June 27, 2012

VIA EDGAR

Mr. Jay Ingram

Legal Branch Chief

United States Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, N.E.

Washington, D.C. 20549

| Re: | Meritage Homes Corporation |

| Amendment No. 1 to Registration Statement on Form S-4 |

| Filed on June 12, 2012 |

| File No. 333-181336 |

| Form 10-K for Fiscal Year Ended December 31, 2011 |

| Filed February 24, 2012 |

| File No. 001-09977 |

Dear Mr. Ingram:

On behalf of Meritage Homes Corporation (the “Company”), I am submitting this letter in response to the comments received from the staff of the Securities and Exchange Commission (the “Commission” and the “Staff”) in a letter dated June 20, 2012 (the “Comment Letter”) with respect to the filing referenced above (the “Form S-4”). The Company has reviewed the Comment Letter and its responses are set forth below. In addition, attached hereto as Exhibit A please find excerpts from the Company’s S-4 reflecting the Company’s proposed changes (the “Proposed Changes”) to its S-4 in response to the Staff’s Comment Letter which the Company proposes to reflect in Amendment No. 2 to its S-4 after receiving any further comments from the Staff. For your convenience, the headings and paragraph numbers in this letter correspond to the headings and paragraph numbers in the Comment Letter.

Amendment No. 1 to Registration Statement on Form S-4

General

| 1. | We note your response to comment one in our letter dated June 1, 2012. Please confirm that you will clearly disclose that Meritage Homes Corporation has no independent assets or operations, as defined by Article 3-10(h)(5) of Regulation S-X, in your future filings, including in your Business section and elsewhere as appropriate. |

RESPONSE

The Company confirms that it will disclose that Meritage Homes Corporation has no independent assets or operations (as defined by Article 3-10(h)(5) of Regulation S-X) in future filings. The Company refers the Staff to footnote 4 to the Financial Statements and Supplementary Data in Item 8 to the Company’s Form 10-K for the year ended December 31, 2011 where this information has historically been disclosed. In response to the Staff’s comment, the Company will also include in future Form 10-Q filings similar disclosure in the Senior and Senior Subordinated Notes footnote. The Company will also include in future Form 10-K (Business section) and Form 10-Q (Organization and Basis of Presentation footnote) filings disclosure substantially similar to the following:

DRAFT DISCLOSURE

“Meritage Homes Corporation was incorporated in 1988 as a real estate investment trust in the State of Maryland. On December 31, 1996, through a merger, we acquired the homebuilding operations of our predecessor company. We currently focus exclusively on homebuilding and related activities and no longer operate as a real estate investment trust. Meritage Homes Corporation operates as a holding company, has no independent assets or operations, and its homebuilding construction, development and sales activities are conducted through its subsidiaries.”

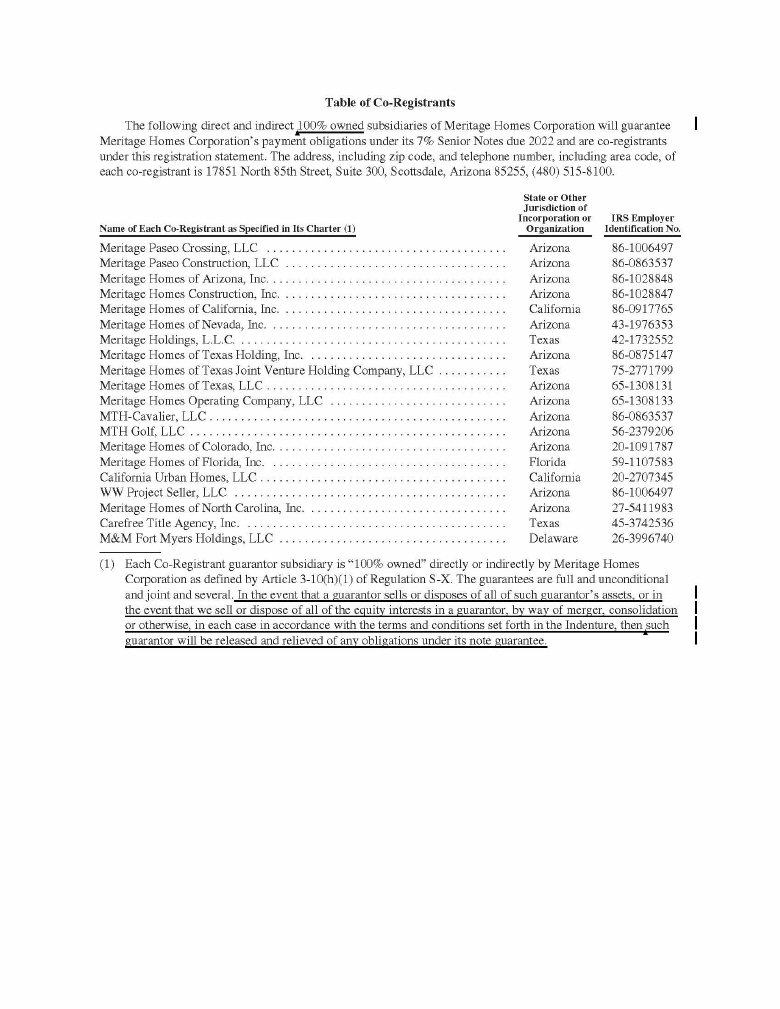

Table of Co-Registrants

| 2. | As previously requested, please note the release provision when disclosing that the guarantees are full and unconditional and provide a description of the release provisions. Please also confirm to us that you will provide the disclosures required by Note 1 to Article 3-10(f) of Regulation S-X in all future periodic report to the extent that the notes are outstanding. |

RESPONSE

The Company will note the release provisions when disclosing that the guarantees are full and unconditional. The Company intends to include the revised disclosure in footnote 1 to the Table of Co-Registrants and on page 49 to the prospectus as reflected in the Proposed Changes. In addition, the Company also confirms that it will provide the disclosures required by Note 1 to Article 3-10(f) of Regulation S-X in all future periodic reports to the extent that the notes are outstanding. The Company’s proposed disclosure is set forth below:

DRAFT DISCLOSURE

“Obligations to pay principal and interest on the senior and senior subordinated

2

notes are guaranteed by all of our wholly-owned subsidiaries (collectively, the “Guarantor Subsidiaries”), each of which is directly or indirectly 100% owned by Meritage Homes Corporation. Such guarantees are full and unconditional, and joint and several. In the event of a sale or other disposition of all of the assets of any Guarantor, by way of merger, consolidation or otherwise, or a sale or other disposition of all of the equity interests of any Guarantor Subsidiary then held by Meritage and its Subsidiaries, then that Subsidiary Guarantor will be released and relieved of any obligations under its note guarantee. There are no significant restrictions on the ability of the Company or any Guarantor Subsidiary to obtain funds from their respective subsidiaries, as applicable, by dividend or loan. We do not provide separate financial statements of the Guarantor Subsidiaries because Meritage (the parent company) has no independent assets or operations and the guarantees are full and unconditional and joint and several. Subsidiaries of Meritage Homes Corporation that are non-guarantor subsidiaries, if any, are, individually and in the aggregate, minor.”

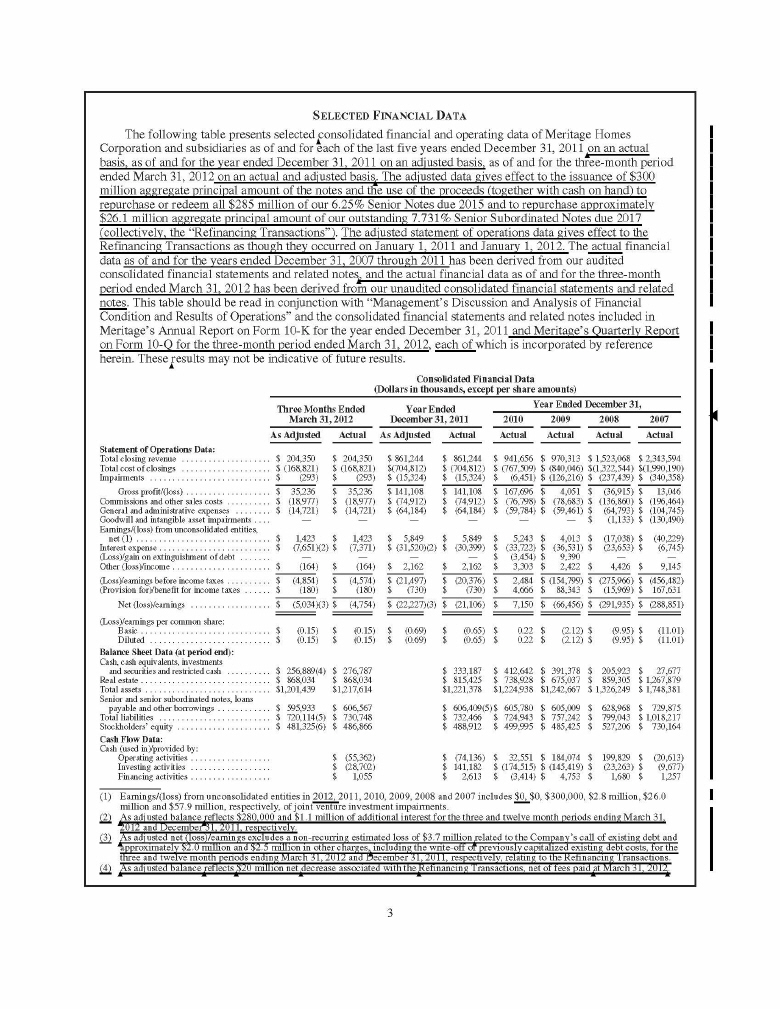

Selected Financial Data, Page 3

| 3. | We note your response to comment seven in our letter dated June 1, 2012, in which you state that pro forma financial information is immaterial. It is unclear how you arrived at this conclusion. In this regard, we note that you will recognize a $5.5 million debt extinguishment charge and an increase of approximately $1.2 million in interest expense. As such, we continue to request that you include pro forma financial information for the issuance of the $300 million 7% Senior Notes and the repurchase of outstanding debt obligations. Please ensure that you provide sufficient footnote disclosure to allow an investor to understand the adjustments being made. In this regard, the $5.5 million debt extinguishment charge would be a disclosure item in accordance with Article 11-02(b)(6) of Regulation S-X, as it will not have a continuing impact on your operating results. Please refer to Article 11-02 of Regulation S-X for guidance. |

RESPONSE

The Company will revise the Selected Financial Data table as reflected in the Proposed Changes to include the pro forma financial information (for the March 31, 2012 and December 31, 2011 columns) for the issuance of the $300 million 7% Senior Notes and the repurchase of the outstanding debt obligations.

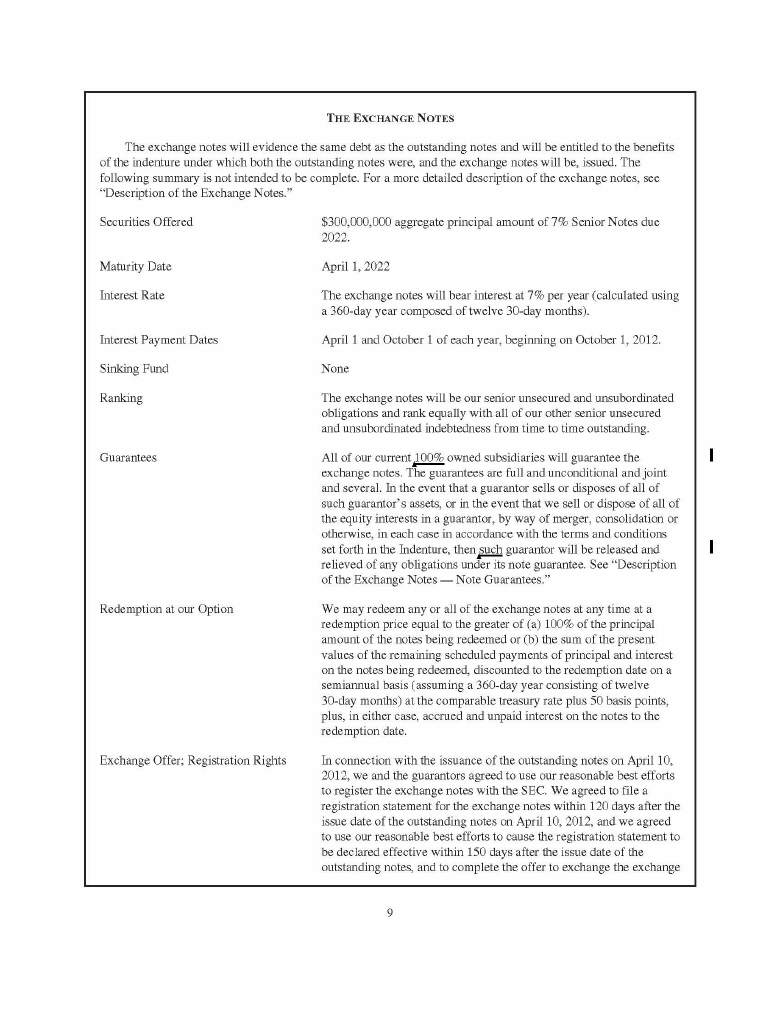

The Exchange Notes, page 8

| 4. | As previously requested, please revise your disclosure to clarify that all of the guarantor subsidiaries are 100% owned by the parent as defined in Article 3-10(h)(i) of Regulation S-X. |

RESPONSE

The Company will revise the disclosure to clarify that all guarantor subsidiaries are 100% owned by the parent as defined in Article 3-10(h)(i) of Regulation S-X. Reference is made to the Table of Co-Registrants and Page 9 under the caption “The Exchange Notes—Guarantees” as reflected in the Proposed Changes.

3

Form 10-K for Fiscal Year Ended December 31, 2011

Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 28

Critical Accounting Policies, page 29

Real Estate, page 30

| 5. | We note your responses to comment 19 in our letter dated June 1, 2012. In future filings, please enhance your current disclosures to address the following: |

| • | Provide the two explanations for the $12.6 million of land and land inventory impairments, including quantification for each. |

| • | Disclose the carrying value of those communities and/or lots by reportable segment that you determined as of the most recent balance sheet date are at-risk for future impairment, whether that risk is due to the community/lot being mothballed, is experiencing larger-than-anticipated reductions in key factors that you monitor and are at higher risk for future impairment, or falls into another category. If you do not believe any of your real estate inventory is at risk for future, material impairment charges, please disclose your conclusion. |

| • | For those communities that you have determined are at-risk for future, material impairment charges, please disclose the segment-specific facts and circumstances that could result in material changes to your estimates and assumptions and lead to a material impairment charge being recognized. For example, you note that one community in Arizona comprises 40% of your mothballed assets and is an active adult community. If you determine that this community is at-risk for a future, material impairment charge in light of its mothballed status, disclosure should be provided for this community of the facts and circumstances that could materially impact your assumptions and estimates for the fair value of this community and result in a material impairment charge being recognized. |

| • | A more complete description of your policies for mothballed communities, as provided in your response letter. |

Please refer to Item 303 of Regulation S-K, SAB Topic 5:P.4 and Sections 216, 501.02 and 501.12.b.3, 501.12.6.4 and 501.14 of the Financial Reporting Codification for guidance regarding forewarning disclosures and disclosures regarding material impairment charges.

4

RESPONSE

| • | Beginning with the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, the Company will include additional information regarding the composition of the $12.6 million of land and land inventory impairments as previously provided to the Staff in the Company’s June 12, 2012 letter. |

| • | At this time, based on our current impairment analysis, improving industry trends and knowledge of community-specific facts, the Company does not believe that any of its mothballed communities or communities with lower-than-average orders/gross margin trends are at risk of future material impairments. In this regard and in response to the Staff’s comment, beginning with the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, the Company will include disclosure similar to the following: |

DRAFT DISCLOSURE

“In addition to our quarterly impairment analysis, which is conducted to determine if any current impairments exist, we also conduct a thorough quarterly review of our underperforming and mothballed communities to determine if they are at risk of future impairment. The financial and operational status and expectations of these mothballed and underperforming communities are analyzed as well as any unique attributes that could be viewed as indicators for future impairments. Based on the facts and circumstances available as of June 30, 2012, we do not believe that any of our underperforming or mothballed communities will incur material impairments in the future. Changes in market and/or economic conditions in the future could materially impact the conclusions of this analysis, and there can be no assurances that future impairments will not occur.”

| • | In any period during which the Company’s position regarding the potential risk of future material impairments from mothballed or underperforming communities changes, the Company will provide disclosure in the next periodic filing regarding (i) the nature of the change in position; (ii) the total number of at-risk communities, and (iii) the carrying value of such communities. |

5

| • | Beginning with the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, we will provide additional disclosure regarding our mothball communities policy that is similar to the disclosure provided to the Staff in the Company’s June 12, 2012 letter. Following is a draft of this disclosure: |

DRAFT DISCLOSURE

“When a community is initially placed into mothball status, it is management’s belief that the community is affected by local market conditions that are expected to improve in the next 1-5 years. Therefore, a temporary postponement of construction and development work is expected to yield better overall returns. At least quarterly, the projections for each mothballed community are re-evaluated to ensure that the underlying assumptions are still valid and that no additional deterioration in market conditions are present. Adjustments are made accordingly and incremental impairments, if any, are recorded at each re-evaluation. Our initial mothball period may be up to five years. As of June 30, 2012, we had mothballed communities with a carrying value of $ in our West Region and mothballed communities with a carrying value of $ in our Central Region. During the six months ended June 30, 2012, we did not place any additional communities into mothball status and took one community out of mothball status, resuming the community’s development and sales activities.

Home Closing Revenue, Home Orders and Order Backlog – Segment Analysis, page 34

| 6. | We note your response to comment 20 in our letter dated June 1, 2012. Specifically, we note that you are unable to meaningfully identify the mix of your revenue as a relative percentage of your different product types and are unable to quantify these impacts due to the inconsistency of your home products sold between periods. Please disclose this fact to allow investors to better understand the information management is and is not able to monitor at the segment level. |

RESPONSE

Beginning with the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, the Company will provide disclosure similar to the following:

DRAFT DISCLOSURE

“The composition of our closings, orders and backlog is constantly changing and is based on a dissimilar mix of communities between periods as new projects open and existing projects wind down. Further, individual homes within a community can range significantly in price due to differing square footage, option selections and lot sizes and quality (e.g., cul-de-sac, view lots, greenbelt lots). These variations result in a lack of detailed price comparability of our orders, closings and backlog mix between periods.”

Note 1 – Business and Summary of Significant Accounting Policies, page 56

Investments in Unconsolidated Entities, page 58

| 7. | We note your response to comment 22 in our letter dated June 1, 2012, along with the significance test computations. While there appear to be a few computational |

6

| inconsistencies with the guidance in Article 1-02(w) of Regulation S-X for the income test and you did not provide the asset test for purposes of Article 4-08(g) of Regulation S-X, it is clear that significance has been met at the 10% threshold at the aggregate level and at least one equity method investee for fiscal years 2011 and 2010. As such, inclusion of the disclosure required by Article 4-08(g) of Regulation S-X for all of your equity method investees is required for all periods presented. Please amend your fiscal year 2011 Form 10-K to provide the required disclosures in your audited footnotes. Please also consider whether the significance tests have been met for the first quarter of fiscal year 2012 and amend the corresponding Form 10-Q in the event that the requirements in Article 10-01(b)(1) of Regulation S-X have been met. If you do not believe an amendment is required to provide the financial information for your equity method investees, please provide us with your computations of the required significance tests prepared in accordance with Article 1-02(w) of Regulation S-X. |

We remind you that when you file your amended fiscal year 2011 Form 10-K and Form 10-Q, if applicable, you should appropriately address the following:

| • | If you conclude that your prior filings should not be relied upon due to an error, please be advised that you are required to disclose the information listed under Item 4.02(a) of Form 8-K within four days of your conclusion. |

| • | Please tell us when you will file your amended and restated Form 10-K and Form 10-Q. We remind you that when you file your amended Form 10-K and Form 10-Q you should appropriately address the following: |

| • | An explanatory paragraph at the beginning of the document explaining why you are amending the document; |

| • | An explanatory paragraph in the reissued audit opinion and/or consideration of the guidance in AU Section 390 and paragraphs .05-.09 in AU Section 561 regarding the impact this excluded disclosure has to their report date; |

| • | Updated Item 9A disclosures in your Form 10-K and Item 4 disclosures in your Form 10-Q should include the following: |

| • | A discussion of the amendment and restated footnote along with the facts and circumstances surrounding it; |

| • | How the amendment and restated footnotes impacted the CEO and CFO’s original conclusions regarding the effectiveness of their disclosure controls and procedures and internal control over financial reporting; |

| • | Changes to internal control over financial reporting; and |

| • | Anticipated changes to disclosure controls and procedures and/or internal control over financial reporting to prevent future material deficiencies and misstatements of a similar nature. |

Refer to Items 307 and 308 of Regulation S-K.

7

| • | Updated reports from management and your independent auditors regarding your internal control over financial reporting. |

| • | Include all updated certifications that refer to the amended filings. |

RESPONSE

The Company acknowledges the Staff’s conclusion that for fiscal years 2011 and 2010, at least one of the equity method investees met the 10% threshold of Article 4-08(g) of Regulation S-X (“4-08(g)”) at the aggregate level. As the Company discussed with the Staff, the Company believes there are compelling reasons that the disclosure of the information called for by Article 4-08(g) is immaterial and that amendment of the Company’s fiscal year 2011 Form 10-K and the first quarter 2012 Form 10-Q is not necessary. As we further discussed with the Staff, the Company is in the process of submitting a separate letter to Office of the Chief Counsel Division of Corporation Finance seeking waiver of the requirement to include the Article 4-08(g) information in its prior periodic report filings.

Note 12 – Commitments and Contingencies, page 75

| 8. | We note your response to comment 25 in our letter dated June 1, 2012. We note that you have disclosed that the lenders related to the Joint Venture Litigation are requesting full payment of $13.2 million, which does provide investors with useful information. However, it remains unclear from your current disclosures and from your draft disclosures what the amount of reasonably possible loss in excess of accrual is for this litigation and your other litigation, which may be disclosed in the aggregate. Please refer to the guidance in ASC 450-20-25-1 regarding the difference between a probable loss contingency, which is accrued to the extent reasonably estimable, and a reasonably possible loss contingency, which is disclosed in excess of the probable and reasonably estimable amount. Please also note that while we understand there are uncertainties associated with estimating the amount of reasonably possible loss in excess of accrual, ASC 450-20-50 does not require the estimate to be precise. As such, we continue to request that you please disclose either (a) the amount or range of reasonably possible loss in excess of accrual for the aggregate of your legal proceedings, (b) that an amount of reasonably possible loss in excess of accrual cannot be estimated for the aggregate of your legal proceedings, or (c) that the amount or range of reasonably possible loss in excess of accrual for the aggregate of your legal proceedings is immaterial. If you are unable to estimate the amount or range of reasonably possible loss for your legal proceedings, please supplementally: (a) explain to us the procedures you undertake on a quarterly basis to attempt to develop a range of reasonably possible loss for disclosure and (b) for each material matter, what specific factors are causing the inability to estimate and when you expect those factors to be alleviated. We recognize that there are a number of uncertainties and potential outcomes associated with loss contingencies. Nonetheless, an effort should be made to develop estimates for purposes of disclosure, including determining which of the potential outcomes are |

8

| reasonably possible and what the reasonably possible range of losses would be for those reasonably possible outcomes. Please refer to ASC 450-20-50-3 – 50-5. Please include your proposed disclosures in your response. |

RESPONSE

Due to the extensive analysis conducted quarterly by the Company’s legal team and senior management on each open claim, the Company believes (1) that its legal reserves represent the reasonably estimated loss for its non-construction defect related claims and litigation matters and (2) that its warranty reserves include as a component thereof the cumulative estimated loss for all existing construction defect related claims and litigation. We believe that any reasonably possible additional costs are immaterial. In response to the Staff’s comment, beginning with the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2012, the Company will provide the following supplemental disclosure:

“On a quarterly basis, our senior management and legal team conduct an in-depth review of all active legal claims and litigation matters and we record a legal or warranty accrual representing the estimated total expense required to resolve each such matter. Except as may be specifically disclosed herein, we currently believe that any reasonably possible additional losses from existing claims and litigation in excess of our existing accruals would be immaterial, individually and in the aggregate, to our financial results.”

9

If you have any questions regarding the Company’s responses set forth above, please contact me at (480) 515-8003.

| Sincerely, |

| /s/ Larry W. Seay |

| Larry Seay Executive Vice President and Chief Financial Officer of Meritage Homes Corporation |

cc: Jeffrey E. Beck, Snell & Wilmer L.L.P.

10

Exhibit A

Proposed Changes to S-4

Table of Co-Registrants The following direct and indirect. 100% owned subsidiaries of Meritage Homes Corporation will guarantee Meritage Homes Corporation’s payment obligations under its 7% Senior Notes due 2022 and are co-registrants under this registration statement. The address, including zip code, and telephone number, including area code, of each co-registrant is 17851 North 85th Street, Suite 300, Scottsdale, Arizona 85255, (480) 515-8100. State or Other Jurisdiction of Incorporation or IRS Employer Name of Each Co-Registrant as Specified in Its Charter (1) Organization Identification No. Meritage Paseo Crossing, LLC Arizona 86-1006497 Meritage Paseo Construction, LLC Arizona 86-0863537 Meritage Homes of Arizona, Inc. Arizona 86-1028848 Meritage Homes Construction, Inc. Arizona 86-1028847 Meritage Homes of California, Inc. California 86-0917765 Meritage Homes of Nevada, Inc. Arizona 43-1976353 Meritage Holdings, L.L.C. Texas 42-1732552 Meritage Homes of Texas Holding, Inc. Arizona 86-0875147 Meritage Homes of Texas Joint Venture Holding Company, LLC Texas 75-2771799 Meritage Homes of Texas, LLC Arizona 65-1308131 Meritage Homes Operating Company, LLC Arizona 65-1308133 MTH-Cavalier, LLC Arizona 86-0863537 MTH Golf, LLC . Arizona 56-2379206 Meritage Homes of Colorado, Inc. . Arizona 20-1091787 Meritage Homes of Florida, Inc. . Florida 59-1107583 California Urban Homes, LLC . California 20-2707345 WW Project Seller, LLC . Arizona 86-1006497 Meritage Homes of North Carolina, Inc. . Arizona 27-5411983 Carefree Title Agency, Inc. . Texas 45-3742536 M&M Fort Myers Holdings, LLC . Delaware 26-3996740 (1) Each Co-Registrant guarantor subsidiary is “100% owned” directly or indirectly by Meritage Homes Corporation as defined by Article 3-10(h)(1) of Regulation S-X. The guarantees are full and unconditional and joint and several. In the event that a guarantor sells or disposes of all of such guarantor’s assets, or in the event that we sell or dispose of all of the equity interests in a guarantor, by way of merger, consolidation or otherwise, in each case in accordance with the terms and conditions set forth in the Indenture, then. .such guarantor will be released and relieved of any obligations under its note guarantee.

SELECTEDFINANCIALDATAThefollowingtablepresentsselected.consolidatedfinancialandoperatingdataofMeritageHomesCorporationandsubsidiariesasofandforeachofthelastfiveyearsendedDecember31,211.onanactualbasis,asofandfortheyearendedDecember31,2011onanadjustedbasis,asofandforthethree-monthperiodendedMarch31,2012onanactualandadjustedbasis.Theadjusteddatagiveseffecttotheissuanceof$300millionaggregateprincipalamountofthenotesandtheuseoftheproceeds(togetherwithcashonhand)torepurchaseorredeemall$285millionofour6.25%SeniorNotesdue2015andtorepurchaseapproximately$26.1millionaggregateprincipalamountofouroutstanding7.731%SeniorSubordinatedNotesdue2017(collectively,the”RefinancingTransactions”).TheadjustedstatementofoperationsdatagiveseffecttotheRefinancingTransactionsasthoughtheyoccurredonJanuary1,2011andJanuary1,2012.TheactualfinancialdataasofandfortheyearsendedDecember31,2007through2011hasbeenderivedfromourauditedconsolidatedfinancialstatemetsandrelatednotes.,andtheactualfinancialdataasofandforthethree-monthperiodendedMarch31,2012hasbeenderivedfromourunauditedconsolidatedfinancialstatementsandrelatednotes.Thistableshouldbereadinconjunctionwith”Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations”andtheconsolidatedfinancialstatementsandrelatednotesincludedinMeritage’sAnnualReportonForm10-KfortheyearendedDecember31,2011andMeritage’sQuarterlyReportonForm10-Qforthethree-monthperiodendedMarch31,2012,eachofwhichisincorporatedbyreferenceherein.These.resultsmaynotbeindicativeoffutureresults.ConsolidatedFinancialData(Dollarsinthousands,exceptpershareamounts)ThreeMonthsEndedMarch31,2012YearEndedDecember31,2011YearEndedDecember31,2010200920082007AsAdjustedActualAsAdjustedActualActualAtualActualActualStatementofOperationsData:Totalclosingrevenue.$204,350$204,350$861,244$861,244$941,656$970,313$1,523,068$2,343,594Totalcostofclosings.$(168,821)$(168,821)$(704,812)$(704,812)$(767,509)$(840,046)$(1,322,544)$(1,990,190)Impairments.$(293)$(293)$(15,324)$(15,324)$(6,451)$(126,216)$(237,439)$(340,358)Grossprofit/(loss).$35,236$35,236$141,108$141,108$167,696$4,051$(36,915)$13,046Commissionsandothersalescosts.$(18,977)$(18,977)$(74,912)$(74,912)$(76,798)$(78,683)$(136,860)$(196,464)Generalandadministrativeexpenses.$(14,721)$(14,721)$(64,184)$(64,184)$(59,784)$(59,461)$(64,793)$(104,745)Goodwillandintangibleassetimpairments.——————$(1,133)$(130,490)Earnings/(loss)fromunconsolidatedentities,net(1).$1,423$1,423$5,849$5,849$5,243$4,013$(17,038)$(40,229)Interestexpense.$(7,651)(2)$(7,371)$(31,520)(2)$(30,399)$(33,722)$(36,531)$(23,653)$(6,745)(Loss)/gainonextinguishmentofdebt.————$(3,454)$9,390——Other(loss)/income.$(164)$(164)$2,162$2,162$3,303$2,422$4,426$9,145(Loss)/earningsbeforeincometaxes.$(4,854)$(4,574)$(21,497)$(20,376)$2,484$(154,799)$(275,966)$(456,482)(Provisionfor)/benefitforincometaxes.$(180)$(180)$(730)$(730)$4,666$88,343$(15,969)$167,631Net(loss)/earnings.$(5,034)(3)$(4,754)$(22,227)(3)$(21,106)$7,150$(66,456)$(291,935)$(288,851)(Loss)/earningspercommonshare:Basic.$(0.15)$(0.15)$(0.69)$(0.65)$0.22$(2.12)$(9.95)$(11.01)Diluted.$(0.15)$(0.15)$(0.69)$(0.65)$0.22$(2.12)$(9.95)$(11.01)BalanceSheetData(atperiodend):Cash,cashequivalents,investmentsandsecuritiesandrestrictedcash.$256,889(4)$276,787$333,187$412,642$391,378$205,923$27,677Realestate.$868,034$868,034$815,425$738,928$675,037$859,305$1,267,879Totalassets.$1,201,439$1,217,614$1,221,378$1,224,938$1,242,667$1,326,249$1,748,381Seniorandseniorsubordinatednotes,loanspayableandotherborrowings.$595,933$606,567$606,409(5)$605,780$605,009$628,968$729,875Totalliabilities.$720,114(5)$730,748$732,466$724,943$757,242$799,043$1,018,217Stockholders’equity.$481,325(6)$486,866$488,912$499,995$485,425$527,206$730,164CashFlowData:Cash(usedin)/providedby:Operatingactivities.$(55,362)$(74,136)$32,551$184,074$199,829$(20,613)Investingactivities.$(28,702)$141,182$(174,515)$(145,419)$(23,263)$(9,677)Financingactivities.$1,055$2,613$(3,414)$4,753$1,680$1,257(1)Earnings/(loss)fromunconsolidatedentitiesin2012,2011,2010,2009,2008and2007includes$0,$0,$300,000,$2.8million,$26.0millionand$57.9million,respectively,ofjointventureinvestmentimpairments.(2).Asadjustedbalance.reflects$280,000and$1.1millionofadditionalinterestforthethreeandtwelvemonthperiodsendingMarch31,2012andDecember31,2011,respectively.(3).Asadjustednet(loss)/earningsexcludesanon-recurringestimatedlossof$3.7million.relatedtotheCompany’scallofexistingdebtandapproximately$2.0millionand$2.5millioninothercharges,.includingthewrite-offofpreviouslycapitalizedexistingdebtcosts,forthethreeandtwelvemonthperiodsendingMarch31,2012andDecember31,2011,respectively,relatingtotheRefinancingTransactions.(4).Asadjustedbalance.reflects.$20millionnet.decreaseassociatedwiththe.RefinancingTransactions,netoffeespaid.atMarch31,2012.SELECTEDFINANCIALDATAThefollowingtablepresentsselected.consolidatedfinancialandoperatingdataofMeritageHomesCorporationandsubsidiariesasofandforeachofthelastfiveyearsendedDecember31,211.onanactualbasis,asofandfortheyearendedDecember31,2011onanadjustedbasis,asofandforthethree-monthperiodendedMarch31,2012onanactualandadjustedbasis.Theadjusteddatagiveseffecttotheissuanceof$300millionaggregateprincipalamountofthenotesandtheuseoftheproceeds(togetherwithcashonhand)torepurchaseorredeemall$285millionofour6.25%SeniorNotesdue2015andtorepurchaseapproximately$26.1millionaggregateprincipalamountofouroutstanding7.731%SeniorSubordinatedNotesdue2017(collectively,the”RefinancingTransactions”).TheadjustedstatementofoperationsdatagiveseffecttotheRefinancingTransactionsasthoughtheyoccurredonJanuary1,2011andJanuary1,2012.TheactualfinancialdataasofandfortheyearsendedDecember31,2007through2011hasbeenderivedfromourauditedconsolidatedfinancialstatemetsandrelatednotes.,andtheactualfinancialdataasofandforthethree-monthperiodendedMarch31,2012hasbeenderivedfromourunauditedconsolidatedfinancialstatementsandrelatednotes.Thistableshouldbereadinconjunctionwith”Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations”andtheconsolidatedfinancialstatementsandrelatednotesincludedinMeritage’sAnnualReportonForm10-KfortheyearendedDecember31,2011andMeritage’sQuarterlyReportonForm10-Qforthethree-monthperiodendedMarch31,2012,eachofwhichisincorporatedbyreferenceherein.These.resultsmaynotbeindicativeoffutureresults.ConsolidatedFinancialData(Dollarsinthousands,exceptpershareamounts)ThreeMonthsEndedMarch31,2012YearEndedDecember31,2011YearEndedDecember31,2010200920082007AsAdjustedActualAsAdjustedActualActualAtualActualActualStatementofOperationsData:Totalclosingrevenue.$204,350$204,350$861,244$861,244$941,656$970,313$1,523,068$2,343,594Totalcostofclosings.$(168,821)$(168,821)$(704,812)$(704,812)$(767,509)$(840,046)$(1,322,544)$(1,990,190)Impairments.$(293)$(293)$(15,324)$(15,324)$(6,451)$(126,216)$(237,439)$(340,358)Grossprofit/(loss).$35,236$35,236$141,108$141,108$167,696$4,051$(36,915)$13,046Commissionsandothersalescosts.$(18,977)$(18,977)$(74,912)$(74,912)$(76,798)$(78,683)$(136,860)$(196,464)Generalandadministrativeexpenses.$(14,721)$(14,721)$(64,184)$(64,184)$(59,784)$(59,461)$(64,793)$(104,745)Goodwillandintangibleassetimpairments.——————$(1,133)$(130,490)Earnings/(loss)fromunconsolidatedentities,net(1).$1,423$1,423$5,849$5,849$5,243$4,013$(17,038)$(40,229)Interestexpense.$(7,651)(2)$(7,371)$(31,520)(2)$(30,399)$(33,722)$(36,531)$(23,653)$(6,745)(Loss)/gainonextinguishmentofdebt.————$(3,454)$9,390——Other(loss)/income.$(164)$(164)$2,162$2,162$3,303$2,422$4,426$9,145(Loss)/earningsbeforeincometaxes.$(4,854)$(4,574)$(21,497)$(20,376)$2,484$(154,799)$(275,966)$(456,482)(Provisionfor)/benefitforincometaxes.$(180)$(180)$(730)$(730)$4,666$88,343$(15,969)$167,631Net(loss)/earnings.$(5,034)(3)$(4,754)$(22,227)(3)$(21,106)$7,150$(66,456)$(291,935)$(288,851)(Loss)/earningspercommonshare:Basic.$(0.15)$(0.15)$(0.69)$(0.65)$0.22$(2.12)$(9.95)$(11.01)Diluted.$(0.15)$(0.15)$(0.69)$(0.65)$0.22$(2.12)$(9.95)$(11.01)BalanceSheetData(atperiodend):Cash,cashequivalents,investmentsandsecuritiesandrestrictedcash.$256,889(4)$276,787$333,187$412,642$391,378$205,923$27,677Realestate.$868,034$868,034$815,425$738,928$675,037$859,305$1,267,879Totalassets.$1,201,439$1,217,614$1,221,378$1,224,938$1,242,667$1,326,249$1,748,381Seniorandseniorsubordinatednotes,loanspayableandotherborrowings.$595,933$606,567$606,409(5)$605,780$605,009$628,968$729,875Totalliabilities.$720,114(5)$730,748$732,466$724,943$757,242$799,043$1,018,217Stockholders’equity.$481,325(6)$486,866$488,912$499,995$485,425$527,206$730,164CashFlowData:Cash(usedin)/providedby:Operatingactivities.$(55,362)$(74,136)$32,551$184,074$199,829$(20,613)Investingactivities.$(28,702)$141,182$(174,515)$(145,419)$(23,263)$(9,677)Financingactivities.$1,055$2,613$(3,414)$4,753$1,680$1,257(1)Earnings/(loss)fromunconsolidatedentitiesin2012,2011,2010,2009,2008and2007includes$0,$0,$300,000,$2.8million,$26.0millionand$57.9million,respectively,ofjointventureinvestmentimpairments.(2).Asadjustedbalance.reflects$280,000and$1.1millionofadditionalinterestforthethreeandtwelvemonthperiodsendingMarch31,2012andDecember31,2011,respectively.(3).Asadjustednet(loss)/earningsexcludesanon-recurringestimatedlossof$3.7million.relatedtotheCompany’scallofexistingdebtandapproximately$2.0millionand$2.5millioninothercharges,.includingthewrite-offofpreviouslycapitalizedexistingdebtcosts,forthethreeandtwelvemonthperiodsendingMarch31,2012andDecember31,2011,respectively,relatingtotheRefinancingTransactions.(4).Asadjustedbalance.reflects.$20millionnet.decreaseassociatedwiththe.RefinancingTransactions,netoffeespaid.atMarch31,2012.› 3

. .(5) As adjusted balance reflects an approximate$10.6 million reduction in senior and subordinated notes payableat March 31, 2012 resulting from the Refinancing Transactions. .(6) As adjusted balance instockholders’ equity reflects theimpact ofthe non-recurring charge noted in footnote 3 above. . . . . › ››››› ›››››››4

THE EXCHANGE NOTES The exchange notes will evidence the same debt as the outstanding notes and will be entitled to the benefits of the indenture under which both the outstanding notes were, and the exchange notes will be, issued. The following summary is not intended to be complete. For a more detailed description of the exchange notes, see “Description of the Exchange Notes.” Securities Offered $300,000,000 aggregate principal amount of 7% Senior Notes due 2022. Maturity Date April 1, 2022 Interest Rate The exchange notes will bear interest at 7% per year (calculated using a 360-day year composed of twelve 30-day months). Interest Payment Dates April 1 and October 1 of each year, beginning on October 1, 2012. Sinking Fund None Ranking The exchange notes will be our senior unsecured and unsubordinated obligations and rank equally with all of our other senior unsecured and unsubordinated indebtedness from time to time outstanding. Guarantees All of our current . .100% owned subsidiaries will guarantee the exchange notes. The guarantees are full and unconditional and joint and several. In the event that a guarantor sells or disposes of all of such guarantor’s assets, or in the event that we sell or dispose of all of the equity interests in a guarantor, by way of merger, consolidation or otherwise, in each case in accordance with the terms and conditions set forth in the Indenture, then. .such guarantor will be released and relieved of any obligations under its note guarantee. See “Description of the Exchange Notes — Note Guarantees.” Redemption at our Option We may redeem any or all of the exchange notes at any time at a redemption price equal to the greater of (a) 100% of the principal amount of the notes being redeemed or (b) the sum of the present values of the remaining scheduled payments of principal and interest on the notes being redeemed, discounted to the redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the comparable treasury rate plus 50 basis points, plus, in either case, accrued and unpaid interest on the notes to the redemption date. Exchange Offer; Registration Rights In connection with the issuance of the outstanding notes on April 10, 2012, we and the guarantors agreed to use our reasonable best efforts to register the exchange notes with the SEC. We agreed to file a registration statement for the exchange notes within 120 days after the issue date of the outstanding notes on April 10, 2012, and we agreed to use our reasonable best efforts to cause the registration statement to be declared effective within 150 days after the issue date of the outstanding notes, and to complete the offer to exchange the exchange 9

SUBSIDIARY GUARANTORS AND FINANCIAL STATEMENTS Each subsidiary guarantor is exempt from Exchange Act reporting pursuant to Rule 12h-5 under the Exchange Act, as: • Meritage Homes Corporation has no independent assets or operations; • the guarantees of the subsidiary guarantors are full and unconditional and joint and several; and • any subsidiaries of Meritage Homes Corporation other than the subsidiary guarantors are, individually and in the aggregate, minor. There are no significant restrictions on the ability of Meritage Homes Corporation or any subsidiary guarantor to obtain funds from its subsidiaries by dividend or loan. In the event that a guarantor sells or disposes of all of such guarantor’s assets, or in the event that we sell or dispose of all of the equity interests in a guarantor, by way of merger, consolidation or otherwise, in each case in accordance with the terms and conditions set forth in the Indenture, then. .such guarantor will be released and relieved of any obligations under its note guarantee. 49