became publicly traded in 1996. Mr. Hilton received his Bachelor of Science degree in accounting from the University of Arizona and is a director of Western Alliance Bancorporation (a NYSE listed company), a leading bank holding company based in Phoenix, Arizona. Mr. Hilton has 30 years of real estate experience and is considered an expert and innovator in the homebuilding industry. He is a frequent participant in panels and interviews regarding the industry. |

|

Raymond Oppel, 58 | | Mr. Oppel has been a director since December 1997. Mr. Oppel is a licensed real estate broker and currently is active as a private investor in real estate development. He was the co-founder, chairman and chief executive officer of The Oppel Jenkins Group, a regional homebuilder in Texas and New Mexico, which was purchased in 1995 by public homebuilder KB Home. Mr. Oppel has almost 30 years of experience in the homebuilding business. Mr. Oppel possesses extensive knowledge about the real estate industry in general and the homebuilding industry in particular. |

|

Richard T. Burke, Sr., 71 | | Mr. Burke has been a director since September 2004. Mr. Burke is currently the Chairman of the Board of Directors of UnitedHealth Group, which he founded, took public in 1984 and served as chief executive officer as well. From 1995 until 2001, Mr. Burke was the owner and chief executive officer of the Phoenix Coyotes, a National Hockey League team and has served as a director for a number of other companies, public and private. Mr. Burke previously served as a director for First Cash Financial Services, Inc., a position from which he resigned within the past five years. Mr. Burke is a business and civic leader in Phoenix, Arizona, and his experience as the chairman and CEO of a multi-billion dollar public company provides the Board with outstanding corporate governance and financial insight. |

|

Dana C. Bradford, 50 | | Mr. Bradford has been a director since August 2009. Currently, Mr. Bradford is the co-founder of and is currently the Executive Chairman of Waitt Brands, a diversified consumer brands company. From 2005 to 2011, Mr. Bradford was the president and managing partner of McCarthy Capital Corporation, a private equity firm. He serves as executive chairman of the board of Prime Global Sports, a tennis and squash company. Mr. Bradford also serves as a director on the boards of the Waitt Company, Vornado Air, Southwest Value Partners, a San Diego-based real estate investment company and Custom Service Profiles, a provider of customer satisfaction data and analytics. Mr. Bradford formerly served as chairman of the board of SAFE Boats International, a director on the boards of Ballantyne (AMEX: BTN); NRG Media; Guild Mortgage; Gold Circle Films and McCarthy Group, an Omaha-based investment company. Mr. Bradford earned a bachelor’s degree in business administration from the University of Arizona and an MBA from Creighton University. Mr. Bradford brings additional perspective to the Board relating to real estate and corporate finance matters. |

|

MERITAGE HOMES | 2015 Proxy Statement 14

|

| | | |

| | | |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | | | |

Class II Directors

|

| | |

Peter L. Ax, 55 | | Mr. Ax has been a director since September 2000. He is the managing partner of Phoenix Capital Management, an operationally focused venture capital firm. Mr. Ax is the former chairman and chief executive officer of SpinCycle, Inc., a public reporting consolidator and developer of coin-operated laundromats. Previously, Mr. Ax served as head of the Private Equity Division and senior vice president of Lehman Brothers in New York and has served in various operating roles for enterprises operated by Phoenix Capital Management. Mr. Ax is also on the board of directors of iGo, Inc. (formerly, NASDAQ: IGOI) and serves on the Advisory Board of Directors of Cascadia Capital, a Seattle-based investment banking and merchant banking firm, and also serves annually as a judge in the Wharton Entrepreneurship Business Plan Competition. Mr. Ax holds an MBA from the Wharton School at the University of Pennsylvania, a J.D. from the University of Arizona, and a B.S.B.A. from the University of Arizona, and has been a certified public accountant. Mr. Ax possesses extensive skills and experience relating to, among other things, capital markets and corporate finance. |

|

Robert G. Sarver, 53 | | Mr. Sarver has been a director since December 1996. He is the chairman and chief executive officer of Western Alliance Bancorporation (a NYSE listed company), a director of Skywest Airlines, and the managing partner of the Phoenix Suns NBA basketball team. From 1995 to 1998, he served as chairman of Grossmont Bank. He was the chairman and chief executive officer of California Bank & Trust from 1998 to 2001. Mr. Sarver earned a bachelor’s degree in business administration from the University of Arizona and has been a certified public accountant. Mr. Sarver has been active in the real estate industry for more than 30 years and is known nationwide as a leader and expert in banking. He has extensive experience in a wide spectrum of successful real-estate activities, including commercial, residential and development projects. |

|

Gerald Haddock, 67 | | Mr. Haddock was appointed as a director in January 2005. Mr. Haddock is the founder of Haddock Enterprises, LLC and formerly served as president and Chief Executive Officer of Crescent Real Estate Equities, a diversified real estate investment trust. He is currently a director of ENSCO International, Plc., a leading global offshore oil and gas drilling service company. As a director for ENSCO, he has served as its co-lead director and Chairperson of the Audit Committee and is also a member of the Nominating & Governance Committee. From December 2004 to October 2008, Mr. Haddock served as a Board Member of Cano Petroleum, Inc. He also serves on the board of trustees and is a member of various committees for the Baylor College of Medicine, the Executive Investment Committee at Baylor University, the M.D. Anderson Proton Therapy Education and Research Foundation, and the CEELI Institute. Mr. Haddock received his Bachelor of business administration and Juris Doctorate degrees from Baylor University. He also received a Masters of Law in Taxation degree from New York University and an MBA degree from Dallas Baptist University. |

|

Michael R. Odell, 51 | | Mr. Odell has been a director since December 2011. From 2008 through 2014, he served as President, chief executive officer and board member of The Pep Boys—Manny, Moe & Jack, a NYSE-listed Fortune 1000 company and the nation's leading automotive aftermarket service and retail chain. Mr. Odell joined Pep Boys in September 2007 as the chief operating officer. Previously, he served as executive vice president and general manager of Sears Retail & Specialty Stores, a $26 billion division of Sears Holdings Corporation. Mr. Odell joined Sears in 1994 where he served in executive operations positions of increasing responsibility, including as Vice President, Stores-Sears Automotive Group. Mr. Odell started his career as a CPA with Deloitte & Touche LLP. Mr. Odell holds an M.B.A. from Northwestern University’s Kellogg School of Management, and a B.S. in Accounting from the University of Denver’s Daniels College of Business. Mr. Odell has deep service and retail experience, with a broad background in strategic planning, leadership, operations and finance. |

|

15 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | |

| | | CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

The Nominating/Governance Committee evaluates and reports to the Board of Directors regarding the independence of each candidate. Consistent with the rules and regulations of the NYSE, at least a majority of the Board of Directors must be independent. No director will be deemed to be independent unless the Board affirmatively determines that the director has no material relationship with the Company, either directly or as an officer, shareowner, member, partner or trustee of an organization that has a relationship with the Company. The Board observes all criteria established by the NYSE and other governing laws and regulations. In its review of director independence, the Board considers all commercial, banking, consulting, legal, accounting, charitable and other business relationships the director may have with the Company.

As a result of its review, the Board of Directors has determined that a majority of Meritage’s Board members are independent. Our independent directors are Peter L. Ax, Raymond Oppel, Richard T. Burke, Sr., Gerald Haddock, Dana Bradford and Michael R. Odell.

In making this determination, the Board of Directors evaluated whether there exists any relationships between these individuals and Meritage and determined no relationship exists between Meritage and any independent director.

Steven J. Hilton is not considered independent because he is employed by the Company.

Prior to 2004, Robert G. Sarver was deemed an independent director. The Nominating/Governance Committee has continually monitored certain relationships between Mr. Sarver and Meritage along with relationships between Mr. Sarver and Mr. Hilton. Mr. Sarver and Mr. Hilton have certain business relationships unrelated to Meritage, including Mr. Sarver serving as trustee of certain of Mr. Hilton’s family trusts. The Nominating/Governance Committee evaluated these relationships and determined that they did not impair Mr. Sarver’s independence because they do not involve Meritage and are insignificant in relation to Mr. Sarver’s net worth. During 2004, Mr. Sarver became the controlling owner of the Phoenix Suns basketball team, in which Mr. Hilton purchased a minority ownership interest. This relationship was closely evaluated by the Nominating/Governance Committee because of its significance to Messrs. Sarver and Hilton. The Nominating/Governance Committee and the Board of Directors believe Mr. Sarver is a valuable member of the Board and that the Company benefits from his extensive business experience. Although Mr. Sarver does not have any material relationship with the Company which under the applicable rules and regulations would deem him not independent, the Nominating/Governance Committee has nevertheless concluded it is at this time in the best interest of Meritage’s stockholders that Mr. Sarver not be deemed an independent director.

The Board has also determined that all governance committees of the Board should be comprised entirely of independent directors and therefore neither Mr. Hilton nor Mr. Sarver serves on any Board governance committees.

|

| | | | |

Board Leadership Structure |

Steven J. Hilton, our co-founder and CEO, also serves as a director and the Chairman of the Board. We believe Mr. Hilton’s unique industry experience and continuing involvement in the day-to-day operations of the Company make him highly qualified to serve as our Board’s Chairman. Mr. Hilton co-founded Meritage Homes and is thus intimately familiar with its history, culture and operations. Mr. Hilton possesses in-depth knowledge and expertise in the homebuilding industry as a whole and Meritage Homes in particular and is the Company’s largest non-institutional shareholder. The Board of Directors has concluded that this puts Mr. Hilton in a unique position and makes it compelling for him to serve both as Chairman of the Board and CEO to effectively represent the stockholders’ interest.

Mr. Ax, our Audit Committee Chairman, also serves as the Board’s lead independent director. Mr. Ax has extensive knowledge of capital markets and corporate finance and has previously served as CEO of a publicly traded corporation. We believe that Mr. Ax’s role as our lead independent director serves as a counterbalance to and complements Mr. Hilton’s position as Board Chairman and provides the appropriate level of independent director oversight. Additionally, our lead independent director presides over all independent director meetings and can call special meetings of the independent directors as he deems necessary to bring any matters the lead independent director feels should be addressed by the majority of our directors at any time.

|

| | | | |

CEO and Management Succession |

Under the charter of the Nominating/Governance Committee, it is the role of the Nominating/Governance Committee to review and recommend to the Board of Directors changes as needed to the Company’s Corporate Governance Principles and Practices, including items such as management succession, policies and principles for CEO selection and performance review, and policies regarding succession in the event of an emergency or departure of the CEO. Our Corporate Governance Principles and Practices provide, among other things, that our Executive Compensation Committee is to conduct an annual review of the performance of the CEO.

MERITAGE HOMES | 2015 Proxy Statement 16

|

| | | |

| | | |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | | | |

The Board of Directors considers management evaluation and CEO succession planning an important responsibility of the Board. Under our Corporate Governance Principles and Practices, the Board of Directors is responsible for approving a succession plan for our CEO and other senior officers. Issues relating to CEO succession planning are addressed regularly (at least annually) by the Board.

Our Board of Directors has overall responsibility for the oversight of risk management. As part of this oversight, on a regular basis, our Board of Directors receives reports from various members of management and is actively involved in monitoring and approving key decisions relating to our operations and strategy. Additionally, the management teams at our divisions must obtain approvals from our corporate executive team prior to engaging in certain activities or committing prescribed amounts of the Company’s financial and operational resources. As a result, senior management, who report directly to executive management, cannot authorize transactions that exceed prescribed thresholds that, while they may result in short-term benefits for their divisions, may expose us to unwarranted risks. Similarly, our executive management (including our NEOs) cannot engage in certain transactions without approval from our Board of Directors. For example, management must obtain approval from the Board of Directors, acting through the Land Committee, before proceeding with any land acquisition above a pre-established threshold. In addition, our General Counsel regularly reports to the Board of Directors information concerning ongoing litigation and possible legal, regulatory and other risks that might expose the Company to liability or loss. The Board also annually reviews the Company’s insurance programs.

Management operates the business within parameters established by an annual budget that is reviewed and approved by the Board of Directors. At each regular Board meeting, management provides the Board of Directors a status report with respect to the budget and addresses any material variances. We believe our budgeting process provides a useful mechanism for identifying risks and the related rewards and provides a quantitative method for evaluating those risks and rewards. The Board of Directors also provides oversight of risk through its standing committees. For example:

| |

• | Our Audit Committee is responsible for reviewing and analyzing significant financial and operational risks and how management is managing and mitigating such risks through its internal controls and risk management processes. Our VP of Internal Audit reports directly to the Audit Committee and provides routine updates on the progress and findings of the on-going internal audit reviews. Our external auditors also have at least quarterly discussions with our Audit Committee, and meet both with and without Company management present, to highlight what they perceive as our key financial risks. Our Audit Committee plays an important role in approving our internal controls monitoring and is regularly engaged in discussions with management regarding business risks, operational risks, transactional risks and financial risks. |

| |

• | Our Executive Compensation Committee oversees risks relating to the compensation and incentives provided to our senior executive officers. The Executive Compensation Committee negotiates and approves all of the employment agreements of our NEOs and the Committee approves all grants of equity awards to all of our eligible employees. Since 2009, we have begun using restricted share grants and restricted stock units (since 2014) in lieu of stock options in our long-term equity compensation plan to provide an incentive to balance the assumption of risk while maintaining shareholder value. In addition, for our NEOs, half of these equity grants contain performance vesting criterion. |

| |

• | All of our Independent Directors sit on all of our governance Committees, with the exception of the Land Committee, to provide greater Director participation in key policy decisions. |

|

| | | | |

The Board and Board Committees |

We currently have eight incumbent directors and the following committees:

| |

• | Executive Compensation Committee |

| |

• | Nominating/Governance Committee |

Our Board of Directors typically meets on a quarterly basis, with additional meetings held as required. During 2014, each director attended at least 75% of the aggregate of the Board and committee meetings of which they were a member, except for Mr. Burke who, though attending at least 75% of the aggregate of the meetings of the three committees of which he is a member, attended four of the six Board meetings held during 2014. Due to schedule conflicts, Mr. Burke was unable to attend these two Board meetings one of which was a telephonic Special Board meeting that had been called with short notice. Mr. Burke discussed with the Chairman the business covered at these two meetings and provided his input and concurrence with all matters discussed and approved by the Board. Our Land Committee does not have regularly scheduled meetings

17 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | |

| | | CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

and rather meets when significant land transactions require the Land Committee’s consideration. Directors are expected to attend our annual meetings of stockholders. All directors attended our 2014 annual meeting, which was held on May 14, 2014.

The following table identifies the current members of our Board of Directors and the number of meetings held during 2014:

|

| | | | | | | | |

Board of Directors | | Audit Committee | | Executive Compensation Committee | | Nominating/ Governance Committee | | Land Committee |

Steven J. Hilton* | | | | | | | | |

Peter L. Ax + | | | | × | | × | | × |

Raymond Oppel | | × | | | | × | | × |

Richard T. Burke, Sr. | | × | | × | | × | | |

Gerald Haddock | | × | | × | | | | × |

Dana Bradford | | × | | × | | × | | × |

Michael R. Odell | | × | | × | | × | | |

Robert G. Sarver | | | | | | | | |

Number of Meetings | | 8 | | 4 | | 4 | | 8 |

|

| | |

* | = | Chairman of the Board |

× | = | Member |

| = | Committee Chair |

+ | = | Lead Independent Director |

Audit Committee

The Board of Directors has established an Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (Exchange Act), and the rules and regulations of the NYSE. The Audit Committee assists the Board of Directors in:

| |

• | fulfilling its oversight of the integrity of our financial statements, |

| |

• | overseeing our compliance with legal and regulatory requirements, |

| |

• | determining the independent registered public accounting firm’s qualifications and independence, |

| |

• | evaluating the performance of our internal audit function and independent registered public accounting firm, and |

| |

• | reviewing and approving any related party transaction between us and senior executive officers and directors. |

The Audit Committee has the sole authority to appoint and replace our independent registered public accounting firm and approves all audit engagement fees and terms of all significant non-audit engagements with the independent registered public accounting firm in accordance with the pre-approval policies set forth in our Audit Committee charter. The Audit Committee has the authority to obtain advice and assistance from, and receives appropriate funding from us for, outside legal, accounting and other advisors as it deems necessary to carry out its duties.

The Audit Committee operates under a written charter established by the Board. The charter is available on our website at investors.meritagehomes.com and we will provide a printed copy to any stockholder upon request. Each member of the Audit Committee meets the independence requirements of the NYSE and the Exchange Act, and is financially literate, knowledgeable and qualified to review our financial statements. In addition, each member of the Audit Committee has accounting or related financial management expertise. The Board of Directors has determined that Peter Ax, the Chairman of our Audit Committee and an independent director as defined by the NYSE’s listing standards, is an “audit committee financial expert.” Information about Mr. Ax’s past business and educational experience is included in his biography in this proxy statement under the caption “—Director Qualifications and Diversity —Class II Directors”.

The report of the Audit Committee is included in this proxy statement under the caption “Report of the Audit Committee.”

Executive Compensation Committee

The Board of Directors has established our Executive Compensation Committee (the “Compensation Committee”) in accordance with the NYSE’s rules and regulations. The Compensation Committee regularly reports to the Board of Directors and its responsibilities include:

| |

• | reviewing and approving goals and objectives relative to the compensation of our NEOs, evaluating our NEOs’ performance in light of these goals and approving the compensation of our NEOs, |

| |

• | reviewing and incorporating stockholder preferences with respect to compensation agreements with our NEOs, |

MERITAGE HOMES | 2015 Proxy Statement 18

|

| | | |

| | | |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | | | |

| |

• | overseeing all equity-based award grants, |

| |

• | making recommendations to the Board of Directors with regard to non-NEO compensation and equity-based awards, and |

| |

• | producing a report on executive compensation to be included in our annual proxy statement. |

The Compensation Committee is currently comprised of six members of the Board, each of whom is independent under the independence standards of the NYSE, a “non-employee director” under Section 16 of the Exchange Act, and an “outside director” for purposes of Section 162(m) of the Internal Revenue Code (the “Code”). Generally the Compensation Committee chairman is in charge of setting the schedule for the Compensation Committee’s meetings, as well as the agenda of each meeting.

The Compensation Committee operates under a written charter, which is available on our website at investors.meritagehomes.com. We will provide a printed copy of the charter to any stockholder upon request.

The Compensation Committee has the sole authority to hire outside advisors and consultants and to determine the terms, fees and costs of such engagements. In 2013 and 2014, the Compensation Committee engaged POE Group, to provide an update on current compensation trends and to provide recommendations on our NEOs’ current compensation packages.

The Compensation Committee determines executive compensation with respect to our NEOs independent of management. The Compensation Committee approves all grants of equity-based awards. For the NEOs, the number and type of equity award grants in most cases are determined or based on an employment agreement between the Company and the NEO, which are negotiated and approved by the Compensation Committee; however, they may be adjusted based on the Compensation Committee’s review of the NEO’s performance and competitive market factors. For non-NEOs, management is responsible for recommending to the Compensation Committee the persons to receive grants and the nature and size of the proposed award. Because management is responsible for the day-to-day operation of the Company, the Compensation Committee believes that management is in the best position to make this recommendation.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is, or has been, an employee of Meritage or any of its subsidiaries. There are no interlocking relationships between Meritage and other entities that might affect the determination of the compensation of Meritage’s executive officers.

Nominating/Governance Committee

The Board of Directors has established a Nominating/Governance Committee, which directly reports to the Board of Directors and is responsible for:

| |

• | identifying individuals qualified to become Board members and recommending director nominees for the next annual meeting of stockholders, |

| |

• | reviewing and recommending changes as needed to the Company’s Corporate Governance Principles and Practices, |

| |

• | addressing such items as management succession, including policies and principles for our CEO selection and performance review and succession in the event of an emergency or departure of the CEO, |

| |

• | developing director qualifications and determining whether newly elected directors or prospective director candidates meet those qualifications, |

| |

• | considering recommendations for director nominations received from stockholders, |

| |

• | reviewing the charters of the Compensation Committee, Audit Committee and Nominating/Governance Committee and any other committees |

| |

• | assessing and monitoring, with Board involvement, the Board’s performance, |

| |

• | recommending nominees for the Compensation Committee, Audit Committee, Land Committee, and |

| |

• | promoting adherence to a high standard of corporate governance and company values. |

The Nominating/Governance Committee has the sole authority to retain and terminate any search firm used to identify director candidates, including sole authority to approve the search firm’s fees and other retention terms. The Nominating/Governance Committee operates under a written charter, which is available on our website at investors.meritagehomes.com. We will provide a printed copy of the charter to any stockholder upon request. Each member of the Nominating/Governance Committee meets the independence requirements of the NYSE.

19 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | |

| | | CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

Director Nomination Process

Stockholder Nominees. The policy of the Nominating/Governance Committee is to consider properly-submitted stockholder recommendations for candidates for membership on the Board of Directors as described below. In evaluating such proposals, the Nominating/Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership qualifications and criteria described below. Any stockholder recommendations proposed for consideration by the Nominating/Governance Committee must include the nominee’s name and qualifications for Board membership and should be submitted to:

Meritage Homes Corporation

8800 East Raintree Drive

Suite 300

Scottsdale, Arizona 85260

Attn: Secretary

The Secretary will forward all recommendations to the Nominating/Governance Committee. In addition, our bylaws permit stockholders to nominate directors for consideration at an annual stockholder meeting. For a description of the process for submitting such nominations, and the deadline to propose actions for consideration at next year’s annual meeting, please see “Stockholder Proposals” on page 47 of this proxy statement.

Director Qualifications. The Nominating/Governance Committee will evaluate prospective nominees using the standards and qualifications set forth in our Corporate Governance Principles and Practices and in our criteria for new directors. Prospective nominees must meet the Company’s qualification requirements set forth in our Corporate Governance Principles and Practices and should have the highest professional and personal ethics and values, as well as broad experience at the policy-making level in business, government, education or public interest. Prospective nominees should be committed to enhancing stockholder value and should have sufficient time to devote to carrying out their duties and to provide insight based upon experience, talent, skill and expertise appropriate for the Board. Each prospective nominee must be willing and able to represent the interests of our stockholders.

Identifying and Evaluating Nominees for Directors. The Nominating/Governance Committee utilizes a variety of methods for identifying and evaluating nominees to serve as directors. The Nominating/Governance Committee assesses the current composition of the Board of Directors, the balance of management and independent directors and the need for Audit Committee expertise in its evaluation of prospective nominees. In the event that vacancies are anticipated, or otherwise arise, the Nominating/Governance Committee may seek recommendations from current Board members, professional search firms, outside legal, accounting and other advisors, or stockholders in order to locate qualified nominees. The Nominating/Governance Committee also evaluates each candidate in the context of maintaining and creating a diverse Board, as previously discussed. After completing its evaluation, the Nominating/Governance Committee will make a recommendation to the full Board of Directors as to the persons who should be nominated by the Board of Directors, and the Board will determine the nominees after considering such recommendations.

Director Orientation and Continuing Education. It is the policy of the Board that all new directors should participate in an orientation program sponsored by the Company. This orientation will be designed to familiarize new directors with the Company’s strategic plans, its significant financial, accounting and risk management issues, its compliance programs, its Code of Ethics, its principal officers, its internal audit function, and its independent auditors. In addition, the Board encourages each director to attend prominent continuing education programs. The Company will pay for the director’s tuition and reasonable and customary travel expenses to attend continuing education programs.

Executive Sessions of Independent Directors

Our Corporate Governance Principles and Practices dictate that the non-management members of the Board of Directors will meet in executive session at least quarterly outside the presence of directors that are employees or officers of the Company. The non-management directors met in executive session four times during 2014. Peter Ax is our Lead Independent Director and presides over these executive session meetings.

Land Committee

In early 2013, the Board of Directors established a Land Committee, which directly reports to the Board of Directors. Prior to such time, the approvals for significant land transactions were obtained by an affirmative vote of a majority of the Board’s directors. The Land Committee is responsible for reviewing and approving/denying land acquisition transactions recommended by management in excess of a predetermined monetary threshold. The Committee is intended to function as an additional approval mechanism for executive management’s land acquisition approval policies and procedures.

As of the date of this filing, the Land Committee was comprised of Messrs. Ax, Oppel, Haddock and Bradford. The Land Committee is transactional in nature; accordingly, the frequency of meetings is not pre-determined, and rather meetings only occur when significant land transactions arise that require Land Committee consideration. Currently, no compensation is paid to any director for service on the Land Committee, and there is not a Land Committee chair.

MERITAGE HOMES | 2015 Proxy Statement 20

|

| | | |

| | | |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS | | | |

We are committed to conducting business consistent with the highest ethical and legal standards. The Board of Directors has adopted a Code of Ethics, which is applicable to all employees, including our senior and executive management and our directors. The Code is available on our website at investors.meritagehomes.com and we will provide a print copy to any stockholder upon request.

Meritage Stock Pledging Policy

In February 2013, the Nominating/Governance Committee approved a modification to the Company’s securities trading policy prohibiting all future pledging of the Company’s equity securities by our employees, NEOs and Directors. In connection with this policy, the Company adopted a grandfather provision relating to existing pledges. As of the date our modified policy was adopted, only Messrs. Hilton and Sarver had outstanding pledges. Our grandfather provision exempts existing pledges and continuation or replacements thereto; provided, however, that with respect to these existing pledges (or continuations or replacements thereof) the number of shares pledged may not exceed the greater of (i) two-thirds of the total number of Meritage shares beneficially owned by Mr. Hilton or Sarver, as the case may be, or (ii) 200,000 shares. In establishing these grandfather provisions, the Board considered the particular circumstances of Mr. Hilton and Mr. Sarver, the founder of the Company and an original board member, respectively, both of whom have a significant ownership in the Company’s equity securities.

Anti-Hedging Policy

We have a securities trading policy that sets forth guidelines and restrictions on transactions involving our stock, which are applicable to all employees, including our NEOs and Directors. Among other things, our policy prohibits all types of hedging transactions, including, but not limited to, purchases of stock on margin, short sales, buying or selling puts or calls and similar transactions involving any derivative securities. These types of transactions would allow employees to own Company stock without the full risks and rewards of ownership. When that occurs, employees may no longer have the same objectives as the Company’s other stockholders and therefore such transactions involving Meritage stock are prohibited.

|

| | | | |

Communications with the Board of Directors |

Interested persons may communicate with the Board of Directors by writing to our Lead Independent Director at the address set forth on page 2. The Lead Independent Director will disseminate the information to the rest of the Board at his discretion.

21 MERITAGE HOMES | 2015 Proxy Statement

|

| | | |

| | | |

| | | COMPENSATION DISCUSSION AND ANALYSIS |

Compensation Discussion and Analysis

The following discussion and analysis should be read in conjunction with the “Summary Compensation Table” and related tables that are presented immediately below.

The purpose of this compensation discussion and analysis (“CD&A”) is to provide information about each material element of compensation that we pay or award to, or that is earned by, our NEOs. For our 2014 fiscal year, our NEOs were:

| |

• | Steven J. Hilton, Chairman and Chief Executive Officer |

| |