0000833079DEF 14Afalse00008330792023-01-012023-12-31iso4217:USDxbrli:pure00008330792022-01-012022-12-3100008330792021-01-012021-12-3100008330792020-01-012020-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:PeoMembermth:PhillppeLordMember2023-01-012023-12-310000833079ecd:PeoMembermth:PhillppeLordMembermth:EquityAwardsVestedDuringTheYearMember2023-01-012023-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembermth:PhillppeLordMember2023-01-012023-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembermth:PhillppeLordMember2023-01-012023-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:PeoMembermth:PhillppeLordMember2022-01-012022-12-310000833079ecd:PeoMembermth:PhillppeLordMembermth:EquityAwardsVestedDuringTheYearMember2022-01-012022-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembermth:PhillppeLordMember2022-01-012022-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembermth:PhillppeLordMember2022-01-012022-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:PeoMembermth:PhillppeLordMember2021-01-012021-12-310000833079ecd:PeoMembermth:PhillppeLordMembermth:EquityAwardsVestedDuringTheYearMember2021-01-012021-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembermth:PhillppeLordMember2021-01-012021-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembermth:PhillppeLordMember2021-01-012021-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:PeoMembermth:StevenJHiltonMember2020-01-012020-12-310000833079ecd:PeoMembermth:EquityAwardsVestedDuringTheYearMembermth:StevenJHiltonMember2020-01-012020-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMembermth:StevenJHiltonMember2020-01-012020-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:PeoMembermth:StevenJHiltonMember2020-01-012020-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000833079mth:EquityAwardsVestedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000833079mth:EquityAwardsVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000833079mth:EquityAwardsVestedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000833079mth:EquityAwardsGrantedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000833079mth:EquityAwardsVestedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000833079mth:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000833079mth:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-31000083307912023-01-012023-12-31000083307922023-01-012023-12-31000083307932023-01-012023-12-31000083307942023-01-012023-12-31000083307952023-01-012023-12-31

| | |

UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| SCHEDULE 14A |

| (Rule 14a-101) |

| Proxy Statement Pursuant to Section 14(a) of the |

| Securities Exchange Act of 1934 |

| (Amendment No. ) |

| | | | | | | | | | | | | | | | | |

| Filed by the Registrant | ý | | |

| Filed by a Party other than the Registrant | ¨ | |

|

Check the appropriate box: |

|

| ¨ | Preliminary Proxy Statement |

|

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

| ý | Definitive Proxy Statement |

|

| ¨ | Definitive Additional Materials |

|

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

| | |

Meritage Homes Corporation |

| (Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) |

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | No fee required. |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Dear Fellow Stockholders:

You are cordially invited to join us for our 2024 Annual Meeting of stockholders on May 16, 2024, at 8:30 a.m. Central Daylight Time. The meeting will be completely virtual and conducted via live audio webcast to enable our stockholders to participate from any location around the world that is convenient to them. You will be able to attend the meeting by first registering at https://viewproxy.com/meritage/2024/ no later than May 15, 2024 at 11:59 p.m. Eastern Time. After registering, you will receive a meeting invitation and password by e-mail with your unique link to join the meeting. Stockholders will be able to listen, vote and submit questions during the virtual meeting. Holders of record of our common stock as of March 21, 2024 are entitled to notice of, and to vote at, the 2024 virtual Annual Meeting.

The Notice of Annual Meeting of Stockholders and the proxy statement that follow describe the business to be conducted at the meeting. We may also report on matters of current interest to our stockholders at that meeting.

We are pleased to be furnishing these materials to our stockholders electronically. We believe this approach provides you with the information that you need in an expedited manner while reducing both the environmental impact and delivery costs of our Annual Meeting. If you would like us to send you printed copies of our proxy statement and accompanying materials, we will do so at no charge upon your request. For more information, please refer to the Important Notice Regarding the Availability of Proxy Materials that we previously mailed to you on or about April 5, 2024.

All stockholders are welcome to attend the virtual Annual Meeting, however, please vote your shares promptly and prior to the meeting to ensure they are represented at the meeting. You may submit your proxy by Internet or telephone, as described in the following materials, or, if you request printed copies of these materials, by completing and signing the proxy or voting instruction card enclosed therein and returning it in the envelope provided.

If your shares are held in the name of a broker, bank, trust or other nominee, you will be asked for proof of ownership of your shares in order to register to attend the virtual meeting.

We thank you for your support.

Sincerely,

Phillippe Lord

Chief Executive Officer

18655 North Claret Drive • Suite 400 • Scottsdale, Arizona • 85255 • Phone 480-515-8100

Listed on the New York Stock Exchange — MTH

Notice of Annual Meeting of Stockholders

Meeting Date: May 16, 2024

Time: 8:30 a.m. Central Daylight Time

Virtual location: See details below for registration

To Our Stockholders:

You are invited to attend the Meritage Homes Corporation 2024 Annual Meeting of stockholders, to be held in a virtual-only format via live audio webcast, at which we will conduct the following business:

1Election of five Class I directors, each to hold office until our 2026 Annual Meeting, and one Class II director, to hold office until our 2025 Annual Meeting,

2Ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year,

3Advisory vote to approve compensation of our Named Executive Officers ("Say on Pay"),

4Shareholder proposal to elect each director annually, and

5The conduct of any other business that may properly come before the meeting or any adjournment or postponement thereof.

These items and information regarding the admission policy and procedures for attending the virtual Annual Meeting are more fully described in the accompanying proxy statement. Only stockholders of record at the close of business on March 21, 2024 are entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND VIRTUALLY, WE URGE YOU TO VOTE AND SUBMIT YOUR PROXY IN ADVANCE OF THE ANNUAL MEETING BY ONE OF THE METHODS DESCRIBED IN THE PROXY MATERIALS FOR THE ANNUAL MEETING. YOU MAY VOTE YOUR SHARES AND SUBMIT A PROXY OR VOTING INSTRUCTION CARD BY USING THE INTERNET, REGULAR MAIL OR TELEPHONE AS DESCRIBED HEREIN OR ON YOUR PROXY OR VOTING INSTRUCTION CARD.

| | | | | |

| By Order of the Board of Directors |

| |

| Malissia Clinton, Secretary |

Scottsdale, Arizona

April 1, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON MAY 16, 2024:

THIS PROXY STATEMENT AND MERITAGE’S 2023 ANNUAL REPORT TO STOCKHOLDERS ARE AVAILABLE AT INVESTORS.MERITAGEHOMES.COM. ADDITIONALLY, AND IN ACCORDANCE WITH THE SECURITIES AND EXCHANGE COMMISSION ("SEC") RULES, YOU MAY ACCESS THESE MATERIALS ON THE COOKIES-FREE WEBSITE INDICATED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS THAT YOU HAVE RECEIVED.

Table of Contents

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Pay Ratio Disclosure | |

| |

| Pay versus Performance | |

| |

| |

| |

| |

| |

| |

| |

| |

MERITAGE HOMES | 2024 Proxy Statement 1

MERITAGE HOMES CORPORATION

18655 NORTH CLARET DRIVE

SUITE 400

SCOTTSDALE, ARIZONA 85255

(480) 515-8100

www.meritagehomes.com

Proxy Summary

This summary highlights selected information contained elsewhere in this proxy statement and is not intended to contain all of the information that you should consider. Please read the entire proxy statement carefully before voting.

Proxy Statement Purpose

The Board of Directors (the "Board") of Meritage Homes Corporation (“Meritage Homes”, "Meritage", "we" or the “Company”) is furnishing this Proxy Statement to solicit your proxy for our 2024 Annual Meeting of Stockholders. This Proxy Statement contains information to help you decide how you want your shares to be voted. To understand the proposals fully, you should carefully read this entire proxy statement and the other proxy materials identified in the Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held Virtually on May 16, 2024 (the "Notice"). This proxy statement will be available on our website, and the Notice will be mailed to stockholders beginning on or about April 5, 2024.

Annual Meeting of Shareholders

| | | | | | | | | | | | | | |

| | | | |

May 16, 2024 8:30 a.m. Central Daylight Time | | The meeting will be completely virtual and conducted via live audio webcast. You will be able to attend the meeting by first registering at https://viewproxy.com/meritage/2024/. | | Record Date: March 21, 2024 |

Who Can Vote

Stockholders who hold shares of our common stock at the close of business on March 21, 2024, the record date, will be entitled to one vote for each share held regarding each of the matters proposed in this proxy statement. Only holders of record of common stock at the close of business on the record date will be permitted to vote, either prior to the meeting or at the virtual meeting. On the record date, there were 36,319,014 shares of Meritage common stock outstanding. The common stock is our only outstanding class of voting securities.

Voting Information

You can vote electronically at the virtual Annual Meeting or submit a proxy prior to the meeting to have your shares represented without attending the virtual meeting. The shares represented by a properly executed proxy will be voted as you direct. To submit a proxy, you must follow the instructions provided in this proxy statement and in the Notice. You may vote via the Internet, regular mail or by calling the telephone number provided in the Notice, and you will be asked to enter your control number. If you request a printed copy of these materials, you may also vote by filling out and signing the proxy or voting instruction card enclosed therein and returning it by mail in the envelope provided. Please make your request for a copy as instructed in the Notice on or before May 8, 2024 to facilitate timely delivery.

If you submit a signed proxy but do not indicate any voting instructions, your shares will be voted FOR the election of the director nominees named in this proxy statement, FOR the ratification of the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for fiscal 2024, FOR the advisory vote to approve the compensation of our Named Executive Officers, and AGAINST the shareholder proposal to elect each director annually.

You can revoke your proxy any time before it is voted by written notice delivered to the Company’s Secretary, by timely delivery of a later signed proxy (including via the Internet, regular mail, or telephone), or by voting electronically at the virtual meeting.

2 MERITAGE HOMES | 2024 Proxy Statement

Attendance at the virtual meeting alone is not sufficient to revoke your proxy. You must also vote your shares to revoke your proxy.

Holders of Record and Beneficial Owners

If your shares are registered directly in your name with our transfer agent, you are considered the “holder of record” of those shares.

If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and the Notice is being forwarded to you by your broker or nominee (the “record holder”) along with a voting instruction card. As the beneficial owner, you have the right to direct your record holder regarding how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions.

As the holder of record or beneficial owner of shares, you are invited to attend the virtual Annual Meeting. Please note, however, that if you are a beneficial owner, you may not vote your shares electronically at the virtual meeting unless you obtain a “legal proxy” from the record holder that holds your shares. Instructions for requesting the “legal proxy” from the record holder will be provided to beneficial owners by the record holder.

Rules of the New York Stock Exchange (the “NYSE”) determine whether proposals presented at stockholder meetings are “routine” or “non-routine.” If a proposal is routine, a broker or other entity holding shares for a beneficial owner in street name may vote on the proposal if the beneficial owner does not provide voting instructions. If a proposal is non-routine, the broker or other entity may vote on the proposal only if the beneficial owner has provided voting instructions. A “broker non-vote” occurs when the broker or other entity is unable to vote on a proposal because the proposal is non-routine and the beneficial owner does not provide instructions. If you are a beneficial owner and do not give instructions to your record holder prior to the meeting, the record holder will be entitled to vote your shares in its discretion only on Proposal 2 (Ratification of Independent Registered Public Accounting Firm) and will not be able to vote your shares on Proposal 1 (Election of Directors), Proposal 3 (Advisory Vote to Approve Compensation of our Named Executive Officers), or Proposal 4 (Shareholder Proposal to Elect Each Director Annually), and your shares will be treated as a “broker non-vote” on those proposals.

Quorum

The presence virtually or by proxy of stockholders representing a majority of the votes entitled to be cast at the meeting is necessary to constitute a quorum at the meeting. Abstentions and broker non-votes are counted as present for purposes of determining whether a quorum exists.

| | | | | | | | | | | |

The following four proposals will be considered at the Annual Meeting: |

| Proposal | Board Vote

Recommendation | Page Number |

| 1 | Election of Directors | FOR Each Nominee | 6 | |

| 2 | Ratification of Independent Registered Public Accounting Firm | FOR | 7 | |

| 3 | Advisory Vote to Approve Compensation of our Named Executive Officers | FOR | 8 | |

| 4 | Shareholder Proposal to Elect Each Director Annually | AGAINST | 10 | |

| | | | | |

| PROPOSAL 1 | |

| Election of Directors | |

Each Class I director nominee is up for election for a two-year term and was a director for all of 2023. Mr. Arriola is a Class II director nominee who was appointed to the Board in June 2023. Each director attended at least 75% of the aggregate of all meetings of the Board and of all Board committees on which they serve.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Class | | Age | | Director Since | | Independent | | AC | | CC | | ESNGC | | LC |

Dennis V. Arriola (1) | II | | 63 | | 2023 | | Yes | | | | | | ü | | |

| Dana C. Bradford | I | | 59 | | 2009 | | Yes | | ü | | ü | | | | ü |

| Louis E. Caldera | I | | 68 | | 2021 | | Yes | | | | ü | | | | |

Deb Henretta (2) | I | | 62 | | 2016 | | Yes | | ü | | | | C | | |

| Steven J. Hilton | I | | 62 | | 1996 | | No | | | | | | | | |

| P. Kelly Mooney | I | | 60 | | 2020 | | Yes | | | | ü | | ü | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| C | = | Committee Chair | | AC | Audit Committee | ESNGC | Environmental, Social, Nominating and Governance Committee |

| ü | = | Member | | CC | Executive Compensation Committee | LC | Land Committee |

MERITAGE HOMES | 2024 Proxy Statement 3

(1) Mr. Arriola was appointed as a member of the ESNG Committee effective November 16, 2023.

(2) Ms. Henretta was appointed as Chair of the ESNG Committee effective January 2, 2024, to replace Gerald Haddock who retired from the Board effective January 2, 2024. Additionally, she was appointed as a member of the Audit Committee effective February 22, 2024.

| | | | | |

| PROPOSAL 2 | |

| Ratification of Independent Registered Public Accounting Firm | |

Ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year.

| | | | | | | | | | | | | | |

| | Summary of Fees |

| | 2023 | | 2022 |

| Audit fees | | $ | 1,240,000 | | | $ | 1,225,000 | |

| Audit-related fees | | — | | | — | |

| Tax fees | | 12,000 | | | — | |

| All other fees | | — | | | — | |

| Total fees | | $ | 1,252,000 | | | $ | 1,225,000 | |

| | | | | |

| PROPOSAL 3 | |

| Advisory Vote to Approve Compensation of our Named Executive Officers | |

Stockholders will be given the opportunity to vote on an advisory resolution to approve the compensation of our Named Executive Officers (“NEOs”) (commonly referred to as “Say on Pay”).

Our executive compensation program is designed to drive and reward superior corporate performance, both annually and over the long-term. The Board believes the Company’s compensation policies and practices are effective in achieving the Company’s goals of paying for performance and aligning the NEOs' long-term interests with those of our stockholders.

Compensation elements for our NEOs include: | | | | | | | | | | | |

| Type | | Form | Terms |

| Cash | | Base Salary | Competitively market-based. |

| Cash | | Annual Incentive Compensation | Based on achievement of performance goals that align with the Company's annual objectives. |

| Cash | | Discretionary Bonuses | Based on specific individual achievements beyond those of the performance goals included in the annual incentive compensation program, subject to approval by the Executive Compensation Committee. Our long-standing practice is to limit discretionary payments. |

| Equity | | Long-term Incentive Awards | Equity awards include a mix of time-based awards and performance-based awards, both of which vest on the third anniversary of the date of grant. Performance-based awards are earned based on goals aligned with the Company's long-term strategy and which span over a combination of a three-year cumulative period or three one-year measurement periods. |

| Other | | Limited Perquisites | Primarily the reimbursement of certain life and disability (or equivalent) policies for the benefit of NEOs and their families and auto allowance for certain NEOs. |

| | |

| PROPOSAL 4 |

Shareholder Proposal to Elect Each Director Annually |

Shareholder proposal to elect each director annually.

4 MERITAGE HOMES | 2024 Proxy Statement

The management and Board of the Company know of no other matters to be brought before the meeting. If other matters are properly presented to the stockholders for action during the meeting or any adjournments or postponements thereof, it is the intention of the proxy holders named in the proxy to vote in their discretion on all matters on which the shares of common stock represented by such proxy are entitled to vote. The entire cost of this solicitation of proxies will be borne by the Company, including expenses incurred in connection with preparing, assembling and mailing the Notice. The Company may reimburse brokers or persons holding stock in their names or in the names of their nominees for their expenses in sending the proxy materials to beneficial owners who request paper copies. Certain officers, directors and regular employees of the Company, who will receive no extra compensation for their services, may solicit proxies by mail, telephone, facsimile, electronically or personally.

Meritage operates within a comprehensive plan of corporate governance for the purpose of defining responsibilities and setting high standards for ethical conduct. Our Board has established the following governance committees:

| | | | | |

| — | Audit Committee |

| — | Executive Compensation Committee ("Compensation Committee") |

| — | Environmental, Social, Nominating and Governance Committee ("ESNG Committee") |

| — | Land Committee |

The charter of each of the committees listed above is available on our website, along with our Lead Director Charter, Code of Ethics, Corporate Governance Principles and Practices, Conflict of Interest and Related Party Transaction Policy, Securities Trading Policy, Clawback Policy, Human Rights Policy, Vendor Code of Conduct, Environmental Responsibility Policy and Responsible Marketing Policy. These items are also available in print, free of charge, to any stockholder who requests them by calling us or by writing to us at our principal executive offices at the address listed previously in this proxy statement, Attention: Secretary.

MERITAGE HOMES | 2024 Proxy Statement 5

| | |

|

| PROPOSAL 1: ELECTION OF DIRECTORS |

Election of Directors

(Proposal No. 1)

Our Board currently has eleven members. The directors are divided into two classes serving staggered two-year terms. This year, our Class I directors are up for election. The Board, upon the recommendation of the ESNG Committee, has nominated for re-election Dana C. Bradford, Louis E. Caldera, Deb Henretta, Steven J. Hilton, and P. Kelly Mooney, all of whom are presently serving as Class I directors. Additionally, Dennis V. Arriola, a Class II director who was appointed to the Board in June 2023, is up for election. Raymond Oppel, a Class I director, is not standing for re-election due to his upcoming retirement, which will be effective at the end of his current term on May 16, 2024.

Biographical information for each of our director nominees is set forth beginning on page 17.

All nominees have consented to serve as directors. The Board of Directors has no reason to believe that any of the nominees will be unable to act as a director. However, should a nominee become unable to serve or should a vacancy on the Board occur before the Annual Meeting, the Board may either reduce its size or designate a substitute nominee. If a substitute nominee is named, your shares will be voted for the election of the substitute nominee designated by the Board. In the vote on the election of the director nominees, stockholders may vote FOR, AGAINST, or ABSTAIN for each director.

Unless you elect to vote differently by so indicating on your signed proxy, your shares will be voted FOR the Board’s nominees. To be elected a director, a director nominee must receive the affirmative vote of the majority of the votes cast, meaning, that the number of votes cast "for" a director nominee must exceed the number of votes "against" that director nominee. Any nominee for director who is an incumbent director but who is not elected by a majority of the votes cast, and with respect to whom no successor has been elected, will promptly tender his or her offer to resign to the Board of Directors for its consideration. The ESNG Committee will recommend to the Board of Directors whether to accept or reject the resignation offer, or whether other action should be taken. Broker non-votes and abstentions will not count as either votes for or against the nominee.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF THE ABOVE-NAMED NOMINEES AS DIRECTORS.

6 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

| PROPOSAL 2: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

Ratification of Independent Registered Public Accounting Firm

(Proposal No. 2)

The Board seeks an indication from stockholders of their approval or disapproval of the Audit Committee’s appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal 2024.

Deloitte & Touche LLP was appointed our auditor in 2004 and no relationship exists between the Company and Deloitte & Touche LLP other than the usual relationship between independent auditors and clients.

An affirmative vote of the majority of the votes cast at the Annual Meeting, at which a quorum is present, is required to ratify the selection of Deloitte & Touche LLP as the Company’s independent auditor for fiscal 2024. Abstentions will not be counted either for or against this proposal. If the appointment of Deloitte & Touche LLP as auditors for 2024 is not approved by stockholders, the adverse vote will be considered a direction to the Audit Committee to consider other auditors for next year. However, because of the difficulty in making any substitution of auditors after the beginning of the current year, the appointment in 2024 will stand, unless the Audit Committee determines there is a reason for making a change. In addition, even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interest of the Company and our stockholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” PROPOSAL NO. 2.

MERITAGE HOMES | 2024 Proxy Statement 7

| | |

|

| PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

Advisory Vote to Approve Compensation of our Named Executive Officers

(Proposal No. 3)

Stockholders will be given the opportunity to vote on the following advisory resolution (commonly referred to as "Say on Pay"):

RESOLVED, that the compensation paid to the Company’s Named Executive Officers, as disclosed herein pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.

In accordance with the Dodd-Frank Act and related SEC rules, including section 14A of the Securities and Exchange Act of 1934 (the "Exchange Act"), as amended stockholders are being given the opportunity to vote at the Annual Meeting on this advisory resolution regarding the compensation of our NEOs.

At our 2023 Annual Meeting of Stockholders (the "2023 Meeting"), the Company's stockholders indicated, on an advisory vote basis, that they preferred that we hold Say on Pay votes on an annual basis (a say on frequency vote is required to be held at least once every six years). This Proposal No. 3 represents this year’s Say on Pay vote. The next stockholder advisory Say on Pay vote is expected to occur at the 2025 annual meeting.

At our 2023 Meeting, the Company’s stockholders approved the compensation of our NEOs (on an advisory basis) by approximately 97% of total votes cast. We believe this high approval rating indicates that our stockholders were in agreement with the direction of our Compensation Committee of setting competitive compensation arrangements based on criterion believed to be both in line with the goals of our stockholders and at levels that are reasonable in relation to the Company’s performance and size.

For a comprehensive description of our executive compensation program, philosophy and objectives, including the specific elements of executive compensation that comprised the program in 2023, please refer to the Compensation Discussion and Analysis section of this proxy statement. The Summary Compensation Table and other executive compensation tables (and accompanying narrative disclosures) that follow it, beginning on page 43, provide additional information about the compensation that we paid to our NEOs in 2023. As described in the Compensation Discussion and Analysis, our executive compensation program is designed to drive and reward superior performance both annually and over the long term while simultaneously striving to be externally competitive.

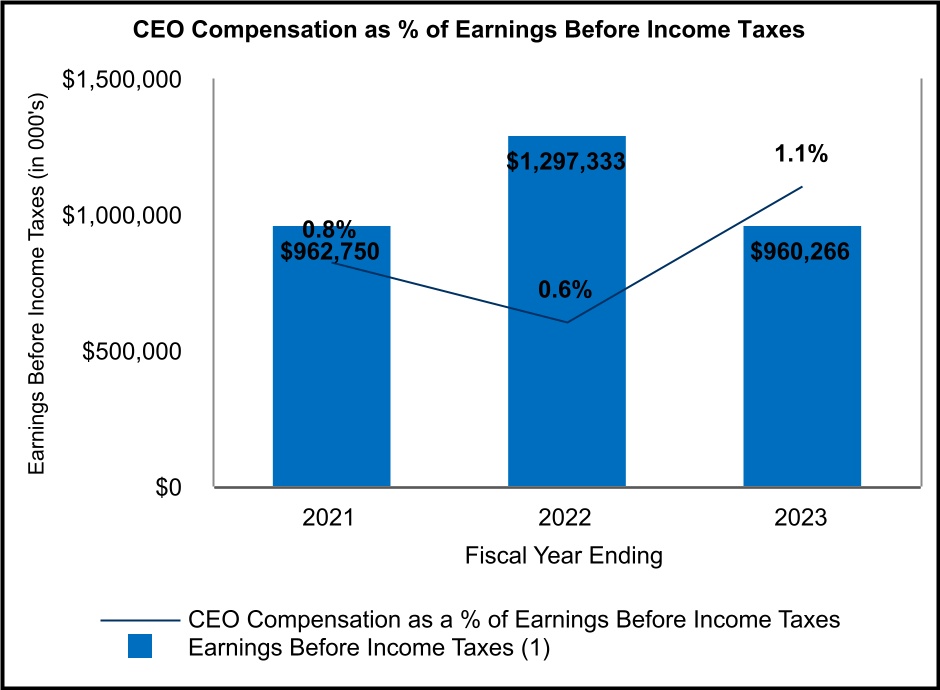

The homebuilding market experienced significant cooling in the last half of 2022 driven by affordability concerns due to rapid increases in interest rates, inflation and a general deterioration in the economy. Early into 2023, homebuyers began to acclimate to the higher interest rate environment and consumer confidence improved, which, combined with favorable demographic need-based housing and the persistent shortage of existing homes for sale, shifted demand to the new home market. The supply chain constraints and labor shortages that began in 2020 and persisted through 2022 began to ease in 2023, and although construction costs remain elevated, they did decline in the second, third and fourth quarters of 2023. Our NEO's and management team have remained nimble during this rapidly changing environment, increasing financing incentives to alleviate customer concerns over monthly mortgage affordability and working with existing and new vendors to minimize costs, resulting in strong operational and financial performance in 2023. Despite lower closings and earnings in 2023 versus a record year in 2022, the Company continued to produce growth in book value per common share and a return on assets performance at historically high levels. Meritage's year-over-year results for certain key metrics follow (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | 2023 | | 2022 | | Change |

| Home Closing Units | | 13,976 | | | 14,106 | | | (0.9)% |

| Home Closing Revenue | | $ | 6,056,784 | | | $ | 6,207,498 | | | (2.4)% |

| Home Order Units | | 13,193 | | | 11,759 | | | 12.2% |

| Home Order Value | | $ | 5,675,892 | | | $ | 5,255,600 | | | 8.0% |

Orders Pace (1) | | 4.0 | | | 3.6 | | | 11.1% |

Quarterly Backlog Conversion Rate (2) | | 109.5 | % | | 74.9 | % | | n/m |

| Home Closing Gross Margin | | 24.8 | % | | 28.6 | % | | (380) bps |

| Commissions and other selling costs and general and administrative expenses (as a percentage of home closing revenue) | | 10.2 | % | | 8.3 | % | | 190 bps |

| Earnings Before Income Taxes | | $ | 949,430 | | | $ | 1,289,318 | | | (26.4)% |

| Diluted Earnings per Common Share | | $ | 19.93 | | | $ | 26.74 | | | (25.5)% |

| Book Value per Common Share | | $ | 126.61 | | | $ | 108.00 | | | 17.2% |

| Return On Assets | | 15.2 | % | | 20.7 | % | | (550) bps |

8 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

| PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

(1) Calculated as number of net home orders per average active community per month.

(2) Calculated as quarterly home closing units divided by beginning backlog. Most recent quarter (fourth quarter) is provided for each period.

The Compensation Committee continually evaluates the compensation packages for our NEOs and adjusts them annually or as conditions warrant, including setting performance targets for both cash and equity awards, some of which have been forfeited in previous years where performance targets were not met. The Compensation Committee engages an independent external compensation consultant regarding the design of our executive compensation program. The Company has implemented prudent and responsible compensation policies in the stockholders’ interest, some of which include:

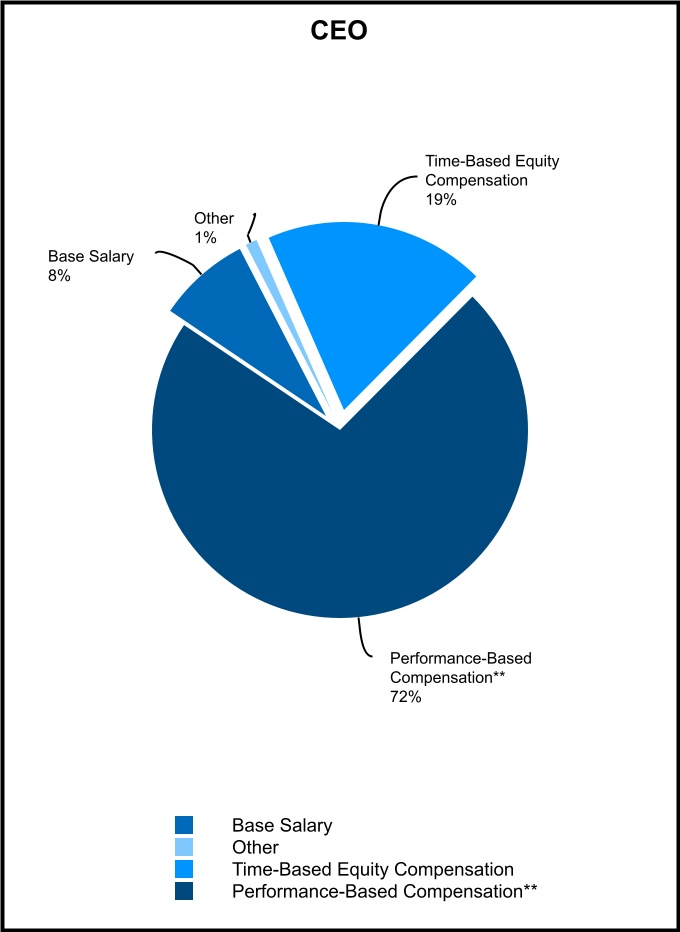

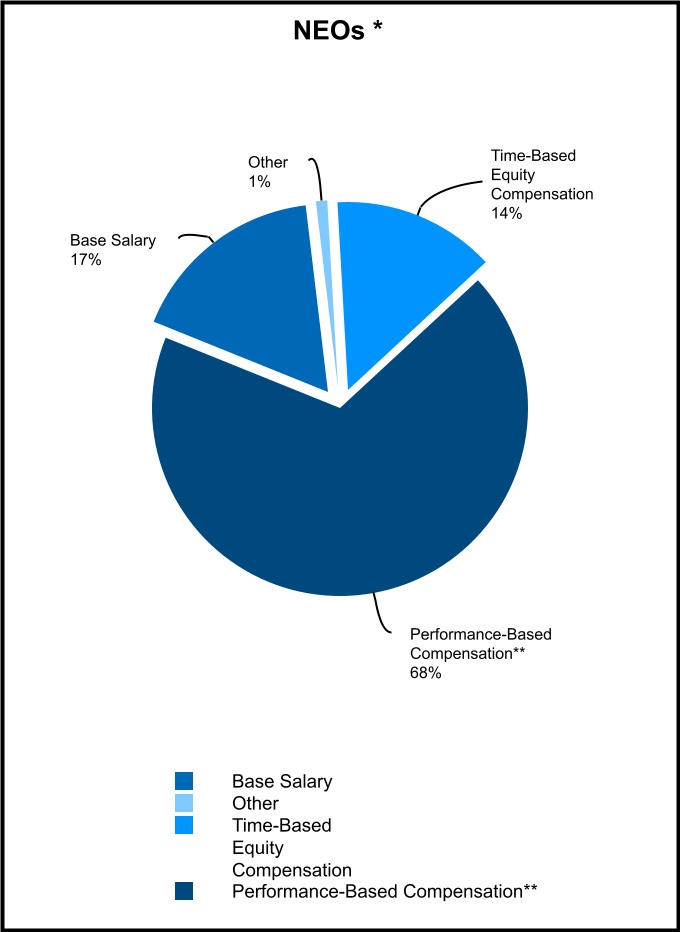

•A substantial portion of compensation is incentive-based and is "at-risk", as discussed beginning on page 33.

•Incentive-based compensation is balanced between short-term cash and long-term equity awards, as discussed beginning on page 33.

•A Clawback Policy that provides for the recovery of erroneously awarded incentive compensation from certain executive officers, including our NEOs, in the event of an accounting restatement, in accordance with applicable laws, regulations, the NYSE listing rules and other terms. The Clawback Policy is available on our website.

•NEOs must comply with stock ownership requirements, as discussed on page 34.

•Perquisites are limited to auto allowances and reimbursement of certain life and disability or long-term care insurance premiums, and limited other benefits as discussed on page 38.

Because the vote on this proposal is advisory in nature, it will not affect any compensation already paid or awarded to our NEOs and will not be binding on the Board of Directors or the Compensation Committee. However, the Compensation Committee will consider the outcome of the vote when making future executive compensation decisions.

An affirmative vote of a majority of the votes cast at the Annual Meeting, at which a quorum is present, is required to approve this advisory vote. Broker non-votes and abstentions have no effect on the result of the vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE RESOLUTION SET FORTH ABOVE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

MERITAGE HOMES | 2024 Proxy Statement 9

| | |

|

PROPOSAL 4: SHAREHOLDER PROPOSAL TO ELECT EACH DIRECTOR ANNUALLY |

Shareholder Proposal to Elect Each Director Annually (Proposal 4)

(Proposal No. 4)

This proposal was submitted by John Chevedden, 2215 Nelson Avenue, No. 205, Redondo Beach, California 90278, the beneficial owner of 50 shares for at least three years. The Board opposes this proposal for the reasons set forth following the proposal.

[Beginning of Shareholder Proposal]

Proposal 4 – Elect Each Director Annually

RESOLVED, shareholders ask that our Company take all the steps necessary to reorganize the Board of Directors into one class with each director subject to election each year for a one-year term.

Although our management can adopt this proposal topic in one-year and one-year implementation is a best practice, this proposal allows the option to phase it in.

Classified Boards like the Meritage Homes Board have been found to be one of 6 entrenching mechanisms that are negatively related to company performance according to "What Matters in Corporate Governance" by Lucien Bebchuk, Alma Cohen and Allen Ferrell of the Harvard Law School.

Arthur Levitt, former Chairman of the Securities and Exchange Commission said, "In my view it's best for the investor if the entire board is elected once a year. Without annual election of each director shareholders have far less control over who represents them."

A total of 79 S&P 500 and Fortune 500 companies, worth more than $1 trillion, have adopted this important proposal topic since 2012. Annual election of each director could make directors more accountable, and thereby contribute to improved performance and increased company value at virtually no extra cost to shareholders. Thus it was not a surprise that this proposal topic won more than 96%-support each at Centene Corporation and Teleflex in 2021.

Annual election of each director gives shareholders more leverage if the Board of Directors performs poorly. For instance if the Board of Directors approves executive pay that is excessive or is poorly incentivized shareholders can soon vote against the Chair of the Board's executive pay committee instead of waiting 2-years under the current setup.

Annual election of each director would give shareholders a more expedient opportunity to see whether a poor performing director improves his performance. For instance Mr. Gerald Haddock was rejected by 7 million shareholder votes in 2023. This compares poorly to 3 other Meritage directors who each received less than 1.2 million against votes. Currently after receiving 7 million against votes, Mr. Haddock need not face another shareholder vote for 2-years.

Please vote yes:

Elect Each Director Annually – Proposal 4

[End of Shareholder Proposal]

| | | | | | | | | | | | | | |

Board Statement in Opposition to Proposal 4 |

The Board of Directors has given careful consideration to this shareholder proposal and does not believe that declassifying our Board of Directors in the manner proposed above is in the best interest of the Company and its stockholders, and recommends a vote AGAINST the stockholder proposal for the following reasons:

Commitment to Declassify in a Phased-In Manner is Already in Place

The Board of Directors, through the ESNG Committee, is already in the process of a Board refreshment initiative with the strategy and vision of transitioning longer tenured directors over an orderly period of time. The Board notes that over the past

10 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

PROPOSAL 4: SHAREHOLDER PROPOSAL TO ELECT EACH DIRECTOR ANNUALLY |

five years, it has added four new independent directors and three long tenured independent directors retired, including most recently Gerald Haddock, who retired on January 2, 2024. In addition, our longest standing independent director, Raymond Oppel, is retiring on May 16, 2024 at the end of his current term. The Board acknowledges and values feedback it has received from the Company’s investor community that annually elected boards increase accountability of directors to a company’s stockholders and that shifting from classified boards to the annual election of directors reflects governance best practices. In response to this feedback, as disclosed in the Company’s 2023 proxy statement and this proxy statement, the Board of Directors has already passed a resolution to sunset the classified board structure within five years from 2023. In light of recent retirements, the Board has recently resolved to accelerate the timeline to declassify the Board by the conclusion of the 2027 annual meeting.

The Board of Directors continues to believe our current classified structure remains in the best interest of stockholders for this short duration as we finalize the on-boarding of our new board members. This time is required in order to effectuate the orderly and phased-in transition to avoid declassifying a sitting director with a continuing term.

All directors, regardless of the length of their term, have a fiduciary duty under the law to act in a manner that they believe to be in the best interests of our Company and all of our stockholders. Accountability depends on the selection of experienced and committed individuals, not on whether they serve terms of one year or two years.

The Board of Directors believes that this proposal is unnecessary and confusing because it is simply a request that our Board of Directors take the necessary steps to elect directors annually, which it has already taken the initial steps to elect directors annually and to sunset the classified structure under a phased-in approach.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE AGAINST THE SHAREHOLDER PROPOSAL TO ELECT EACH DIRECTOR ANNUALLY.

MERITAGE HOMES | 2024 Proxy Statement 11

| | |

|

| SECURITY OWNERSHIP OF MANAGEMENT AND PRINCIPAL STOCKHOLDERS |

Security Ownership of Management and Principal Stockholders

Management. The following table summarizes, as of March 21, 2024, the number and percentage of outstanding shares of our common stock beneficially owned by the following:

•each Meritage director and nominee for director;

•each executive officer named in the Summary Compensation Table; and

•all Meritage directors and executive officers as a group. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name Of Beneficial Owner (1) | | Position With The

Company | | Number

Of Shares

Owned | | Right To

Acquire By

May 20,

2024 | | Total Shares Beneficially Owned (2) | | Percent Of Outstanding Shares (3) |

| Steven J. Hilton | | Director, Executive Chairman | | 388,971 | | (4) | — | | | 388,971 | | | 1.1 | % |

| Raymond Oppel | | Director | | 12,750 | | | 6,100 | | (7) | 18,850 | | | * |

| Peter L. Ax | | Director | | 17,779 | | (5) | — | | | 17,779 | | | * |

| Dana C. Bradford | | Director | | 59,250 | | | — | | | 59,250 | | | * |

| Michael R. Odell | | Director | | 27,750 | | | — | | | 27,750 | | | * |

| Deb Henretta | | Director | | 22,117 | | | — | | | 22,117 | | | * |

| Joseph Keough | | Director | | 14,850 | | | — | | | 14,850 | | | * |

| P. Kelly Mooney | | Director | | 10,350 | | | — | | | 10,350 | | | * |

| Louis E. Caldera | | Director | | 4,600 | | | — | | | 4,600 | | | * |

| Dennis V. Arriola | | Director | | — | | | — | | | — | | | * |

| Phillippe Lord | | Director, Chief Executive Officer | | 100,266 | | (6) | — | | | 100,266 | | | * |

| Hilla Sferruzza | | Executive Vice President and

Chief Financial Officer | | 47,070 | | | — | | | 47,070 | | | * |

| Clint Szubinski | | Executive Vice President and Chief Operating Officer | | 14,881 | | | — | | | 14,881 | | | * |

| Malissia Clinton | | Executive Vice President, General Counsel and Secretary | | — | | | — | | | — | | | * |

| Javier Feliciano | | Executive Vice President and Chief People Officer | | 17,307 | | | — | | | 17,307 | | | * |

| All current directors and executive officers as a group (15 persons) | | | | 737,941 | | | 6,100 | | | 744,041 | | | 2.0 | % |

*Less than 1%.

(1)The address for our directors and executive officers is c/o Meritage Homes Corporation, 18655 North Claret Drive, Suite 400, Scottsdale, Arizona 85255.

(2)The amounts shown include the shares of common stock actually owned as of March 21, 2024, and the shares that the person or group had the right to acquire within 60 days of that date. The number of shares includes shares of common stock owned by other related individuals and entities over whose shares of common stock such person has custody, voting control or the power of disposition.

(3)Based on 36,319,014 shares outstanding as of March 21, 2024.

(4)Shares are held by family trusts except for 17,000 shares held in a charitable remainder trust, which is controlled by Mr. Hilton.

(5)All shares are held by a living trust.

(6)42,760 shares are held by a family limited partnership controlled by Mr. Lord and 57,506 shares are held by a limited liability company controlled by Mr. Lord.

(7)Mr. Oppel is retiring from the Board effective May 16, 2024 and all of his outstanding equity awards will vest on that date.

12 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

| SECURITY OWNERSHIP OF MANAGEMENT AND PRINCIPAL STOCKHOLDERS |

Certain Other Beneficial Owners. Based on filings made under the Exchange Act, as of March 21, 2024, the only known beneficial owners of more than 5% of Meritage common stock are shown in the following table:

| | | | | | | | | | | | | | | | | | | | |

| | | | | Shares Beneficially Owned |

| Name of Other Beneficial Owners | | Address Of Beneficial Owner | | Number | | Percent |

BlackRock, Inc. (1) | | 50 Hudson Yards, New York, NY 10001 | | 6,113,417 | | | 16.8 | % |

| The Vanguard Group (2) | | 100 Vanguard Blvd., Malvern, PA 19355 | | 4,122,623 | | | 11.4 | % |

| | | | | | |

(1)Based solely on a Schedule 13G/A filed with the SEC on January 22, 2024, BlackRock, Inc. and certain affiliated entities have sole voting power with respect to 6,005,047 shares and sole dispositive power with respect to 6,113,417 shares. The Schedule 13G/A discloses that the interest of iShares Core S&P Small-Cap ETF and BlackRock Fund Advisors hold more than five percent of the outstanding stock of the Company.

(2)Based solely on a Schedule 13G/A filed with the SEC on February 13, 2024, The Vanguard Group has shared voting power with respect to 32,103 shares, sole dispositive power with respect to 4,052,193 shares, and shared dispositive power with respect to 70,430 shares.

For each of the reporting owners set forth above, the beneficially owned shares are held in various individual funds owned or managed by the reporting owners.

There are no stockholders with preferential voting or non-voting shares.

MERITAGE HOMES | 2024 Proxy Statement 13

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

Corporate Governance and Board Matters | | | | | | | | | | | | | | |

| Role of the Board of Directors |

The Board is elected by the stockholders to oversee the stockholders’ interests in the operation and overall success of our business. The Board serves as our ultimate decision-making body, except for those matters that require a vote of our stockholders. The Board selects and oversees the members of executive management who are charged by the Board with conducting our business. We have established, and operate in accordance with, a comprehensive plan of corporate governance that defines and sets ethical standards for the conduct of our directors, officers and employees. This plan provides an important framework within which the Board can pursue our strategic objectives and ensure long-term stockholder value.

| | | | | | | | | | | | | | |

| Corporate Governance Principles and Practices |

We have adopted Corporate Governance Principles and Practices that define the key elements of our corporate governance framework and philosophy, including:

| | | | | |

•director qualifications, | •director access to officers and employees, |

•independence criteria, | •our philosophy with respect to director compensation, |

•director responsibilities, | •Board evaluation process, |

•committee responsibilities and structure, | •confidentiality requirements, |

•officer and director stock ownership requirements, | •director orientation and continuing education, and |

•director resignation policy, | •our plans with respect to management succession. |

•evaluations of Executive Chairman and CEO, | |

Our Corporate Governance Principles and Practices are available on our website at investors.meritagehomes.com. These principles are reviewed regularly by the ESNG Committee and changes are made as the Board deems appropriate on recommendation of the ESNG Committee.

| | | | | | | | | | | | | | |

| Director Qualifications and Diversity |

Our Board is comprised of a group of individuals whose previous experience, financial and business acumen, personal ethics and dedication and commitment to our Company allow the Board to complete its key task as the overseer and governing body of the Company. The specific experience and qualifications of each of our Board members are set forth below. The Board is committed to a policy of inclusiveness and diversity. The Board believes members should be comprised of persons with diverse backgrounds, skills, expertise, and experiences, including the following:

•management or board experience in a wide variety of enterprises and organizations,

•banking and capital markets,

•accounting and finance,

•legal, compliance and regulatory,

•real estate, including homebuilding, commercial and land development,

•technology, cybersecurity and artificial intelligence ("AI"),

•sales, marketing and branding,

•environmental, social and governance ("ESG")

•human capital, and

•operations.

14 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

The below matrix illustrates the key skills, expertise, and experience of each director:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Capabilities | Steven J. Hilton | Phillippe Lord | Peter L. Ax | Raymond Oppel | Dana C. Bradford | Michael R. Odell | Deb Henretta | Joseph Keough | P. Kelly Mooney | Louis E. Caldera | Dennis V. Arriola |

| Executive Management | X | X | X | X | X | X | X | X | X | X | X |

| Cyber/IT/Technology/AI | | | X | | | | X | | | | |

| ESG | | | | | | | X | | | X | X |

| Financial | X | | X | | X | X | X | X | | X | X |

| Home Building/Real Estate | X | X | | X | | | | X | | | |

| Human Capital | | | | | | | | | X | X | X |

| Legal, Regulatory & Compliance | | | X | | | | | | | X | X |

| Manufacturing or Operations | X | X | | X | X | X | X | | | | X |

| Marketing & Sales | X | | X | X | X | X | X | | X | | |

| Private Board | X | | X | X | X | X | X | X | X | X | X |

| Public Board | X | | X | X | X | X | X | X | X | X | X |

Our bylaws require a customary majority voting standard for the election of directors. In addition, our Corporate Governance Principles and Practices require that any nominee for director who is an incumbent director but who is not elected by the vote required in the bylaws, and with respect to whom no successor has been elected, promptly tender his or her offer to resign to the Board for its consideration. The ESNG Committee of the Board will recommend to the Board whether to accept or reject the resignation offer, or whether other action should be taken. In determining whether to recommend that the Board accept any resignation offer, the ESNG Committee will be entitled to consider all factors believed relevant by the ESNG Committee’s members. The Board will act on the ESNG Committee’s recommendation within 90 days following certification of the election results and will announce its determination and rationale in a Form 8-K. In deciding whether to accept the resignation offer, the Board will consider the factors considered by the ESNG Committee and any additional information and factors that the Board believes to be relevant. If the Board accepts a director’s resignation offer pursuant to its process, the ESNG Committee will recommend to the Board and the Board will thereafter determine what action, if any, will be taken with respect to any vacancy created by a resignation. Any director who tenders his or her resignation pursuant to this policy will not participate in the proceedings of either the ESNG Committee or the Board with respect to his or her own resignation.

In case of a Board vacancy or if the Board elects to increase its size, determinations regarding the eligibility of director candidates are made by the ESNG Committee, which considers the candidate’s qualifications as to skills and experience in the context of the needs of the Board and our stockholders. When seeking new Board candidates, the ESNG Committee is committed to a policy of inclusiveness and will take reasonable steps to ensure that women and people of color are considered for the pool of candidates from which the Board nominees are chosen, and will endeavor to include qualified candidates from non-traditional venues. On January 2, 2024, Gerald Haddock, a long tenured director retired and on March 14, 2024, Raymond Oppel announced his retirement, which will be effective at the end of his current term on May 16, 2024. Accordingly, the Board has begun a search for a new female board member candidate. While the timing of the identification and appointment of a new board member cannot be guaranteed, we anticipate our search will conclude by the end of the fiscal year. The Board is also committed to search for a female director upon any subsequent board retirement, in a good faith effort to improve board gender diversity over a reasonable time period.

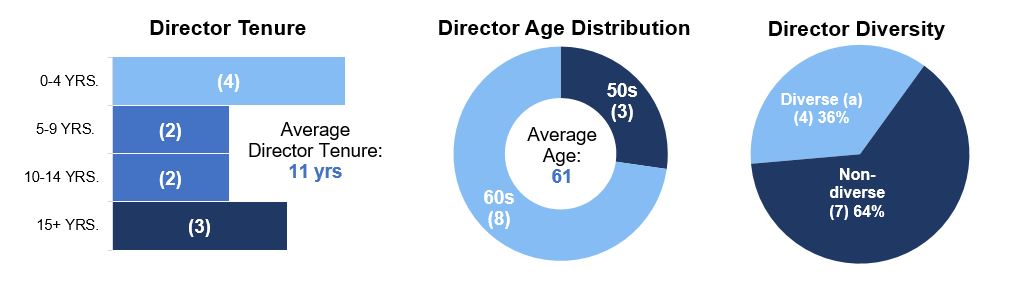

The following charts and biographies provide summary information about the tenure, demographics and experience of our directors as of March 21, 2024:

(a) Includes two females and two persons of color.

MERITAGE HOMES | 2024 Proxy Statement 15

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

The following table illustrates the voluntarily self-identified ethnic composition, as defined by NASDAQ, of our current Board and its Committees.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ethnicity | | Board of Directors | | Audit

Committee | | Compensation

Committee | | ESNG

Committee | | Land

Committee | | | | |

| African American or Black | | | | | | | | | | | | | | |

| Alaskan Native or Native American | | | | | | | | | | | | | | |

| Asian | | | | | | | | | | | | | | |

| Hispanic or Latino | | 2 | | | | 1 | | 1 | | | | | | |

| Native Hawaiian or Pacific Islander | | | | | | | | | | | | | | |

| White | | 9 | | 4 | | 4 | | 3 | | 4 | | | | |

| Two or More Races or Ethnicities | | | | | | | | | | | | | | |

| Total Number of Members | | 11 | | 4 | | 5 | | 4 | | 4 | | | | |

16 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

Our Board is comprised of the following members: | | | | | | | | |

Class I Directors | | |

| Steven J. Hilton, 62 | | Mr. Hilton is the Executive Chairman of Meritage Homes and has been a director since 1996. Mr. Hilton led Meritage Homes for 35 years as Chairman and CEO until his retirement as CEO effective January 1, 2021. In 1985, Mr. Hilton cofounded Arizona-based Monterey Homes, the predecessor company to Meritage Homes. Under Mr. Hilton’s leadership, Monterey became publicly traded in 1997. Mr. Hilton received a Bachelor’s degree in Accounting from the University of Arizona. He serves as a board member for Translational Genomics Research Institute (TGEN) Foundation and the Boys & Girls Clubs of Greater Scottsdale Foundation. He also previously served as Chairman of the Board for Banner Health Foundation from 2021 to 2023, and as a board member for Western Alliance Bancorporation, (NYSE: WAL) until June 2022. Mr. Hilton brings extensive and intimate knowledge of the Company to the Board as its co-founder and through over 35 years of experience in leading the Company. |

|

| Raymond Oppel, 67 | | Mr. Oppel has been a director since December 1997 and is retiring on May 16, 2024. Mr. Oppel is a licensed real estate broker and currently is active as a private investor in real estate development. He was the co-founder, Chairman and CEO of The Oppel Jenkins Group, a regional homebuilder in Texas and New Mexico, which was purchased in 1995 by public homebuilder KB Home.

Mr. Oppel has over 30 years of experience in the homebuilding business. Mr. Oppel possesses extensive knowledge about the real estate industry in general and the homebuilding industry in particular. |

|

| Dana C. Bradford, 59 | | Mr. Bradford has been a director since August 2009. In 2012, Mr. Bradford cofounded and was appointed and currently serves as Chairman and CEO of C3 Brands, the parent company to a number of consumer brands. From 2005 to 2012, Mr. Bradford was the President and Managing Partner of McCarthy Capital Corporation, a private equity firm. He also serves as a director on the boards of Southwest Value Partners, a San Diego-based real estate company, and Customer Service Profiles, an Omaha-based provider of customer satisfaction data and analytics. Mr. Bradford formerly served as Chairman of the Board of Vornado Air, a Wichita-based consumer brands company, and formerly served as a director on the boards of McCarthy Groups, Ballantyne, NRG Media, Guild Mortgage and Gold Circle Films.

Mr. Bradford earned a Bachelor's degree in Business Administration from the University of Arizona and an MBA from Creighton University. Mr. Bradford brings additional perspective to the Board relating to real estate and corporate finance matters. |

|

| Deb Henretta, 62 | | Ms. Henretta has been a director since March 2016. Ms. Henretta retired from Procter & Gamble, Co. ("P&G") in 2015. Throughout her 30 years at P&G, she held various senior positions throughout several sectors, serving as President of Global e-Business while concurrently serving as President/Senior Executive Officer of Global Beauty; President of Global Baby Care; and Vice President of Fabric Conditioners and Bleach. She has been a director at Corning Incorporated. (NYSE: GLW) since 2013, at Nisource Inc. (NYSE: NI) since 2015, and at American Eagle Outfitters (NYSE:AEO) since 2019. Ms. Henretta is a Partner at Council Advisors (formerly G100 Companies) where she assisted in establishing a Board Excellence Program for Corporate Board Directors that includes director education on board oversight and governance, including digital transformation and cybersecurity.

Ms. Henretta graduated summa cum laude from St. Bonaventure University with a Bachelor of Arts in Communication. She earned her Master of Arts in Advertising from Syracuse University Newhouse School of Public Communications and holds an honorary Doctorate of Humane Letters from St. Bonaventure University. Ms. Henretta brings additional perspective and expertise to the Board relating to technology, cybersecurity, climate and sustainability, and diversity and inclusion. |

| |

| P. Kelly Mooney, 60 | | Ms. Mooney has been a director since March 2020. Ms. Mooney is the Founder and CEO of Equipt Women, a public benefit corporation dedicated to connecting, empowering and upskilling young professional women. She was previously a co-owner of Resource/Ammirati, a digital marketing and customer experience innovation firm, and held various positions of leadership including CEO from January 2011 to September 2017; President from June 2001 to January 2011; and Chief Experience Officer and Director of Intelligence from March 1995 to May 2001. During that tenure, she advised dozens of Fortune 500 executives on customer growth strategy and digital transformation to increase shareholder value. In 2016, Resource/Ammirati was sold to IBM to become part of IBM iX, one of the world’s largest digital consultancies. Ms. Mooney joined IBM iX in September 2017 and served as Chief Experience Officer until June 2018. She advises consumer and technology-focused entrepreneurs on leadership, strategy and innovation.

Ms. Mooney has also served as a board member of Sally Beauty Supply Holdings, Inc. (NYSE:SBH), an international specialty retailer and distributor of professional beauty supplies, and J.Jill Inc. (NYSE: JILL), an omnichannel women's apparel brand. She graduated with honors with a Bachelor of Science in Industrial Design from The Ohio State University. Ms. Mooney brings additional perspective on innovation, sustainability, diversity and inclusion. |

| |

MERITAGE HOMES | 2024 Proxy Statement 17

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

Class I Directors (continued) | | | | | | | | |

| Louis E. Caldera, 68 | | Mr. Caldera has been a director since December 2021. Mr. Caldera is a private investor and corporate director. He has been serving as a director of DallasNews Corporation (NASDAQ: DALN), formerly Belo Corp, since 2001, where he also chairs the compensation and management development committee, and has been serving as a director of Granite Construction Incorporated (NYSE: GVA) since 2021. Mr. Caldera has been a Senior Lecturer at Harvard Business School since July 2023. Since March 2021, Mr. Caldera has served as a senior advisor to Belay Associates, LLC, a private equity firm, and its affiliate Everest Consolidator Acquisition Corporation (NYSE: MTNT.U). Mr. Caldera has held several leadership positions in education, including Distinguished Adjunct Professor of Law at American University Washington College of Law from September 2018 to June 2021, and Professor of Leadership and a Senior Fellow of the George Washington University Cisneros Hispanic Leadership Institute from 2016 to 2018. He has also served in government as Secretary of the Army in the Clinton Administration and as an Assistant to the President and Director of the White House Military Office in the Obama Administration. Mr. Caldera began his career as an army officer, corporate lawyer, and California state legislator. He is the co-founder and co-chair of the Presidents’ Alliance on Higher Education and Immigration, a nonprofit organization, and serves on the board of the Latino Corporate Directors Association.

Mr. Caldera holds an MBA from Harvard Business School, a Juris Doctor from Harvard Law School and a Bachelor of Science from the United States Military Academy. He has significant knowledge and experience in the leadership of large organizations, corporate governance including environmental, social and sustainability governance, and in legal, regulatory and policy matters. |

| |

18 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

| | | | | | | | |

Class II Directors | | |

| Peter L. Ax, 64 | | Mr. Ax has been a director since September 2000 and is the Company's lead independent director. In 2001, he joined UpscriptHealth, a telemedicine-based software platform which facilitates pharmaceutical manufacturers selling medications direct-to-consumers, where he currently serves as the CEO. He was also the Managing Partner of Phoenix Capital Management, an operationally focused venture capital firm, which became a subsidiary of UpscriptHealth in 2021. Mr. Ax was the Chairman and CEO of SpinCycle, Inc., a public reporting consolidator and developer of coin-operated laundromats. Previously, Mr. Ax served as head of the Private Equity Placement Division and Senior Vice President of Lehman Brothers in New York and has served in various operating roles for enterprises operated by Phoenix Capital Management. Mr. Ax also served on the board of directors of iGo, Inc. (formerly, NASDAQ: IGOI) from 2007 to January 2022.

Mr. Ax holds an MBA from the Wharton School at the University of Pennsylvania, a Juris Doctorate from the University of Arizona, and a Bachelor of Science in Business Administration from the University of Arizona, and has been a Certified Public Accountant. Mr. Ax possesses extensive skills and experience relating to, among other things, capital markets and corporate finance. |

|

| Michael R. Odell, 60 | | Mr. Odell has been a director since December 2011. Since 2017, he has been Board Member, President and CEO of Marubeni Automotive Aftermarket Holdings ("Marubeni"), a holding company for investments in the automotive aftermarket. He also currently serves as Board Member, President and CEO of Marubeni subsidiaries, XL Parts and The Parts House, both automotive parts distributors. From 2015 through 2016, he served as President of Eastern Auto Parts Warehouse, an automotive parts distributor. From 2008 through 2014, he served as President, CEO and board member of The Pep Boys - Manny, Moe & Jack, then a NYSE-listed company. Mr. Odell joined Pep Boys in 2007 as Chief Operating Officer. Previously, he served as Executive Vice President and General Manager of Sears Retail & Specialty Stores, a $26 billion division of Sears Holdings Corporation.

Mr. Odell started his career as a CPA with Deloitte & Touche LLP. Mr. Odell holds an MBA from Northwestern University's Kellogg School of Management, and a Bachelor of Science in Accounting from the University of Denver's Daniels College of Business. Mr. Odell has deep service, retail and distribution experience, with a broad background in strategic planning, leadership, sales, operations and finance.

|

|

| Joseph Keough, 54 | | Mr. Keough has been a director since June 2019. He currently serves as Chairman and CEO of Wood Partners, one of the nation's largest multifamily real estate companies. Before joining Wood Partners, Mr. Keough was Chief Operating Officer of Fuqua Capital, the office for the Atlanta-based Fuqua family. Mr. Keough had also been a Senior Vice President in the office and multifamily division of Cousins Properties (NYSE: CUZ), as well as a Principal at The Boston Consulting Group. Mr. Keough is also on the board of directors of Interface, Inc. (NASDAQ: TILE).

Mr. Keough earned his MBA from Harvard Business School and received his Bachelor degree in Finance and Economics from Babson College. Mr. Keough brings over 20 years of strong business leadership, deep understanding of real estate and first-hand experience driving organizational transformation.

|

| |

| Dennis V. Arriola, 63 | | Mr. Arriola was appointed to the Board on June 14, 2023. Mr. Arriola is standing for election at the 2024 Annual Meeting. Mr. Arriola was initially recommended to serve as a director by a third-party search firm, which was followed by a collective determination by our Board to nominate him. He is currently an Operating Partner at Sandbrook Capital, a private equity firm focused on transforming energy infrastructure investments. Prior to joining Sandbrook Capital, he served as CEO and member of the Executive Committee of Avangrid, Inc. (NYSE: AGR) from July 2020 to May 2022, and was the Executive Vice President and Chief Sustainability Officer at Sempra Energy (NYSE: SRE) from January 2017 to June 2020. Mr. Arriola has been serving as a director of Commercial Metals Company (NYSE: CMC) since March 2024, and as a director and member of the Audit & Finance Committee and Human Resources & Compensation Committee of ConocoPhillips (NYSE: COP) since September 2022. In addition, Mr. Arriola has been a director of Automobile Club of Southern California (AAA) since May 2020, where he has served as a member of the public affairs committee since May 2020, the finance and investment committee since May 2023, and served as a member of the audit committee from May 2020 to May 2023.

Mr. Arriola holds an MBA from Harvard Business School and a Bachelor of Arts in Economics from Stanford University. He has substantial knowledge and leadership experience in environmental, social and governance ("ESG"), operations and finance, and brings additional perspective to the Board in sustainability as well as regulatory, policy and legislative issues. |

| |

| Phillippe Lord, 50 | | Mr. Lord became the CEO of Meritage Homes on January 1, 2021 and was appointed to the Board at that time. He previously served as Chief Operating Officer of Meritage Homes from 2015 to 2020. From 2012 to 2015, Mr. Lord was President of the West Region at Meritage Homes. Mr. Lord began his Meritage Homes career in 2008 by creating the Company’s strategic operations and market research department, which analyzes land acquisitions, product and pricing.

Prior to joining Meritage Homes, Mr. Lord held leadership positions with Acacia Capital, Centex Homes and Pinnacle West Capital. Mr. Lord received a Bachelor's degree in Economics and Business from Colorado State University and completed his master's coursework in Economics at the University of Arizona. As CEO of the Company, Mr. Lord is uniquely qualified to serve as a member on our Board. |

| |

MERITAGE HOMES | 2024 Proxy Statement 19

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

The ESNG Committee evaluates and reports to the Board regarding the independence of each Board candidate. Consistent with the rules and regulations of the NYSE, at least a majority of the Board must be independent. No director will be deemed to be independent unless the Board affirmatively determines that the director has no material relationship with the Company, either directly or as an officer, stockholder, member, partner or trustee of an organization that has a relationship with the Company. The Board observes all criteria established by the NYSE and other governing laws and regulations. In its review of director independence, the Board considers all commercial, banking, consulting, legal, accounting, charitable, personal and other business relationships the director may have with the Company.

As a result of its review, the Board has determined that all of our current Board members are independent directors, with the exception of Messrs. Hilton and Lord. In making this determination, the Board evaluated whether any relationships exist between these individuals and Meritage and determined that no relationship exists between Meritage and any independent director. Messrs. Hilton and Lord are not considered independent because they are executive officers of the Company.

There are no familial relationships between members of the Board.

The Board has determined that all committees of the Board should be comprised entirely of independent directors and therefore Messrs. Hilton and Lord do not serve on any Board committees. The Board limits its independent members from serving on more than three other public company boards, limits the Executive Chairman to serving on two additional public company boards, and limits the CEO to serving on one additional public company board.

| | | | | | | | | | | | | | |

| Board Leadership Structure |

Steven J. Hilton, the Company's co-founder, serves as the Executive Chairman of the Board. We believe Mr. Hilton’s unique industry experience and continuing involvement in the strategic operations of the Company make him highly qualified to serve as Executive Chairman. Mr. Hilton co-founded Meritage Homes and is thus intimately familiar with its history, culture and operations. Mr. Hilton possesses in-depth knowledge and expertise in the homebuilding industry as a whole and Meritage Homes in particular and is the Company’s largest non-institutional stockholder. The Board has concluded that this puts Mr. Hilton in a unique position and makes it compelling for him to serve as Executive Chairman of the Board to effectively represent the stockholders’ interest.

Mr. Ax, our Audit Committee Chair, serves as the Board’s lead independent director. Mr. Ax has extensive knowledge of capital markets and corporate finance and has previously served as CEO of a publicly traded corporation. We believe that Mr. Ax’s role as our lead independent director serves as a counterbalance to and complements Mr. Hilton’s position as Executive Chairman and provides the appropriate level of independent director oversight. Additionally, our lead independent director collaborates with Mr. Hilton in establishing agendas for Board meetings, presides over all independent director meetings and can call special meetings of the independent directors as he deems necessary to address any matters the lead independent director feels should be addressed by the majority of our directors at any time. To more formalize the role, duties and qualifications of the lead independent director, the Board has adopted a Lead Director Charter. This Charter is available on our website at investors.meritagehomes.com.

| | | | | | | | | | | | | | |

| CEO and Management Succession; Board Composition and Refreshment |

Under the charter of the ESNG Committee, it is the role of the ESNG Committee to review and recommend to the Board changes as needed to the Company’s Corporate Governance Principles and Practices, including items such as management succession, policies and principles for CEO selection and performance review, policies regarding succession in the event of an emergency or departure of the CEO, and Board diversity, tenure and refreshment. Our Corporate Governance Principles and Practices provide, among other things, that our Lead Director is to conduct an annual review of the performance of the CEO.

The Board is committed to good corporate governance and regularly solicits and receives feedback from investors, potential investors, and other participants in the investing community. As indicated above, the Board seeks to achieve a balance of Board director tenures in order to benefit from long-tenured directors’ institutional knowledge and newly elected directors’ fresh perspectives and, towards this goal, has added four new independent directors over the past five years. The Board believes an effective refreshment program must be continuous and ongoing. On January 2, 2024, Gerald Haddock, a long tenured director, retired, and on March 14, 2024 Raymond Oppel announced his retirement, which will be effective at the end of his current term on May 16, 2024. Accordingly, the Board has begun a search for a new female board member candidate. While the timing of the identification and appointment of a new board member cannot be guaranteed, we anticipate our search will conclude by the end of the fiscal year. The Board is also committed to search for a female director upon any subsequent board retirement, in a good faith effort to improve board gender diversity over a reasonable time period.

20 MERITAGE HOMES | 2024 Proxy Statement

| | |

|

| CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS |

Our Board has overall responsibility for the oversight of risk management. As part of this oversight, on a regular basis, our Board receives reports from various members of management and is actively involved in monitoring our operations and approving key decisions relating to our strategy. Additionally, the management teams at our divisions must obtain approvals from our corporate executive team prior to engaging in certain activities or committing prescribed amounts of the Company’s financial and operational resources. As a result, senior management, who report directly to executive management, cannot authorize transactions that exceed prescribed thresholds that, while they may result in short-term benefits for their divisions, may expose the Company to unwarranted risks. Similarly, our executive management (including our NEOs) cannot engage in certain transactions without approval from our Board. For example, the Board must approve all debt and equity transactions. In addition, our legal department regularly reports to the Board information concerning ongoing litigation and possible legal, regulatory and other risks that might expose the Company to liability or loss. The Board also annually reviews the Company’s insurance programs.

In addition to their formal risk assessment activities and oversight, the Board and committees of the Board are also involved in risk oversight on a more informal basis at regular Board and committee meetings. At each regular Board meeting, management provides the Board a status report with respect to the Company's budget and addresses any material variances. The Board also receives and reviews business updates from senior management, which involve detailed reports on trends and any business risks that the Company may be facing. The Board also provides oversight of risk through its standing committees. For example:

•Our Audit Committee is responsible for reviewing and analyzing significant financial and operational risks and how management is managing and mitigating such risks through its internal controls and financial risk management processes. Our VP of Internal Audit reports directly to the Audit Committee and provides routine updates on the progress and findings of the department's ongoing internal audit reviews. Our external auditors also have at least quarterly discussions with our Audit Committee, and meet both with and without Company management present, to highlight what they perceive as our key financial risks. Our Audit Committee plays an important role in overseeing our internal controls monitoring and is regularly engaged in discussions with management regarding business risks, operational risks, transactional risks, cybersecurity, AI and financial risks. Cybersecurity and affiliated risks related to our information technology are a key component of our Board’s risk oversight, and our Chief Information Officer (CIO) provides a formal update to our Audit Committee at least twice per year, reviewing cybersecurity risks, trends, plans for future actions and measurements against recognized external cybersecurity frameworks and benchmarks.

•Our Compensation Committee oversees risks relating to the compensation and incentives provided to our executive officers. The Compensation Committee negotiates and approves all of the employment agreements of our NEOs and the Compensation Committee approves all grants of equity awards to all of our eligible employees. The Compensation Committee has the sole authority to hire outside compensation advisors and consultants and to determine the terms, scope and fees of such engagements.