NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Date: Wednesday, May 12, 2004

Time: 10:00 a.m. Texas time

The Crescent Club

200 Crescent Court

Dallas, Texas

75201

To Our Stockholders:

1. |

To elect three Class I Directors, each to hold office for a two-year term, |

2. |

To approve an amendment to our Stock Option Plan to increase the total number of shares authorized for issuance by 800,000 and change the maximum number of shares that can be issued to any one person from 300,000 in the aggregate to 100,000 shares per year, and |

3. |

To transact any other business that may properly come before the meeting. |

LARRY W. SEAY, SECRETARY

Scottsdale,

Arizona

April 9, 2004

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THIS MEETING, PLEASE SUBMIT YOUR PROXY BY SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE ENVELOPE PROVIDED. YOU MAY ALSO VOTE BY USING THE INTERNET OR TELEPHONE AS DESCRIBED ON THE PROXY CARD.

MERITAGE CORPORATION

8501 E. PRINCESS DRIVE

SUITE 290

SCOTTSDALE,

ARIZONA 85255

PROXY STATEMENT

VOTING SECURITIES OUTSTANDING

VOTE NECESSARY FOR ACTION

1

ELECTION OF DIRECTORS

(Proposal No. 1)

· |

vote FOR all nominees; |

· |

vote to WITHHOLD votes for all nominees; or |

· |

WITHHOLD votes as to specific nominees. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE

ELECTION OF

THE ABOVE-NAMED NOMINEES FOR ELECTION AS DIRECTORS.

2

DIRECTOR INFORMATION

3

SECURITY OWNERSHIP BY MANAGEMENT AND PRINCIPAL STOCKHOLDERS

· |

each Meritage director and nominee for director; |

· |

each executive officer named in the compensation summary under “Executive Compensation”; |

· |

all Meritage directors and executive officers as a group. |

| Name

Of Beneficial Owner

|

Position

With The Company |

Number Of Shares Owned(1) |

Right

To Acquire By May 15, 2004 |

Total Beneficial Shares |

Percent

Of Outstanding Shares |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

John

R. Landon |

Director, Co-Chairman and Co-CEO |

1,010,168 | (2) | 97,200 |

1,107,368 |

8.3% |

||||||||||||||||

Steven

J. Hilton |

Director, Co-Chairman and Co-CEO |

1,100,616 | (3) | 92,200 |

1,192,816 |

8.9% |

||||||||||||||||

Robert

G. Sarver |

Director |

479,000 | (4) | 32,500 |

511,500 |

3.8% |

||||||||||||||||

Raymond

Oppel |

Director |

— | 7,500 |

7,500 |

* |

|||||||||||||||||

Peter

L. Ax |

Director |

— | 16,500 |

16,500 |

* |

|||||||||||||||||

William

G. Campbell |

Director |

— | 2,500 |

2,500 |

* |

|||||||||||||||||

C.

Timothy White |

Director |

632 | 32,500 |

33,132 |

* |

|||||||||||||||||

Larry

W. Seay |

Chief Financial Officer, VicePresident-Finance and Secretary |

14,108 | 46,400 |

60,508 |

* |

|||||||||||||||||

Richard

T. Morgan |

Vice

President and Treasurer |

5,152 | 24,200 |

29,352 |

* |

|||||||||||||||||

All

directors and executive officers as a group (9 persons) |

2,609,676 | 351,500 |

2,961,176 |

22.2% |

||||||||||||||||||

* |

Less than 1%. |

(1) |

The amounts shown include the shares of common stock actually owned as of March 15, 2004, and the shares which the person or group had the right to acquire within 60 days of that date. In calculating the percentage of ownership, all shares of common stock which the identified person had the right to acquire within 60 days of March 15, 2004 upon exercise of options are considered as outstanding for computing the percentage of the shares owned by that person or group, but are not considered as outstanding for computing the percentage of the shares of stock owned by any other person. |

(2) |

Mr. Landon owns 933,334 shares with his spouse, as tenants-in-common. |

(3) |

Shares are held by family trusts. |

(4) |

Mr. Sarver is deemed to beneficially own 3,000 shares through his spouse and 1,000 shares through a minor child. |

4

| Shares Beneficially Owned At December 31, 2003 |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Certain Other Beneficial Owners |

Address Of Beneficial Owner |

Number |

Percent |

||||||||||||

Capital

Growth Management LP (1) |

One

International Place, Boston, MA 02110 |

1,052,700 | 8.0 | % | |||||||||||

FMR Corp.

(2) |

82

Devonshire Street, Boston, MA 02109 |

723,200 | 5.5 | % | |||||||||||

Wasatch

Advisors, Inc. (3) |

150

Social Hall Avenue, Salt Lake City, UT 84111 |

724,709 | 5.5 | % | |||||||||||

Wellington

Management Company, LLP (4) |

75

State Street, Boston, MA 02109 |

739,500 | 5.6 | % | |||||||||||

(1) |

Based solely on Schedule 13G/A, filed with the SEC on February 6, 2004. Capital Growth Management LP (“CGM”) has sole voting power with respect to 1,052,700 shares and shared dispositive power with respect to those 1,052,700 shares. The Schedule 13G/A also states that CGM disclaims any beneficial interest in the shares. |

(2) |

Based solely on Schedule 13G/A, filed with the SEC on February 17, 2004. FMR Corp. has sole voting power with respect to 23,200 shares and sole dispositive power with respect to 723,200 shares. The interest of Fidelity Low Priced Stock Fund, an investment company registered under the Investment Company Act of 1940, in Meritage common stock amounted to 700,000 shares or 5.3% of total outstanding shares at December 31, 2003. The voting of these 700,000 shares is carried out under guidelines established by the fund’s Boards of Trustees. |

(3) |

Based solely on Schedule 13G, filed with the SEC on February 18, 2004. Wasatch Advisors, Inc. has sole voting and dispositive power with respect to 724,709 shares. |

(4) |

Based solely on Schedule 13G/A, filed with the SEC on February 12, 2004. Wellington Management Company, LLP has shared voting power with respect to 479,300 shares and shared dispositive power with respect to 739,500 shares. |

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

Corporate Governance Principles and Practices

· |

director qualifications, |

· |

independence criteria, |

· |

director responsibilities, |

· |

our committee structure, |

· |

director access to officers and employees, |

· |

our philosophy with respect to director compensation, |

5

· |

director orientation and continuing education, and |

· |

our plans with respect to management succession. |

Director Qualification and Independence

· |

In the case of Mr. Sarver, he indirectly owns a 5% beneficial interest, through a partnership, in real property subject to a purchase contract with Meritage. Mr. Sarver’s beneficial interest in this property is estimated to be approximately $230,000. In addition, from time to time, we charter an aircraft from a company owned by Mr. Sarver. The Board of Directors determined that these items are not material and do not affect Mr. Sarver’s independence because these transactions and holdings are not significant to Mr. Sarver’s net worth or financial position. |

· |

In the case of Mr. Oppel, in 2001 he discontinued making investments in transactions involving Meritage. Prior to this, Mr. Oppel made investments as a minority investor in several limited partnerships that are party to option contracts that sell housing lots to Meritage. In addition, Mr. Oppel has a minority interest in an entity that in 2001 entered into a contract with Hammonds Homes for the sale of housing lots. By virtue of our acquisition of Hammonds Homes in 2002, Meritage became a party to this contract. The Board of Directors determined that these transactions are not material and do not affect Mr. Oppel’s independence because the transactions are not significant to Mr. Oppel’s net worth or financial position. |

6

The Board and Board Committees

| Board of Directors |

Audit Committee |

Executive Compensation Committee |

Nominating/Governance Committee |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

John R.

Landon |

||||||||||||||

Steven J.

Hilton |

||||||||||||||

Robert G.

Sarver* |

X | X | X | ** | ||||||||||

Raymond

Oppel* |

X | X | X | |||||||||||

Peter L. Ax*

+ |

X | ** | X | ** | ||||||||||

William G.

Campbell* |

X | X | ||||||||||||

C. Timothy

White |

||||||||||||||

Number of

Meetings |

8 | 4 | 1 | |||||||||||

* |

Independent X = Member ** = Chair + = Lead Independent Director |

Audit Committee

· |

in fulfilling its oversight of the integrity of the Company’s financial statements, |

· |

in determining the Company’s compliance with legal and regulatory requirements, |

· |

in determining the independent auditors’ qualifications and independence, and |

· |

in evaluating the performance of the Company’s internal audit function and independent auditors. |

7

Executive Compensation Committee

· |

reviewing and approving goals and objectives relative to the compensation of our Co-CEOs, evaluating our Co-CEOs’ performance in light of these goals and approving the compensation of our Co-CEOs, |

· |

making recommendations to the Board of Directors with regard to non-CEO compensation plans and equity-based plans, and |

· |

producing a report on executive compensation to be included in our annual Proxy Statement. |

Nominating/Governance Committee

· |

identifying individuals qualified to become Board members and recommending director nominees for the next annual meeting of stockholders, |

· |

developing and recommending Corporate Governance Principles and Practices applicable to the Company, |

· |

leading the Board of Directors in its annual review of the Board’s performance, and |

· |

recommending nominees for the Executive Compensation Committee and Audit Committee. |

Director Nomination Process

Meritage Corporation

8501 E. Princess Drive

Suite 290

Scottsdale,

Arizona 85255

Attn: Corporate Secretary

8

for consideration at next year’s annual meeting, please see “Stockholder Proposals” on page 24 of this Proxy Statement.

Executive Sessions of Independent Directors

Code of Ethics

Communications with the Board of Directors

DIRECTOR COMPENSATION

9

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

| Annual

Compensation

|

Long-Term Compensation Awards |

|||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name And Principal Position |

Year

|

Salary

($)

|

Bonus($)

|

Other

Annual Compensation ($) |

Securities Underlying Options (#) |

All

Other Compensation($)(4) |

||||||||||||||||||||

John R. Landon — Co- Chairman and Co-Chief Executive Officer |

2003 | $ | 712,500 | $ | 2,582,856 | — |

40,000 | $94,673 | ||||||||||||||||||

| 2002 | 425,000 | 1,935,043 | — |

40,000 | 58,575 | |||||||||||||||||||||

| 2001 | 425,000 | 1,417,401 | — |

49,000 | 57,277 | |||||||||||||||||||||

Steven J. Hilton — Co- Chairman and Co-Chief Executive Officer |

2003 | 712,500 | 2,582,856 | — |

40,000 | 61,192 | ||||||||||||||||||||

| 2002 | 425,000 | 1,935,043 | — |

40,000 | 23,026 | |||||||||||||||||||||

| 2001 | 425,000 | 1,417,401 | — |

49,000 | 40,964 | |||||||||||||||||||||

Larry W. Seay — Chief Financial Officer, Vice President-Finance and Secretary |

2003 | 262,019 | 786,784 | (1) | — |

15,000 | 20,144 | |||||||||||||||||||

| 2002 | 224,678 | 600,130 | (2) | — |

15,000 | 12,937 | ||||||||||||||||||||

| 2001 | 195,346 | 270,000 | (3) | — |

19,500 | 11,191 | ||||||||||||||||||||

Richard T. Morgan — Vice President and Treasurer |

2003 | 165,000 | 180,000 | (1) | — |

10,000 | 9,200 | |||||||||||||||||||

| 2002 | 150,000 | 165,455 | (2) | — |

10,000 | 5,811 | ||||||||||||||||||||

| 2001 | 150,000 | 130,000 | (3) | — |

13,500 | 4,968 | ||||||||||||||||||||

(1) |

Includes deferred compensation of $46,000 for each Messrs. Seay and Morgan, payable in December 2006. |

(2) |

Includes deferred compensation of $45,455 for each Messrs. Seay and Morgan, payable in December 2005. Mr. Morgan also received an award of 152 shares of Meritage stock in 2002. |

(3) |

Includes deferred compensation of $45,000 and $40,000 for Messrs. Seay and Morgan, respectively, payable in December 2004. Mr. Seay also received an award of 108 shares of Meritage stock in 2001. |

(4) |

These amounts represent matching contributions by us to the officers’ accounts under the 401(k) plan, group medical, long-term disability and life insurance plan premiums and automobile allowances paid by us as follows: |

| Name |

Year |

401(k) Match |

Group, Long- Term Disability And Life Insurance |

Vehicle Travel Allowance |

Total Other Compensation |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

John R.

Landon |

2003 | $3,125 | $74,445 | $17,103 | $94,673 | |||||||||||||||||

| 2002 | 3,087 | 39,816 | 15,672 | 58,575 | ||||||||||||||||||

| 2001 | 2,250 | 38,347 | 16,680 | 57,277 | ||||||||||||||||||

Steven J.

Hilton |

2003 | 3,553 | 25,595 | 32,044 | 61,192 | |||||||||||||||||

| 2002 | 3,278 | 18,735 | 1,013 | 23,026 | ||||||||||||||||||

| 2001 | 3,130 | 15,115 | 22,719 | 40,964 | ||||||||||||||||||

Larry W.

Seay |

2003 | 3,408 | 4,436 | 12,300 | 20,144 | |||||||||||||||||

| 2002 | 3,300 | 3,637 | 6,000 | 12,937 | ||||||||||||||||||

| 2001 | 3,150 | 3,391 | 4,650 | 11,191 | ||||||||||||||||||

Richard T.

Morgan |

2003 | 2,715 | 6,485 | — | 9,200 | |||||||||||||||||

| 2002 | 2,475 | 3,336 | — | 5,811 | ||||||||||||||||||

| 2001 | 2,362 | 2,606 | — | 4,968 | ||||||||||||||||||

10

OPTION GRANTS IN 2003

| Individual

Grants

|

Potential

Realizable Value At Assumed Annual Rates Of Stock Price Appreciation For Option Term |

|||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name

|

Number

Of

Shares Underlying Options Granted (#) |

Percent

of

Total Options Granted to Employees In 2003 |

Exercise

Of Base Price ($/Sh) |

Expiration Date |

5%

($)

|

10%

($)

|

||||||||||||||||||||

John

R. Landon |

37,160 | 11.1 | % | 32.00 | 3/12/10 | 484,091 | 1,128,138 | |||||||||||||||||||

John

R. Landon |

2,840 | 0.8 | % | 35.20 | 3/12/08 | 27,619 | 61,031 | |||||||||||||||||||

Steven

J. Hilton |

37,160 | 11.1 | % | 32.00 | 3/12/10 | 484,091 | 1,128,138 | |||||||||||||||||||

Steven

J. Hilton |

2,840 | 0.8 | % | 35.20 | 3/12/08 | 27,619 | 61,031 | |||||||||||||||||||

Larry

W. Seay |

15,000 | 4.5 | % | 32.00 | 3/12/10 | 195,408 | 455,384 | |||||||||||||||||||

Richard

T. Morgan |

10,000 | 3.0 | % | 32.00 | 3/12/10 | 130,272 | 303,589 | |||||||||||||||||||

AGGREGATED OPTION EXERCISES IN 2003

AND 2003 YEAR-END OPTION

VALUES

| Number

Of Securities Underlying Unexercised Options At December 31, 2003 (#) |

Value

of Unexercised In- The-Money Options At December 31, 2003 ($) |

||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Shares Acquired On Exercise (#) |

Value Realized ($) |

Exercisable

|

Unexercisable

|

Exercisable

|

Unexercisable

|

|||||||||||||||||||

John

R. Landon |

31,645 | 1,515,063 | 88,995 | 139,760 | 4,674,072 | 5,751,697 | |||||||||||||||||||

Steven

J. Hilton |

24,000 | 1,123,190 | 55,640 | 139,760 | 2,712,048 | 5,751,697 | |||||||||||||||||||

Larry

W. Seay |

14,000 | 789,666 | 32,600 | 64,400 | 1,733,828 | 2,902,622 | |||||||||||||||||||

Richard

T. Morgan |

34,000 | 1,372,585 | 10,800 | 40,200 | 511,984 | 1,760,426 | |||||||||||||||||||

11

REPORT OF THE EXECUTIVE COMPENSATION COMMITTEE

ON EXECUTIVE

COMPENSATION

· |

a base salary, |

· |

performance bonuses designed to reward performance based on financial results, and |

· |

stock-based incentives designed to tie the executive officers’ overall compensation to the interests of Meritage’s stockholders by providing rewards to executives if stockholders benefit from stock price appreciation. |

12

performance and stock options. Both agreements provide for an annual performance-based bonus. In 2003, the bonus component for our Co-CEOs was based on a percentage of our pre-tax net earnings. In 2003, the objective performance criteria used to determine whether our Co-CEOs were entitled to a bonus was based on (i) the achievement of certain budget targets as determined by the Executive Compensation Committee and (ii) Meritage’s return on assets and return on equity relative to other peer homebuilder companies. The Executive Compensation Committee believes that tying compensation to financial performance aligns the interests of executives with those of our stockholders as determined by the Board of Directors. These agreements expire in 2005.

· |

an annualized salary of $850,000, |

· |

a performance bonus of $2,582,856, and |

· |

a grant of 40,000 stock options vesting over five years. |

Robert G. Sarver

Raymond Oppel

13

EMPLOYMENT AGREEMENTS

· |

payments to purchase additional life insurance coverage and disability insurance coverage, |

· |

a supplemental savings plan enabling deferred compensation in excess of current 401(k) limitations, |

· |

supplemental retirement benefits, and |

· |

charter aircraft services and the use of a Company car. |

· |

$10 million, in equal monthly installments over a period of two years, which payment represents consideration for consulting, severance and non-competition, and |

· |

where the Company discharges him without cause during the last three months of the Company’s fiscal year, a pro rata bonus based on the Company’s performance for that fiscal year. |

14

· |

100% of his base salary and 100% of his average bonus for the previous two fiscal years, which payment represents consideration for consulting, severance and non-competition, and |

· |

where the Company discharges him without cause during the last three months of the Company’s fiscal year, a pro rata bonus based on the Company’s performance for that fiscal year. |

15

CHANGE OF CONTROL ARRANGEMENTS

· |

for Messrs. Landon and Hilton, three times the highest of the following (i) his average incentive compensation for the two years prior to the termination of his employment, (ii) his incentive compensation for the year preceding the year in which the change of control occurred or (iii) the incentive compensation he would have been entitled if the year were to end on the day on which the change of control occurs (based on performance up to that date), |

· |

for Mr. Seay, two times the highest of the following (i) his average incentive compensation for the two years prior to the termination of his employment, (ii) his incentive compensation for the year preceding the year in which the change of control occurred or (iii) the incentive compensation he would have been entitled if the year were to end on the day on which the change of control occurs (based on performance up to that date), and |

· |

for Mr. Morgan, one times one times the average of the higher of (i) his incentive compensation for the two years prior to the termination of his employment, or (ii) his incentive compensation on the date preceding the change in control. |

16

REPORT OF THE AUDIT COMMITTEE

· |

serve as an independent and objective party to monitor Meritage’s financial reporting process and internal controls, |

· |

review and appraise the audit efforts of Meritage’s independent accountants, and |

· |

provide an open avenue of communication among the independent accountants, financial and senior management, and the Board of Directors. |

Robert G. Sarver

Raymond Oppel

William G. Campbell

17

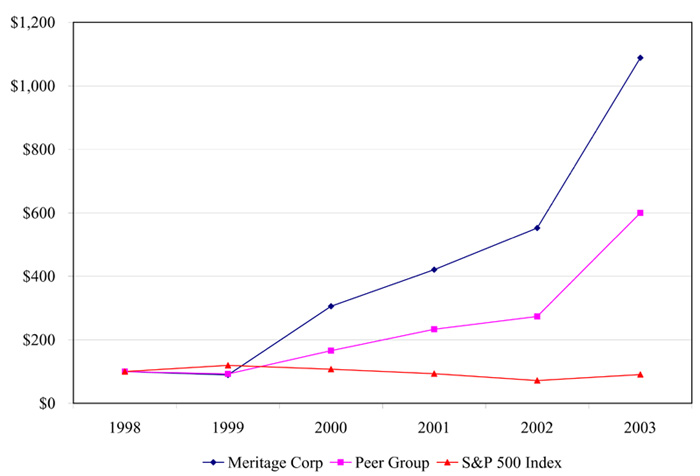

PERFORMANCE GRAPH

| As of December 31, |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

||||||||||||||||||||||

Meritage

Corporation |

100 | 89 | 306 | 421 | 552 | 1,088 | |||||||||||||||||||||

S&P

500 |

100 | 120 | 107 | 93 | 72 | 90 | |||||||||||||||||||||

Peer

Group(1) |

100 | 93 | 166 | 233 | 273 | 634 | |||||||||||||||||||||

| (1) | The Peer Group consists of the following companies: Beazer Homes USA, Inc., Dominion Homes, Inc., Hovnanian Enterprises, Inc., MDC Holdings, Inc., Ryland Group, Inc., Toll Brothers, Inc., Standard- Pacific Corporation, Technical Olympic USA, Inc., M/I Schottenstein Homes, Inc., WCI Communities, Inc., and William Lyon Homes. |

18

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

19

PROPOSAL TO APPROVE AMENDMENT TO THE MERITAGE CORPORATION

STOCK OPTION

PLAN

(Proposal No. 2)

General — Description of Available Awards

20

Change of Control

· |

a merger or consolidation in which the Company is not the surviving entity, |

· |

the sale, transfer or other disposition of all or substantially all of the assets of the Company in a liquidation or dissolution of the company, or |

· |

any reverse merger in which the Company is the surviving entity but in which the beneficial ownership of securities possessing more than 50% of the total combined voting power of the Company’s outstanding securities are transferred to holders different from those who held such securities immediately prior to such merger. |

21

Plan Benefits

| Individual Or Group Name |

Number Of Shares Subject To Options Granted |

Weighted Average Exercise Price Per Share |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Executive

Officers |

||||||||||

John R.

Landon |

40,000 | $ | 32.23 | |||||||

Steven J.

Hilton |

40,000 | $ | 32.23 | |||||||

Larry W.

Seay |

15,000 | $ | 32.00 | |||||||

Richard T.

Morgan |

10,000 | $ | 32.00 | |||||||

Executive

Officer Group (4 persons) |

105,000 | $ | 32.17 | |||||||

Non-Executive

Officer Director Group (5 persons) |

12,500 | $ | 32.00 | |||||||

Non-Executive

Officer Employee Group (55 persons) |

230,500 | $ | 32.89 | |||||||

Non-Employee

Group (1 person) |

1,000 | $ | 39.40 | |||||||

Amendments to Plan

22

EQUITY COMPENSATION PLAN INFORMATION

| (a) |

(b) |

(c) |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||||||

Equity

compensation plans approved by security holders |

1,346,512 | $ | 22.74 | 57,540 | ||||||||||

Equity

compensation plans not approved by security holders |

0 | 0 | 0 | |||||||||||

Total |

1,346,512 | $ | 22.74 | 57,540 | ||||||||||

Securities Act Registration

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” APPROVAL OF THIS

PROPOSAL

TO AMEND THE MERITAGE CORPORATION STOCK OPTION PLAN.

23

INDEPENDENT AUDITORS

| 2003 |

2002 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Audit fees

(1) |

$ | 459,089 | $ | 361,319 | ||||||

Audit related

fees (2) |

12,000 | 11,000 | ||||||||

Audit and

audit related fees |

471,089 | 372,319 | ||||||||

Tax fees

(3) |

528,491 | 119,893 | ||||||||

All other

fees |

— | — | ||||||||

Total

fees |

$ | 999,580 | $ | 492,212 | ||||||

(1) |

Audit fees consisted principally of fees for audit and review services, services related to various SEC filings and related research and the 2003 senior note add-ons. In 2002, audit fees consisted primarily of fees for audit and review services, services related to the acquisitions of Hammonds Homes and Perma-Bilt Homes, and our equity offering. |

(2) |

Audit related fees consisted of fees related to the audit of our 401(k) Plan. |

(3) |

Tax fees consisted of fees for income tax consulting and tax (including state and local tax procurement) compliance, including preparation of original and amended state and federal income tax returns, refund claims, and IRS tax audit assistance. |

STOCKHOLDER PROPOSALS

OTHER MATTERS

24

ELECTRONIC DELIVERY OF FUTURE ANNUAL MEETING MATERIALS

Larry W. Seay

Chief Financial Officer, Vice President-Finance

and Secretary

April 9, 2004

25

EXHIBIT A

MERITAGE CORPORATION

AUDIT COMMITTEE

OF THE BOARD OF

DIRECTORS CHARTER

| I. | PURPOSE AND AUTHORITY |

· |

Receive and review reports received from independent auditors, and review any audit problems. |

· |

Prepare audit committee reports for Corporation proxy statements. |

· |

Conduct periodic, separate meetings with each of the outside auditors, internal auditors and management. |

· |

Discuss earnings releases and analyst guidance with management. |

· |

Establish policies of the Corporation with respect to risk assessment and risk management. |

· |

Establish clear hiring policies with regard to current or past employees of the outside auditor that the Corporation may be seeking to hire as an employee of the Corporation. |

· |

Perform annual evaluations of the Audit Committee itself. |

· |

Make regular reports to the Board. |

| II. | COMPOSITION |

A-1

| III. | MEETINGS |

| IV. | RESPONSIBILITIES AND DUTIES |

Documents/Reports Review

1. |

Review and update this Charter periodically, at least annually, as conditions dictate. The Audit Committee shall annually review the Committee’s own performance. |

2. |

Review the organization’s annual audited financial statements and any reports or other financial information submitted to any governmental body, or the public, including the Corporation’s disclosures and MD&A, any certification, report, opinion or review rendered by the independent accountants, and recommend whether the audited financial statements shall be included in the Corporation’s Form 10-K. |

3. |

Review the Corporation’s Form 10-Q and quarterly financial statements with financial management and the independent accountants, if necessary, prior to its filing. The Chair of the Committee may represent the entire Committee for purposes of this review. |

Independent Accountants

4. |

Select the independent accountants, considering independence and effectiveness and approve the fees and other compensation to be paid to the independent accountants. |

5. |

Review the performance of the independent accountants and approve any proposed discharge of the independent accountants when circumstances warrant. |

6. |

Meet in separate sessions with management, the independent auditors and those responsible for the internal audit function to enable a productive identification of any issues that would warrant the Audit Committee’s attention. |

7. |

Review the experience and qualifications of the senior members of the independent accountant team and the internal audit team. |

8. |

Obtain and review a report from the independent auditor at least annually regarding (a) all critical accounting policies and practices to be used, (b) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the Corporation, and (c) other material written communications between the independent accountant and management, such as any management letter or schedule of unadjusted differences. Evaluate the qualifications, performance and independence of the independent accountant, including considering whether the accountant’s quality controls are adequate and the provision of non-audit services is compatible with maintaining the accountant’s independence, and taking into account the opinions of management and the internal auditor. The Audit Committee shall present its conclusions to the Board and, as necessary, recommend that the Board take additional action to satisfy itself of the qualifications, performance and independence of the accountants. |

A-2

9. |

At least annually, obtain and review a report on the outside auditor that addresses: the firm’s internal quality-control procedures; any material issues raised by the most recent internal quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one of more independent audits carried out by the firm, and any steps taken to deal with any issues; and all relationships between the independent auditor and the Corporation. |

10. |

Obtain and review the Corporation’s signing officer(s)’ disclosures regarding (a) all significant deficiencies in the design or operation of internal controls which could adversely affect the Corporation’s ability to record, process, summarize and report financial data and any material weaknesses in internal controls, and (b) any fraud whether or not material, that involves management or other employees who have a significant role in the Corporation’s internal controls. |

11. |

Consider whether, in order to assure continuing auditor independence, it is appropriate to adopt a policy of rotating the lead audit partner or even the independent accounting firm itself on a regular basis. |

12. |

Ensure that the lead audit partner of the independent auditor has not performed audit services for the Corporation in each of the five (5) previous fiscal years of that Corporation. |

13. |

Recommend to the Board policies for the Corporation’s hiring of employees or former employees of the independent accountant who were engaged on the Corporation’s account. |

14. |

Discuss with the independent accountant any communications between the audit team and the firm’s national office with respect to auditing or accounting issues presented by the engagement. |

15. |

Meet with the independent accountant prior to the audit to discuss the planning and staffing of the audit and discuss budget and staffing of the Corporation’s internal audit function. |

16. |

Pre-approve all audit and non-audit services provided by the independent auditor, unless these services are de minimis. |

Financial Reporting Processes

17. |

Discuss with management and the independent accountants significant financial reporting issues and judgments made in connection with the preparation of the Corporation’s financial statements, including any significant changes in the Corporation’s selection or application of accounting principles, any major issues as to the adequacy of the Corporation’s internal controls, the development, selection and disclosure of critical accounting estimates, and analyses of the effect of alternative assumptions, estimates or GAAP methods on the Corporation’s financial statements. |

18. |

Discuss with management the Corporation’s earnings press releases, including the use of “pro forma” or “adjusted” non-GAAP information, as well as financial information and earnings guidance provided to analysts and rating agencies. |

19. |

Discuss with management and the independent accountants the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Corporation’s financial statements. |

20. |

Discuss with management the Corporation’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Corporation’s risk assessment and risk management policies. |

Process Improvement

21. |

Establish regular and separate systems of reporting to the Audit Committee by each of management and the independent accountants regarding any significant judgments made in management’s preparation of the financial statements and the view of each as to appropriateness of such judgments. |

A-3

22. |

Following completion of the annual audit, review separately with each of management and the independent accountants any significant difficulties encountered during the course of the audit, including any restrictions on the scope of work or access to required information. |

23. |

Review any significant disagreements among management and the independent accountants in connection with the preparation of the financial statements and management’s response. |

24. |

Review with the independent accountants and management the extent to which changes or improvements in financial or accounting practices, as approved by the Audit Committee, have been implemented. (This review should be conducted at an appropriate time subsequent to implementation of changes or improvements, as decided by the Audit Committee.) |

Ethical and Legal Compliance

25. |

Review and update periodically the Corporation’s employee handbook and Code of Ethics and ensure that management has established a system to enforce these policies. |

26. |

Review management’s monitoring of the Corporation’s compliance with the organization’s conduct policies, and ensure that management has the proper review system in place to ensure that Corporation’s financial statements, reports and other financial information disseminated to governmental organizations, and the public, satisfy legal requirements. |

27. |

Establish procedures for the submission, receipt, retention and treatment of complaints and concerns regarding internal accounting controls, accounting matters or auditing matters and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters. |

28. |

Review, with the organization’s counsel, legal compliance matters including corporate securities trading policies. |

29. |

Review, with the organization’s counsel, any legal matter that could have a significant impact on the Corporation’s financial statements. |

30. |

Perform any other activities consistent with this Charter, the Corporation’s Bylaws and governing law, as the Audit Committee or the Board deems necessary or appropriate. |

A-4

EXHIBIT B

MERITAGE CORPORATION

STOCK OPTION PLAN

| 1. | ESTABLISHMENT, PURPOSE AND DEFINITIONS |

a. |

The Stock Option Plan (the “Option Plan”) of Meritage Homes (the “Company”) is hereby adopted. The Option Plan shall provide for the issuance of incentive stock options (“ISOs”) and nonqualified stock options (“NSOs”). |

b. |

The purpose of this Option Plan is to promote the long-term success of the Company by attracting, motivating and retaining key executives, consultants and directors (the “Participants”) through the use of competitive long-term incentives which are tied to stockholder interests by providing incentives to the Participants in the form of stock options which offer rewards for achieving the long-term strategic and financial objectives of the Company. |

c. |

The Option Plan is intended to provide a means whereby Participants may be given an opportunity to purchase shares of Stock (as defined herein) of the Company pursuant to (i) options which may qualify as ISOs under Section 422 of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”), or (ii) NSOs which may not so qualify. |

d. |

The term “Affiliates” as used in this Option Plan means parent or subsidiary corporations, as defined in Section 424(e) and (f) of the Code (but substituting “the Company” for “employer corporation”), including parents or subsidiaries which become such after adoption of the Option Plan. |

| 2. | ADMINISTRATION OF THE PLAN |

a. |

The Option Plan shall be administered by members of the Board of Directors of the Company (the “Board”) qualifying as “non-employee directors” as such term is defined in Rule 16b-3 promulgated by the Securities and Exchange Commission (the “Commission”). |

b. |

The Board may from time to time determine which employees of the Company or its Affiliates or other individuals or entities (each an “option holder”) shall be granted options under the Option Plan, the terms thereof (including without limitation determining whether the option is an incentive stock option and the times at which the options shall become exercisable), and the number of shares of Stock for which an option or options may be granted. |

c. |

If rights of the Company to repurchase Stock are imposed, the Board may, in its sole discretion, accelerate, in whole or in part, the time for lapsing of any rights of the Company to repurchase shares of such Stock or forfeiture restrictions. |

d. |

If rights of the Company to repurchase Stock are imposed, the certificates evidencing such shares of Stock awarded hereunder, although issued in the name of the option holder concerned, shall be held by the Company or a third party designated by the Board in escrow subject to delivery to the option holder or to the Company at such times and in such amounts as shall be directed by the Board under the terms of this Option Plan. Share certificates representing Stock that is subject to repurchase rights shall have imprinted or typed thereon a legend or legends summarizing or referring to the repurchase rights. |

e. |

The Board shall have the sole authority, in its absolute discretion, to adopt, amend and rescind such rules and regulations, consistent with the provisions of the Option Plan, as, in its opinion, may be advisable in the administration of the Option Plan, to construe and interpret the Option Plan, the rules and regulations, and the instruments evidencing options granted under the Option Plan and to make all other determinations deemed necessary or advisable for the administration of the Option Plan. All decisions, determinations and interpretations of the Board shall be binding on all option holders under the Option Plan. |

B-1

| 3. | STOCK SUBJECT TO THE PLAN |

a. |

“Stock” shall mean Common Stock of the Company or such stock as may be changed as contemplated by Section 3(c) below. Stock shall include shares drawn from either the Company’s authorized but unissued shares of Common Stock or from reacquired shares of Common Stock, including without limitation shares repurchased by the Company in the open market. The maximum number of shares of Common Stock that can be issued under this Option Plan is 2,950,000 shares, and the maximum number of shares of Common Stock that can be issued to any one person under this Option Plan is 100,000 shares per year. |

b. |

Options may be granted under the Option Plan from time to time to eligible persons. Stock options awarded pursuant to the Option Plan which are forfeited, terminated, surrendered or canceled for any reason prior to exercise shall again become available for grants under the Option Plan (including any option canceled in accordance with the cancellation regrant provisions of Section 6(f) herein). |

c. |

If there shall be any changes in the Stock subject to the Option Plan, including Stock subject to any option granted hereunder, through merger, consolidation, recapitalization, reorganization, reincorporation, stock split, reverse stock split, stock dividend, combination or reclassification of the Company’s Stock or other similar events, an appropriate adjustment shall be made by the Board in the number of shares of Stock. Consistent with the foregoing, in the event that the outstanding Stock is changed into another class or series of capital stock of the Company, outstanding options to purchase Stock granted under the Option Plan shall become options to purchase such other class or series and the provisions of this Section 3(c) shall apply to such new class or series. |

d. |

The aggregate number of shares of Stock approved by the Option Plan may not be exceeded without amending the Option Plan and obtaining stockholder approval within twelve months of such amendment. |

| 4. | ELIGIBILITY |

| 5. | EXERCISE PRICE FOR OPTIONS GRANTED UNDER THE PLAN |

(a) |

All ISOs and NSOs will have option exercise prices per option share not less than the fair market value of a share of the Stock on the date the option is granted, except that in the case of ISOs granted to any person possessing more than 10% of the total combined voting power of all classes of stock of the Company or any Affiliate the price shall be not less than 110% of such fair market value. The price of ISOs or NSOs granted under the Option Plan shall be subject to adjustment to the extent provided in Section 3(c) above. |

(b) |

The fair market value on the date of grant shall be determined based upon the closing price on an exchange on that day or, if the Stock is not listed on an exchange, on the average of the closing bid and asked prices in the Over the Counter Market on that day. |

| 6. | TERMS AND CONDITIONS OF OPTIONS |

a. |

Each option granted pursuant to the Option Plan shall be evidenced by a written stock option agreement (the “Option Agreement”) executed by the Company and the person to whom such option is granted. The Option Agreement shall designate whether the option is an ISO or an NSO. |

B-2

b. |

The term of each ISO and NSO shall be no more than 10 years, except that the term of each ISO issued to any person possessing more than 10% of the voting power of all classes of stock of the Company or any Affiliate shall be no more than 5 years. Subsequently issued options, if Stock becomes available because of further allocations or the lapse of previously outstanding options, will extend for terms determined by the Board or the Committee but in no event shall an ISO be exercised after the expiration of 10 years from the date of its grant. |

c. |

In the case of ISOs, the aggregate fair market value (determined as of the time such option is granted) of the Stock to which ISOs are exercisable for the first time by such individual during any calendar year (under this Option Plan and any other plans of the Company or its Affiliates if any) shall not exceed the amount specified in Section 422(d) of the Internal Revenue Code, or any successor provision in effect at the time an ISO becomes exercisable. |

d. |

The Option Agreement may contain such other terms, provisions and conditions regarding vesting, repurchase or other provisions as may be determined by the Board. To the extent such terms, provisions and conditions are inconsistent with this Option Plan, the specific provisions of the Option Plan shall prevail. If an option, or any part thereof, is intended to qualify as an ISO, the Option Agreement shall contain those terms and conditions, which the Board determines, are necessary to so qualify under Section 422 of the Internal Revenue Code. |

e. |

The Board shall have full power and authority to extend the period of time for which any option granted under the Option Plan is to remain exercisable following the option holder’s cessation of service as an employee, director or consultant, including without limitation cessation as a result of death or disability; provided, however, that in no event shall such option be exercisable after the specified expiration date of the option term. |

f. |

As a condition to option grants under the Option Plan, the option holder agrees to grant the Company the repurchase rights as the Company may at its option require and as may be set forth in a separate repurchase agreement. Any option granted under the Option Plan may be subject to a vesting schedule as provided in the Option Agreement and, except as provided in this Section 6 herein, only the vested portion of such option may be exercised at any time during the Option Period. All rights to exercise any option shall lapse and be of no further effect whatsoever immediately if the option holder’s service as an employee is terminated for “Cause” (as hereinafter defined) or if the option holder voluntarily terminates the option holder’s service as an employee. The unvested portion of the option will lapse and be of no further effect immediately upon any termination of employment of the option holder for any reason. In the remaining cases where the option holder’s service as an employee is terminated due to death, permanent disability, or is terminated by the Company (or its affiliates) without Cause at any time, unless otherwise provided by the Committee, the vested portion of the option will extend for a period of three (3) months following the termination of employment and shall lapse and be of no further force or effect whatsoever only if it is not exercised before the end of such three (3) month period. “Cause” shall be defined in an Employment Agreement between Company and option holder and if none there shall be “Cause” for termination if (i) the option holder is convicted of a felony, (ii) the option holder engages in any fraudulent or other dishonest act to the detriment of the Company, (iii) the option holder fails to report for work on a regular basis, except for periods of authorized absence or bona fide illness, (iv) the option holder misappropriates trade secrets, customer lists or other proprietary information belonging to the Company for the option holder’s own benefit or for the benefit of a competitor, (v) the option holder engages in any willful misconduct designed to harm the Company or its stockholders, or (vi) the option holder fails to perform properly assigned duties. |

g. |

No fractional shares of Stock shall be issued under the Option Plan, whether by initial grants or any adjustments to the Option Plan. |

B-3

| 7. | USE OF PROCEEDS |

| 8. | AMENDMENT, SUSPENSION OR TERMINATION OF PLAN |

a. |

The Board may at any time suspend or terminate the Option Plan, and may amend it from time to time in such respects as the Board may deem advisable provided that (i) such amendment, suspension or termination complies with all applicable state and federal requirements and requirements of any stock exchange on which the Stock is then listed, including any applicable requirement that the Option Plan or an amendment to the Option Plan be approved by the stockholders, and (ii) the Board shall not amend the Option Plan to increase the maximum number of shares of Stock subject to ISOs under the Option Plan or to change the description or class of persons eligible to receive ISOs under the Option Plan without the consent of the stockholders of the Company sufficient to approve the Option Plan in the first instance. The Option Plan shall terminate on the earlier of (i) tenth anniversary of the Plan’s approval or (ii) the date on which no additional shares of Stock are available for issuance under the Option Plan. |

b. |

No option may be granted during any suspension or after the termination of the Option Plan, and no amendment, suspension or termination of the Option Plan shall, without the option holder’s consent, alter or impair any rights or obligation under any option granted under the Option Plan. |

c. |

[Reserved.] |

d. |

Nothing contained herein shall be construed to permit a termination, modification or amendment adversely affecting the rights of any option holder under an existing option theretofore granted without the consent of the option holder. |

| 9. | ASSIGNABILITY OF OPTIONS AND RIGHTS |

10. PAYMENT UPON EXERCISE

B-4

11. WITHHOLDING TAXES

a. |

Shares of Stock issued hereunder shall be delivered to an option holder only upon payment by such person to the Company of the amount of any withholding tax required by applicable federal, state, local or foreign law. The Company shall not be required to issue any Stock to an option holder until such obligations are satisfied. |

b. |

The Board may, under such terms and conditions as it deems appropriate, authorize an option holder to satisfy withholding tax obligations under this Section 11 by surrendering a portion of any Stock previously issued to the option holder or by electing to have the Company withhold shares of Stock from the Stock to be issued to the option holder, in each case having a fair market value equal to the amount of the withholding tax required to be withheld. |

12. RATIFICATION

13. CORPORATE TRANSACTIONS

a. |

For the purpose of this Section 13, a “Corporate Transaction” shall include any of the following stockholder-approved transactions to which the Company is a party: |

(i) |

a merger or consolidation in which the Company is not the surviving entity, except for a transaction the principal purpose of which is to change the State of the Company’s incorporation; |

(ii) |

the sale, transfer or other disposition of all or substantially all of the assets of the Company in liquidation or dissolution of the Company; or |

(iii) |

any reverse merger in which the Company is the surviving entity but in which beneficial ownership of securities possessing more than fifty percent (50%) of the total combined voting power of the Company’s outstanding securities are transferred to holders different from those who held such securities immediately prior to such merger. |

b. |

Upon the occurrence of a Corporate Transaction, if the surviving corporation or the purchaser, as the case may be, does not assume the obligations of the Company under the Option Plan, then irrespective of the vesting provisions contained in individual option agreements, all outstanding options shall become immediately exercisable in full and each option holder will be afforded an opportunity to exercise their options prior to the consummation of the merger or sale transaction so that they can participate on a pro rata basis in the transaction based upon the number of shares of Stock purchased by them on exercise of options if they so desire. To the extent that the Option Plan is unaffected and assumed by the successor corporation or its parent company a Corporate Transaction will have no effect on outstanding options and the options shall continue in effect according to their terms. |

c. |

Each outstanding option under this Option Plan which is assumed in connection with the Corporate Transaction or is otherwise to continue in effect shall be appropriately adjusted, immediately after such Corporate Transaction, to apply and pertain to the number and class of securities which would have been issued to the option holder in connection with the consummation of such Corporate Transaction had such person exercised the option immediately prior to such Corporate Transaction. Appropriate adjustments shall also be made to the option price payable per share, provided the aggregate option price payable for such securities shall remain the same. In addition, the class and number of securities available for issuance under this Option Plan following the consummation of the Corporate Transaction shall be appropriately adjusted. |

B-5

d. |

The grant of options under this Option Plan shall in no way affect the right of the Company to adjust, reclassify, reorganize or otherwise change its capital or business structure or to merge, consolidate, dissolve, liquidate or sell or transfer all or any part of its business or assets. |

| 14. | REGULATORY APPROVALS |

| 15. | NO EMPLOYMENT/SERVICE RIGHTS |

| 16. | MISCELLANEOUS PROVISIONS |

a. |

The provisions of this Option Plan shall be governed by the laws of the State of Arizona, as such laws are applied to contracts entered into and performed in such State, without regard to its rules concerning conflicts of law. |

b. |

The provisions of this Option Plan shall insure to the benefit of, and be binding upon, the Company and its successors or assigns, whether by Corporate Transaction or otherwise, and the option holders, the legal representatives of their respective estates, their respective heirs or legatees and their permitted assignees. |

c. |

The option holders shall have no dividend rights, voting rights or any other rights as a stockholder with respect to any options under the Option Plan prior to the issuance of a stock certificate for such Stock. |

d. |

If there is a conflict between the terms of any employment agreement pursuant to which options under this Plan are to be granted and the provisions of this Plan, the terms of the employment agreement shall prevail. |

B-6

|

|

|

Please |

£ |

|

|

|

|

SEE REVERSE SIDE |

||

|

|

ELECTION OF CLASS II

DIRECTORS: |

|

FOR |

|

WITHHELD |

|

|

|

FOR |

AGAINST |

ABSTAIN |

|

|

|

01 Steven J. Hilton |

|

£ |

|

£ |

|

2. |

To approve amendment to

Company’s |

£ |

£ |

£ |

|

|

|

02 Raymond Oppel |

|

|

|

|

|

|

|

||||

|

|

03 William G. Campbell |

|

|

|

|

|

THIS PROXY, WHEN PROPERLY EXECUTED WILL BE VOTED AS YOU SPECIFY ABOVE. IF NO SPECIFIC VOTING DIRECTIONS ARE GIVEN BY YOU, THIS PROXY WILL BE VOTED FOR THE DIRECTOR NOMINEES LISTED AND AND FOR THE AMENDMENT OF THE STOCK OPTION PLAN IN PROPOSAL 2, AND WITH RESPECT TO SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING, IN ACCORDANCE WITH THE DISCRETION OF THE APPOINTED PROXY. PLEASE SIGN, DATE AND RETURN THIS PROXY PROMPTLY. |

|

||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

WITHHELD FOR: (Write that nominee’s name in the space |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

Signature |

|

Date |

|

|

Please sign exactly as name(s) appear herein. If acting as an executor, administrator, trustee, custodian, guardian, etc., you should so indicate in signing. If the stockholder is a corporation, please sign the full corporate name, by a duly authorized officer. If shares are held jointly, each stockholder named should sign. |

|||||

|

p FOLD AND DETACH HERE p |

|||||

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and

telephone voting is available through 11:59 PM Eastern Time

the day prior to annual meeting day.

Your

Internet or telephone vote authorizes the named proxies to vote your shares in

the same manner

as if you marked, signed and returned your proxy card.

|

Internet |

|

Telephone |

|

Mail |

|

Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. |

Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. |

If you

vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

|

|

MERITAGE CORPORATION |

|

|

|

|

|

|

|

ANNUAL MEETING OF STOCKHOLDERS - May 12, 2004` |

|

|

|

|

|

|

|

The undersigned hereby appoints each of John R. Landon or Steven J. Hilton or proxies with full power of substitution acting unanimously and voting or if only one is present and voting then that one, to vote the shares of stock of Meritage Corporation, which the undersigned is entitled to vote, at the Annual Meeting of Stockholders to be held at the The Crescent Club, 200 Crescent Court, Dallas, Texas 75201 on Wednesday, May 12, 2004 at 10:00 a.m. local time, and at any adjournment or adjournments thereof, with all the powers the undersigned would possess if present. |

|

|

|

|

|

|

|

IF YOU RETURN YOUR PROPERLY EXECUTED PROXY, WE WILL VOTE YOUR SHARES AS YOU DIRECT. IF YOU DO NOT SPECIFY ON YOUR PROXY CARD HOW YOU WANT TO VOTE YOUR SHARES, WE WILL VOTE THEM FOR THE ELECTION OF THE DIRECTOR NOMINEES LISTED IN PROPOSAL 1 AND FOR THE AMENDMENT OF THE STOCK OPTION PLAN IN PROPOSAL 2 AND IN THE DISCRETION OF THE PROXIES ON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENTS THEREOF. |

|

|

|

|

|

|

|

Please mark, sign and date the reverse side and |

|

|

|

|

|

|

|

(Continued on reverse side) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address Change/Comments (Mark the corresponding box on the reverse side) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

p FOLD AND DETACH HERE p |